Goldman Hails Global Rebound as Currie Sees Commodity Demand

This article by Stephen Engle , Ben Sharples , and Ranjeetha Pakiam for Bloomberg may be of interest to subscribers. Here is a section:

“We’re seeing a cyclical uptick in global economic activity and that’s driving demand, not only for oil but all commodities,” Jeffrey Currie, head of commodities research, said in Hong Kong on Tuesday. “That’s the core reason why we upgraded our outlook on commodities to overweight,” he said, referring to the bank’s November decision.

Commodities made a comeback in 2016 with the first annual gain in six years as stimulus in China stabilized growth, and oil producers led by OPEC reversed course to limit supplies. Currie -- who spoke both on Bloomberg TV and to a reporter -- said the impact of China’s stimulus will probably last well into the first half of 2017. He added that policies from new U.S. President Donald Trump may reinforce inflationary pressures, aiding raw materials.

“U.S. and China are focal points where we’re seeing the uptick, but even the outlook for Europe is much more positive than what people would have thought six months to a year ago,” he said. “It’s not what’s happening on the supply side but rather what’s happening on the demand side.”

The Continuous Commodity Index (Old CRB) is unweighted and therefore gives a more accurate picture of activity in the commodity markets than the CRB Index which is heavily skewed by oil prices. The Index hit a medium-term peak in 2011 below 700 and trended lower for five years until the beginning of 2016.

It found support in the region of the 2008 lows, staged an impressive short covering rally which rolled over in July and spent the last six months ranging. It is now testing its recovery peak near 440 following what has been an orderly reversion to the mean. A sustained move above 440 would reassert demand dominance.

The LME Metals Index bounced emphatically from the region of the trend mean at the turn of the year and a sustained move below the 2500 area would be required to question potential for additional upside.

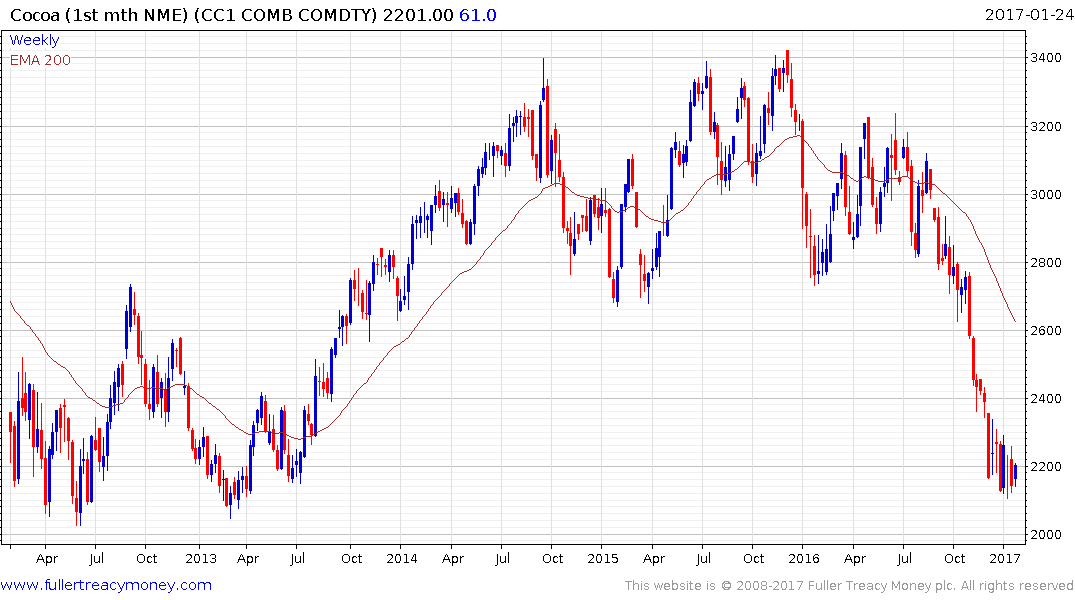

Coffee and sugar have already staged impressive rebounds while cocoa has lost downward momentum in the region of the 2008 and 2012/13 lows. A sustained move above $2250 would break the progression of lower rally highs and potentially signal the beginning of a reversionary rally.

Orange Juice has experienced a deep pullback over the last couple of months and has developed a short-term oversold condition. It is trading in backwardation, suggesting a near supply deficit, but a clear upward dynamic will be required to signal a return to demand dominance.