Sibanye $2.2bn acquisition of Stillwater passes antitrust conditions

This article by Cecilia Jamasmie for Mining.com may be of interest to subscribers. Here it is in full:

Sibanye Gold (JSE:SGL) (NYSE:SBGL), South Africa’s largest miner producer of the precious metal, has been given the green light to proceed with the $2.2 billion acquisition of Stillwater Mining (NYSE:SWC), the only US platinum producer.

The deal, announced in December, was subject to antitrust conditions that fall under the US’s Hart-Scott-Rodino premerger legislation.

“Satisfying the HSR Act antitrust condition in a timely manner is an important first step towards concluding the acquisition of Stillwater,” chief executive Neal Froneman said in the statement.

The Johannesburg-listed company, which was spun out of South Africa’s Gold Fields in 2013, spent most of last year shopping for new mines, particularly in the platinum sector.The company first expanded into the grey precious metal used in jewellery and diesel car engines in Sep. 2015, by buying Aquarius Platinum and three Anglo American Platinum mines.

Together with reducing Sibanye’s dependence on its aging South African mines, the deal will make the company the world's third largest palladium producer and fourth biggest platinum group metals miner, Froneman noted last month when announcing the planned acquisition.

If it goes through, the takeover will be the second-biggest South African outbound M&A transaction since 2015.

Sibanye Gold has an Estimated P/E of 8.61 and yields 5.56%. The sharp decline in precious metals prices as well as the expense of the company’s expansion plans contributed to a steep decline in prices over the last few months; falling from a peak near $21 to a low below $7. A mean reversion rally is now underway and a clear downward dynamic would be required to check momentum beyond a brief pause.

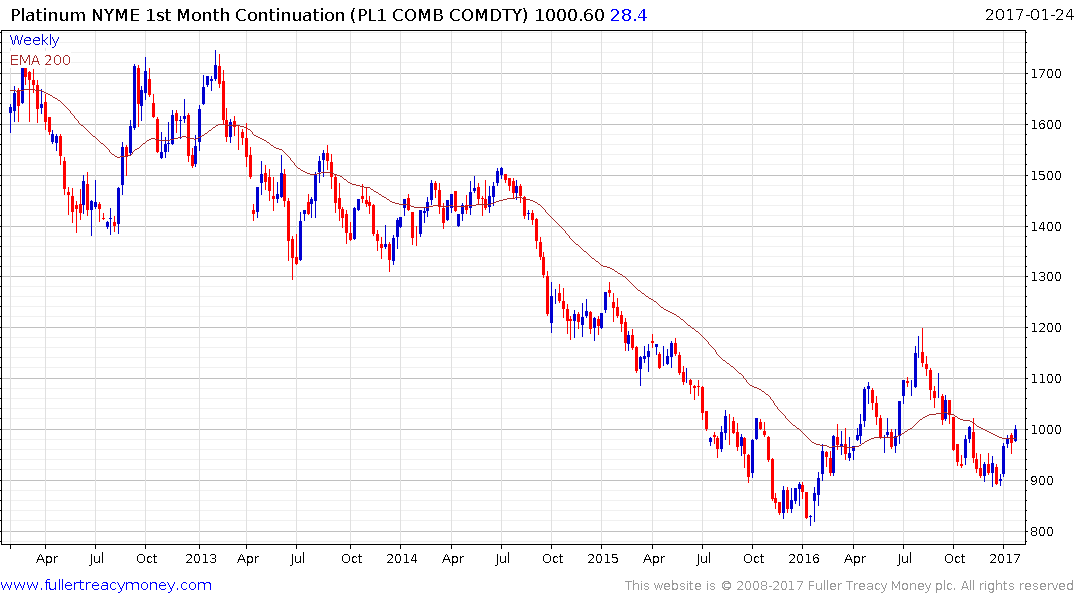

Platinum traded back above the psychological $1000 level for the first time since November today. It will need to improve on this move but recovery potential can be given the benefit of the doubt provided it holds the low near $950.

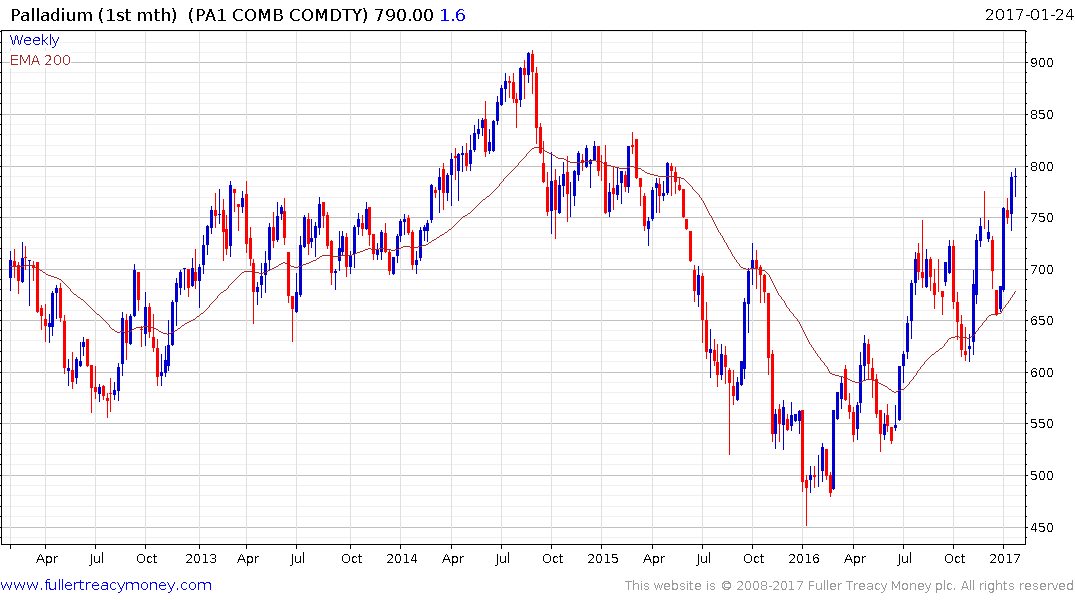

Palladium has held a progression of higher reaction lows for a year is now testing the $800 area. A short-term overbought condition has developed but a clear downward dynamic would be required to confirm resistance in this area.

The timing of Sibanye’s acquisitions highlights the countercyclical strategy espoused by management since the company’s inception. Provided precious metal prices remain on a recovery trajectory, the share should have medium-term recovery potential.