Gold: Ringing the bell

Thanks to a subscriber for this note from UBS which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

US Federal Reserve Chair Jerome Powell highlighted patience and uncertainty at yesterday's Fed press conference, but ultimately he remained upbeat. While acknowledging a growth slowdown in the US and globally, and fading jobs growth and business spending, he took pains to be positive about the medium term, arguing he does not see a marked pickup in risks to financial stability. However, simply put, we think he's done hiking; he just doesn't know it yet. Also, the Fed's balance sheet runoff ends in September.

Regarding inflation, we believe recent Fed statements suggest it's a central bank that wants to foster a period of inflation modestly above its target, reinforcing our view that real interest rates have likely peaked and should trend lower. While the bar to the Fed cutting rates remains high, money market pricing seems overly aggressive at this stage (intimating a cut); hence, re-pricing remains a moderate risk for gold.

All things considered, we are lifting our gold forecasts: the three-month range is now USD 1275–1375/oz (from USD 1,250–1,350) and our stance is bullish (from sideways). Our six and 12-month forecasts have also been raised to USD 1,350/oz and USD 1,400/oz, respectively (from USD 1,300/oz and USD 1,350/oz). From a portfolio perspective, we believe equity investors should hold gold as a hedge against likely spikes in equity market volatility, a weaker US dollar, or a rise in geopolitical risks.

The clearest rationale for a positive view on gold is when we have evidence of negative real interest rates. That is becoming an increasingly likely scenario since global central banks are desperate to stoke inflation and are willing to allow their economies to run hot in order to achieve a self-sustaining cycle. That further supports the argument we are at the top of the interest rate cycle.

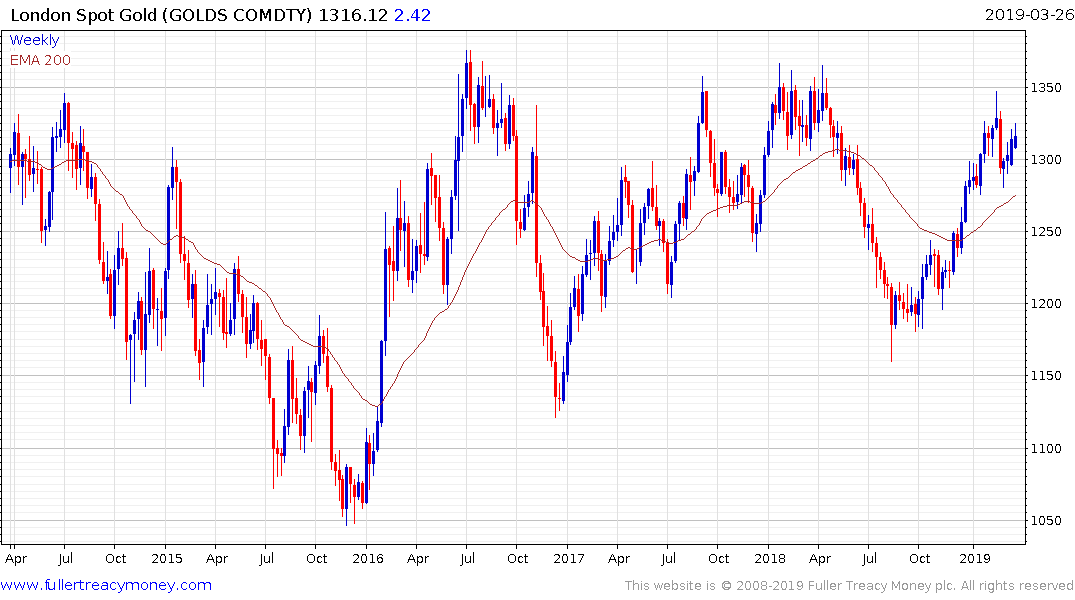

Gold has been ranging below $1400 since 2013. As an asset that cannot be lent into existence it is likely negative real interest rates will be a catalyst for this base to be completed. Short-term the price continues to firm from the region of the trend mean.

As high beta gold, silver should also benefit from these medium-term themes but the price has been underperforming over the last few years. The price continues to firm from the $15 area and will need to hold that level if support building is to continue to be given the benefit of the doubt.

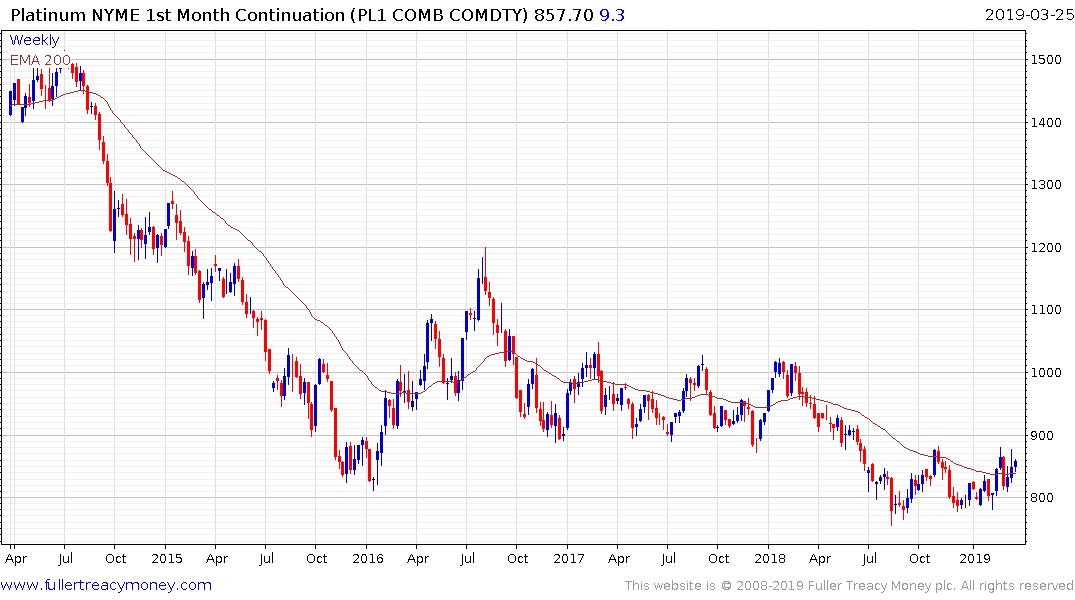

Platinum continues to firm from the $800 and is close to testing the upper side of its range.