Gold remains expensive insurance

Thanks to a subscriber for this report from the Deutsche Bank which may be of interest. Here is a section:

Expensive by any number of measures…

At the current spot price of USD1,260 – 1,265/oz, gold screens as expensive against almost all other metrics. The average of nine metrics suggests that the fair value for gold is USD1,015/oz. At the bottom end of the range G7 per capita income (gold’s affordability) would suggest a fair value of USD735 – 740/oz. At the upper end of the range and the only measure whereby gold looks cheap is treating gold as a reserve currency. Here the size of the big four central bank balance sheets (ECB, BoJ, PBoC and Fed) would suggest a fair value of USD1,650/oz. As a blunt gauge of relative value, this approach is okay, but the spread is too wide to be of any real use as a serious forecasting tool. Instead, we prefer to synthesize the main price drivers into a four factor regression model.The current gold price suggests that heightened risk perceptions persist

Although the correlation coefficient on our model is 87%, there are very discrete periods when gold trades above the model forecast as well as below. Our interpretation is that when gold trades above, the market is going through a period of heightened risk perceptions, be it the expectation of a collapse in the global financial system or rampant inflation. Over the past 10 years, we have had an extended “bull market” period lasting 3 and half years and an equivalent “bear market” of 3 and a half years. Our model suggests that gold should be trading at USD1,185/oz, 6% below the current spot price. The current “premium” period for gold started in February 2016. We expect this environment to continue into 2018. Nevertheless, we retain our cautious to neutral view on gold with the Deutsche Bank house view on the model inputs pointing to a year end price of USD1,150/oz even when factoring in further political and financial uncertainty. Our Q4 price forecast is USD1,230/oz, which already incorporates a risk premium.A short term insurance policy for those who want it

Although gold screens as expensive, there is a short term scenario (3 month) which would justify gold trading higher, in our view. In the near term, our US rates economist Dominic Konstam sees scope for the US 10-year bond yield to fall to 2% (before rising to 2.75% by year-end), as falling excess liquidity points to softer US growth momentum ahead. If we apply a US 10 year bond yield of 2%, a USD 2% weaker from current levels (not our FX strategist view) and the S&P500 down 5% from current levels, our fair value model points to a gold price of USD1,320/oz.

Here is a link to the full report.

Many fundamental investors think gold is a barbaric relic because it is impossible to value on a dividend discount model metric. So are zero coupon bonds and yet the market has found a way to value those. That highlights what might be considered a blind spot for an asset that has been considered a store of value of millennia.

The best scenario for gold is when inflation is rising faster than interest rates. That’s when its inflation hedging characteristics come into their own. However that is not the case today with central bank inflation measures still muted while interest rates have been rising.

Meanwhile geopolitical tensions are simmering, not least on the Korean peninsula and have the capacity to escalate at some point over the summer. The outcome of the UK election and the uncertainty that remains over how the schism will be negotiated is an additional source of uncertainty.

Continued global central bank largesse most particularly by the ECB is also positive for an asset in relatively limited supply like gold. However that benefit is not limited to gold, if the number of global indices breaking out of long-term ranges is any indication.

I continue to maintain that the most important thing the gold price has done in the last 18 months is break the medium-term progression of lower rally highs to complete a Type-2 bottom, as taught at The Chart Seminar. It has been ranging in a volatile manner for more than a year and is currently firming from the $1200 area, where it most recently found support. This period of volatile ranging, “right-hand extension” or a “first step above the Type-2 bottom” is characteristic of this kind of low. However if medium-term potential for higher to lateral ranging is to be given the benefit of the doubt then the progression of higher reaction lows will need to hold.

Silver continues to bounce as it unwinds its short-term oversold condition. A sustained move above $18.70 would confirm a return to demand dominance beyond the short term.

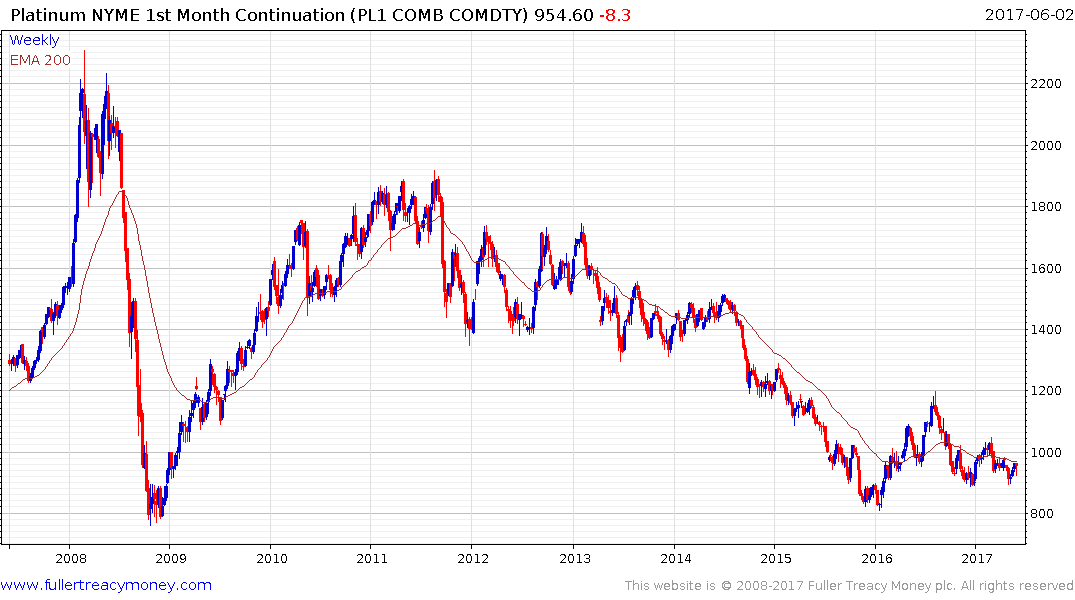

Platinum unwound yesterday’s sharp drawdown today to push back up to test the region of the trend mean.

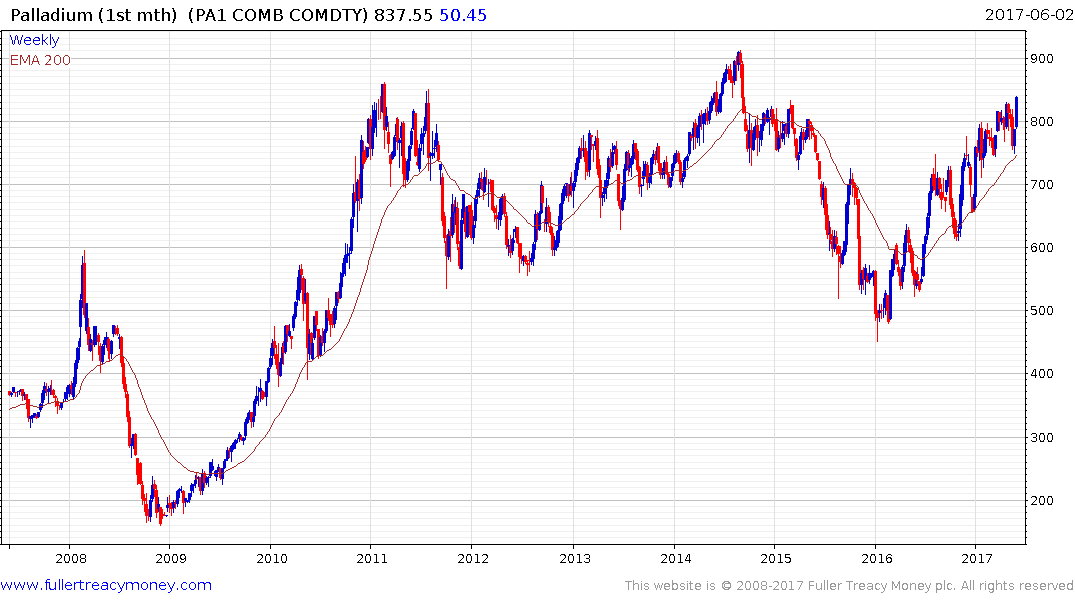

Palladium remains the sector’s leader and firmed over the last couple of weeks to hit a new recovery high.