Gold Reaches Lowest Since 2010 as Traders Shrug Off China Hoard

This article by Eddie van der Walt, Joe Deaux and Laura Clarke for Bloomberg may be of interest to subscribers. Here is a section:

China said it boosted bullion assets to about 1,658 metric tons, less than brokers at GoldCore Ltd and Sharps Pixley Ltd. expected. Futures dropped to the lowest since 2010 on Friday as signs of improving U.S. economic growth further diminished the metal’s appeal as a haven.

With investors in the U.S. scoffing at the precious metal, bulls were holding out hope that buying from China could help to buoy demand. The Asian country vies with India as the world’s top consumer.

“I’m shocked by how small the figure is,” Ross Norman, chief executive officer of dealer Sharps Pixley, said by telephone from London, referring to China’s gold reserves. “I don’t think I was alone in thinking they have accumulated three times as much.”

A clue to the fact that the Chinese government has not been accumulating vast quantities of the metal is in the fact that prices have held a sequence of lower highs since 2011. Generally speaking if on aggregate the metal had been under accumulation a progression of higher reaction lows would have been evident within the ranging phase of the last two years.

Gold hit a new closing low today as it tests the November and March lows. A short-term oversold condition is evident but a clear upward dynamic would now be required to question potential for additional downside.

Silver has returned to test the region of the November and this month’s lows. It is not as oversold on long-term stochastics as gold, following the short-term bounce earlier this month, but a clear upward dynamic will be required to check the downward bias.

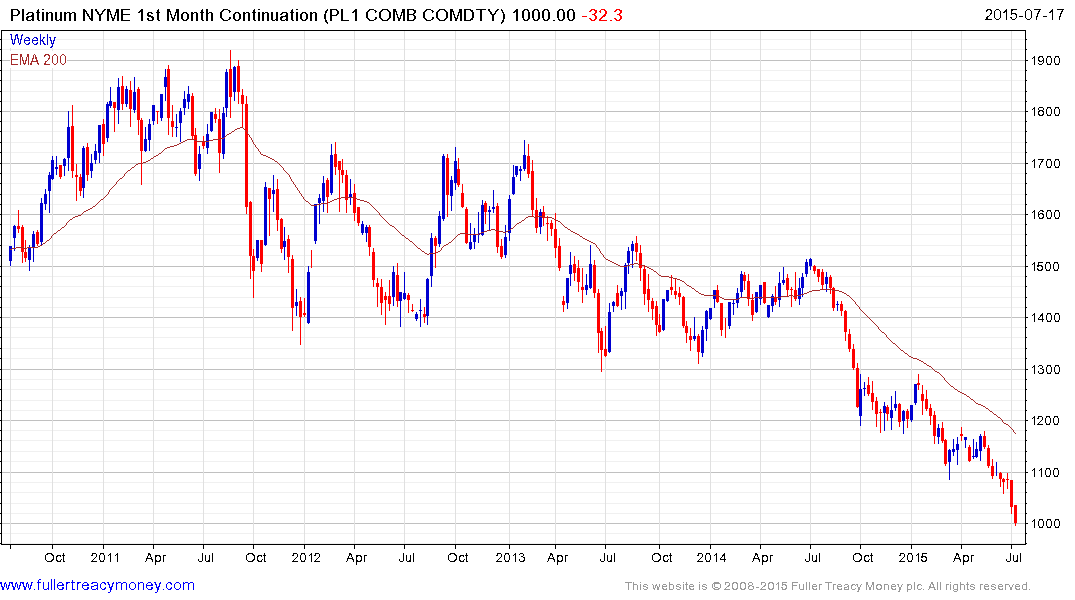

Platinum has been leading the decline and dropped today to test the psychological $1000 level. A clear upward dynamic would be required to signal anything other than temporary support in this level.

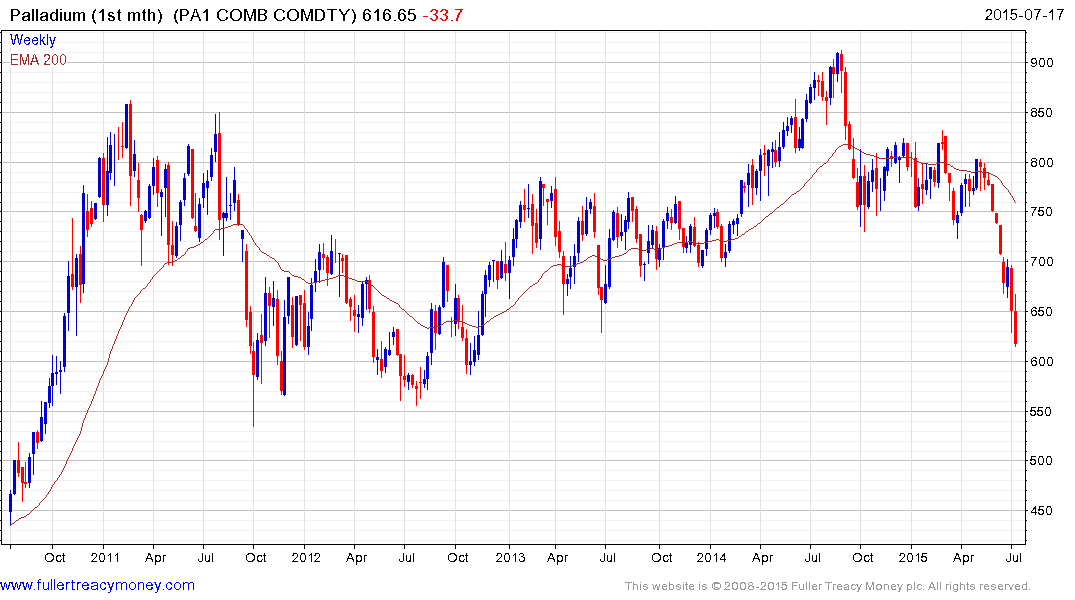

Palladium broke down from its overhead trading range in June and continues to extend the decline. It has also developed a short-term oversold condition but a break in the progression of lower rally highs, currently near $675, would be required to question the consistency of the decline.

The NYSE Arca Gold BUGS Index extended the breakdown from its eight-month trading range this week and a sustained move above 150 would be the minimum required to signal a return to demand dominance beyond scope for short-term steadying.

Rhodium is more commonly used as an auto catalyst and anti-tarnish coating for silver jewellery than as a precious metal investment vehicle but it is noteworthy that it jumped higher earlier this week. How well it can hold its low in the current weak environment will likely influence the ability of prices to improve on the rally. This note from Bloomberg may be of interest.