Carney Rate Comments Supercharge Pound to Best Week Since 2009

This article by David Goodman and Marianna Aragao for Bloomberg may be of interest to subscribers. Here is a section:

“The decision as to when to start such a process of adjustment will likely come into sharper relief around the turn of this year,” Carney said in a speech on Thursday in Lincoln, England. “The need for bank rate to rise reflects the momentum in the economy and a gradual firming of underlying inflationary pressures.”

?Investors don’t foresee an increase until May 2016 at the earliest, according to forward contracts based on the sterling overnight index average, or Sonia. That compares with August as recently as last week. Implied yields on short-sterling futures contracts expiring in March 2016 climbed three basis points, or 0.03 percentage point, to 0.92 percent, up from 0.83 percent at the end of last week.

U.K. government bonds were little changed, with the benchmark 10-year gilt yielding 2.08 percent. The price of the 5 percent bond due in March 2025 was 125.35 percent of face value.“With rates markets only fully pricing tightening by the second quarter of next year, the comments should keep the pound under appreciation pressure,” BNP Paribas SA analysts including Steven Saywell, the London-based global head of foreign-exchange strategy, wrote in a note published on Friday. “Our positioning analysis signals that, while rates markets have become more upbeat on the Bank of England, FX investors do not hold a sizable long-pound position.”

The UK budget was business friendly and comes in addition to the positive attitude many business owners have been exuding over the last year. This report from the Small Business Federation may be interest. Here is a section from the introduction:

Our latest FSB Small Business Index (SBI) shows strong levels of confidence amongst FSB members, with a clear recovery from the seasonal low of 2014 Q4, to +37.9. Encouragingly this momentum looks set to continue with nearly two thirds of members looking to grow either moderately or rapidly over the next year – a high since our surveys started. That optimisim is reflected in the record high number of firms (+31.9%) who intend to increase capital investment in their businesses over the next 12 months - good news for an economic recovery based on investment not just consumption. Further encouragement is provided by strong indications that plans for job creation will remain strong. Enabled by supportive government initiatives, our members are also increasing UK exports with more small businesses exporting goods or services overseas.

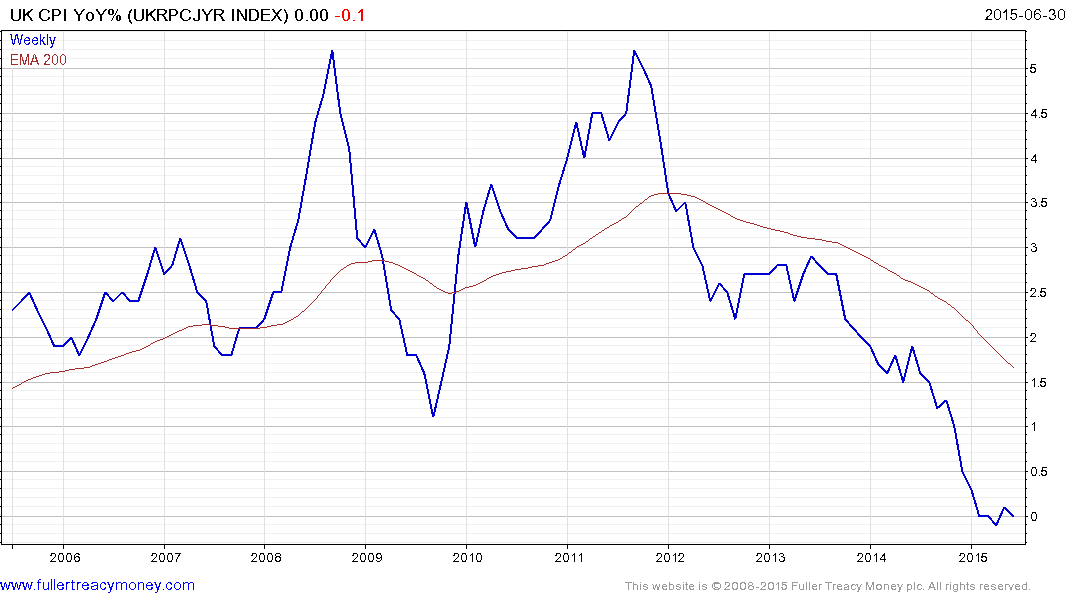

With small business doing well, a recovering consumer and the UK’s independence from the chaotic environment in the Eurozone, it is reasonable that the Bank of England is beginning to think about raising rates. However continued low inflation with CPI well below the Bank’s target rate suggests they are under little pressure to hurry.

The Pound broke out of a four-month range against the Euro this week to reassert medium-term demand dominance. While some consolidation is possible a sustained move below €1.39 would be required to question medium-term scope for a retest of the €1.50 area which offered resistance between 2003 and 2007.

The FTSE-250 Index of midcaps, which is more reflective of the UK economy than the FTSE-100, remains in a consistent medium-term uptrend. It found support last week in the region of the 200-day MA and improved on that performance this week. A sustained move below 17,000 would be required to begin to question medium-term demand dominance. The iShares FTSE 250 ETF (MIDD) tracks this index).