Gold Prices Seen Falling to $1,000 for SocGen on Oil Drop

This article by Debarati Roy for Bloomberg may be of interest to subscribers. Here is a section:

Bullion erased its gains for the year yesterday after the government reported the U.S. grew at a faster pace than analysts forecast in the third quarter. A stronger economy is validating optimism that prompted the Federal Reserve to say this week that it will stop buying debt, further diminishing the appeal of precious metals as an inflation hedge. Gold fell today after the Bank of Japan expanded stimulus, spurring gains in the dollar.

Crude oil tumbled 23 percent since the end of June through yesterday, touching a two-year low this week. The fuel’s slump into a bear market is “going to have an effect on the cost of production of other commodities, which means downward pressure on costs, which is a good thing,” Haigh said. “The U.S. growth story is the other headwind” for bullion, he said

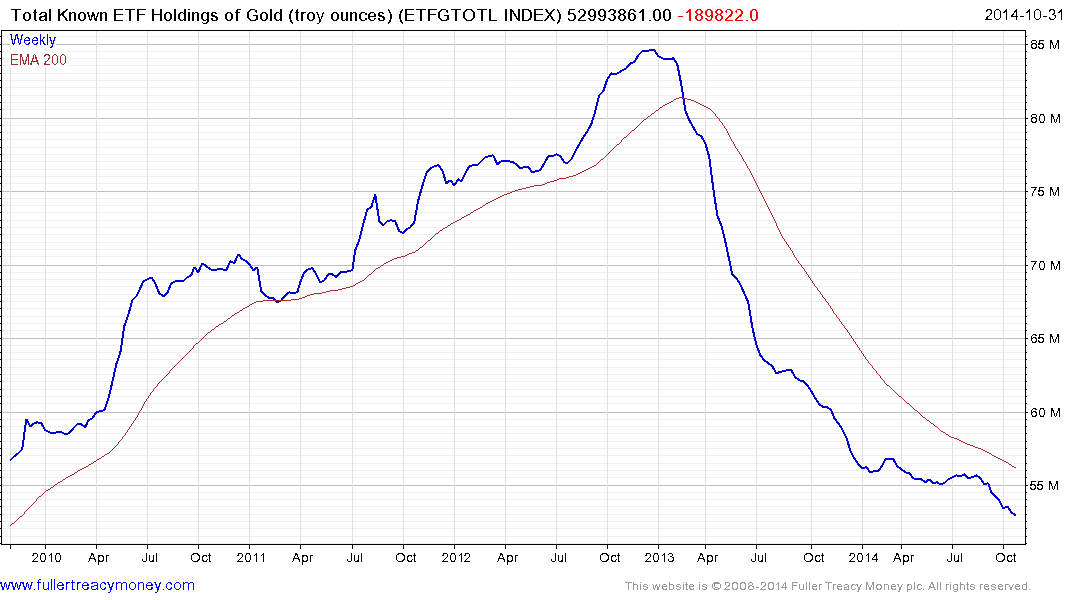

Investment demand for gold, at least in the West, as measured by total ETF holdings remains on a downward trajectory. This represents a headwind, not least as ETF holdings were such an important source of demand during gold’s advance.

Wall Street has broken up out of a 13-year range while gold prices have been lackluster. This has seen the Dow/Gold ratio reverse its lengthy decline suggesting that despite potential for occasional contractions, the Dow is more likely to outperform gold over the next decade.

Gold broke downwards today from a more than yearlong range. A clear upward dynamic will be required to question current scope for additional weakness.

The NYSE Arca Gold Bugs Index has returned to test the 2008 lows near 150. This area represents a potential area of support but a clear upward dynamic would be required to check momentum and begin to suggest demand returning in this area.