Email of the day on Norwegian oil service shares

Interestingly, oil services was a hot topic in one of today’s financial newspapers in Norway. A former oil service analyst (seven times oil service analyst of the year in Norway), now asset manager, sold his last oil service stocks a year ago. He believe the trouble for oil service stocks is far from over. Big fundamental problems will take many years to be solved. He says we might see short term rallies but prices will come further down and he won’t consider buying for the next five years. Current oil price drop, and downward pressure on costs from technological development and increased efficiency of shale production are cited as reasons.

Skagen (asset manager) says they are not looking to buy at these levels…

So it may not be over yet…

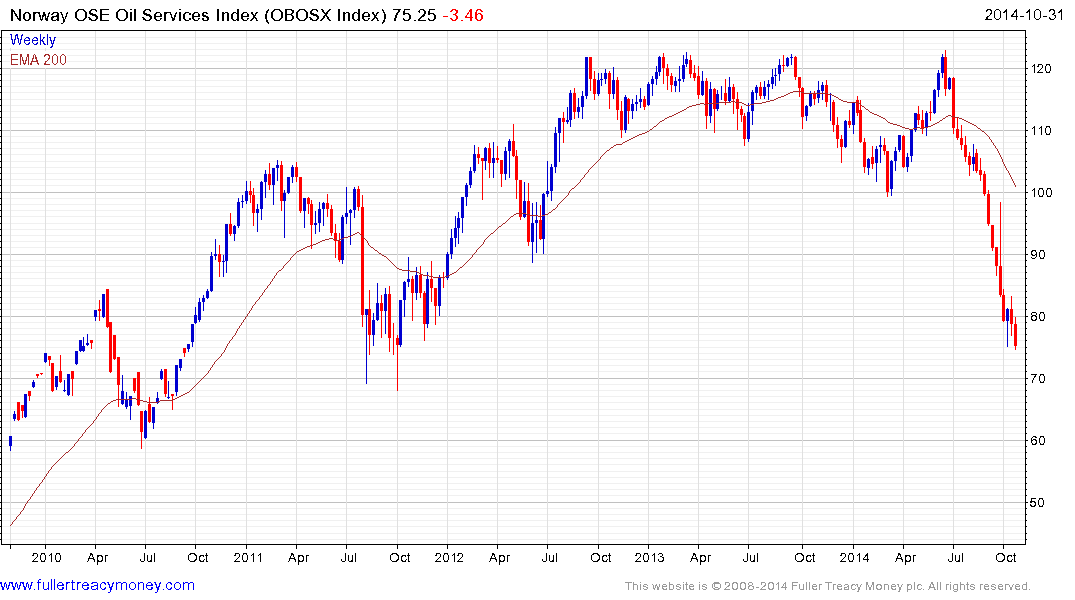

Thank you for this additional intelligence which highlights how well understood the bearish case is. Considering the depth of the declines posted to date, this is to be expected and it is true that the issues affecting oil and gas services in a declining oil price environment are non-trivial.

As a veteran of The Chart Seminar you will be familiar with the fact that acceleration is a trend ending but of undetermined duration. As an increasingly oversold condition develops, market participants increase shorts and investors panic out of long positions. This serves to depress sentiment among potential buys and boost confidence among those benefitting from the decline. In addition the decline would not have happened without a fundamental cause and the perception of how credible this is increases as prices decline.

As you say, potential for a relief rally is increasing but there is no sign that is has begun just yet and prices might fall further before it starts. We will not have evidence of more than a temporary low until shares find support at progressively higher levels following a short covering rally so it is still too early to talk about recovery. Potential catalysts such as M&A activity or a firmer tone on oil prices are not yet present.

Back to top