Gold-gold matters

Thanks to a subscriber for this note by Douglas Pollitt which may be of interest. Here is a section:

If the surface float is less than we think it is, then inground stocks, (otherwise known as reserves), are also showing signs of depletion. On the cusp of the last boom, the reserves of senior producers?¡¥, as measured in years of mine life, would be ballpark twice what they are today. And moreover these stocks here have been shown to be highly inelastic ?¡ãtens upon tens of billions of exogenous capital poured into the sector and very, very little was found. Unlike the frackers or, say, the zinc industry, a rally in gold will not see more metal get coughed up from the primary producers; indeed, gold production will almost certainly fall for the next twenty years no matter what the gold price does.

Investors in gold equities can gnash their teeth at the shenanigans on the Comex, and that?¡¥s fair enough. The current price makes no sense at all in terms of gold-gold economics. It should nonetheless be borne in mind that the last boom was largely a paper gold boom, where punters, suffuse with visions of geopolitical and monetary overreach, piled willy-nilly into long positions. The next boom, however, if the float is as thin as we think it is, may well be driven by physical scarcity, something a gold exploration geologist knows something about, be they in the jungle or on the tundra.

Here is a link to the full report.

Gold ore grades have been deteriorating for some time which has been a contributing factor in the rising marginal cost of production for the mining sector. Rather than classify the bull market in gold prices being solely as a result of a rise in demand for paper gold over physical supply, it is more reasonable to conclude that price represents the point at which the two different portions of the market converge.

The NYSE Arca Gold BUGS Index found support this week in the region of the psychological 100 level and a process of mean reversion is now underway. The short-term oversold condition is now being unwound but the Index will need to hold a progression of higher reaction lows and sustain a move above the 200-day MA to suggest a return to demand dominance beyond the short term.

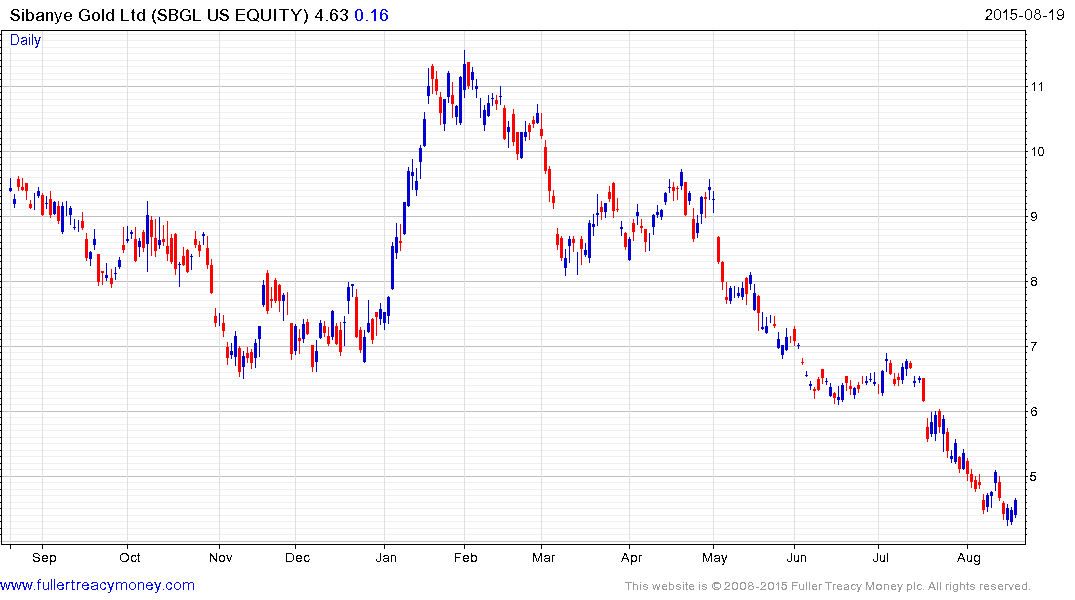

Sibanye Gold is working on an upside weekly key reversal following a steep decline.

Canadian listed Centerra Gold continues to hold a progression of higher reaction lows and hit a new recovery high today.