Gold Drops to Six-Month Low as Dollar Surges on Recession Fear

This article may be of interest to subscribers. Here is a section:

Gold slumped to the lowest in more than six months as the dollar rallied amid growing recession fears that caused losses across risk assets.

The greenback surged to the highest in more than two years as investors retreated to the haven, putting pressure on bullion. US stocks briefly slumped more than 2% amid fears that the Federal Reserve’s rate hikes to damp inflation could cause a slowdown in the world’s largest economy.

A pronounced drop in the euro also aided the dollar’s gain, driven by bets that the European Central Bank will be slower to tighten monetary policy than the Fed. Recession concerns in the bloc are particularly acute due to fears Russia will cut supplies of natural gas.

Gold fell 1.9% to $1,774.26 an ounce, after earlier touching the lowest since mid-December 2021. The Bloomberg Dollar Spot Index climbed 1.1%. Silver and platinum slid, while palladium edged lower.

The Dollar is not only rallying against the Euro and Pound. It is surging against just about every currency. The Bloomberg Dollar Index, which has less of a Euro weighting, is rallying to test the 2020 peak. The regular Dollar Index has already broken higher.

Gold is not immune from contagion selling. It is now falling in sympathy with commodities and global stocks. It dropped below the psychological $1800 level today to break the 15-month sequence of higher reaction lows. A clear countermanding upward dynamic will be required to check current scope for further downside.

Gold is not immune from contagion selling. It is now falling in sympathy with commodities and global stocks. It dropped below the psychological $1800 level today to break the 15-month sequence of higher reaction lows. A clear countermanding upward dynamic will be required to check current scope for further downside.

This article from the Australian, kindly forwarded by a subscriber, sheds some light on the underperformance of gold shares. Here is a section:

It’s also pretty easy to game the guidelines enough to bury your true costs. Under the guidelines, AISC only includes costs of running and sustaining current operations. Spending for growth projects – such as starting a new mine – would not be included.

If, like many smaller players, a company doesn’t have a tier-one deposit and is mining over a broader region, there’s a fair bit of wiggle room. Is opening up a new pit 10km down the road growth or sustaining capital? How do you account for a development drive to access a new section of an underground orebody? The WGC has guidelines, but they are just that, and there’s no audit on AISC figures.

There is no doubt the rising cost of energy has been a significant factor in reducing profitability for many miners. The weakness of domestic currencies versus the Dollar has exacerbated the issue. Rising labour costs are an additional headache that is unlikely to dissipate quickly. However, the quick reversal of oil prices is good news for all miners. The fact it comes with falling metal prices is less welcome.

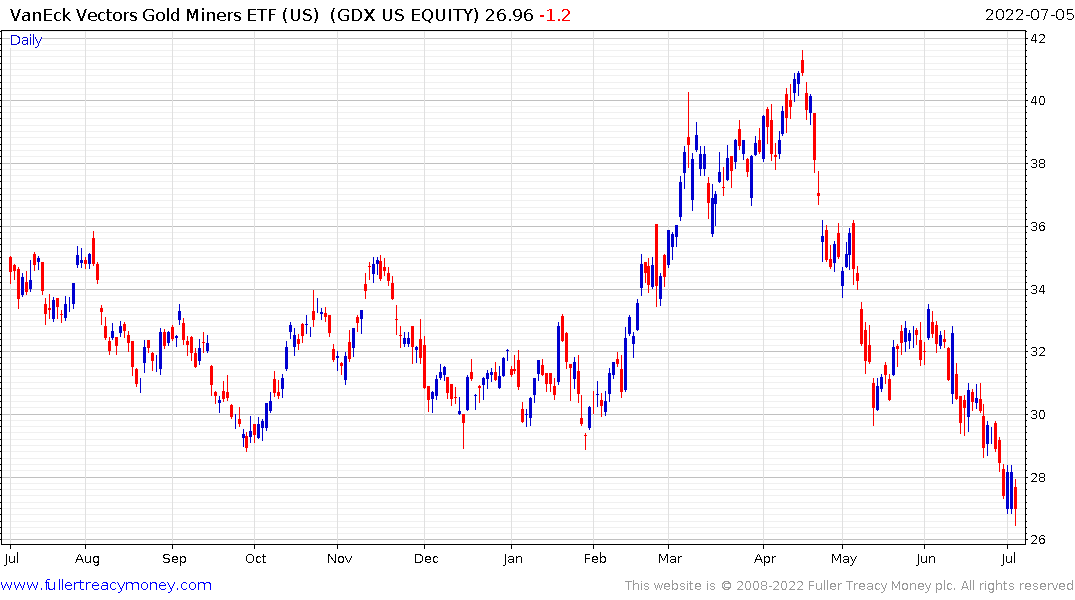

The VanEck Gold Miners ETF extended its decline today to post a new reaction low and to extend the drop below the psychological $30 area.

The VanEck Gold Miners ETF extended its decline today to post a new reaction low and to extend the drop below the psychological $30 area.

Silver failed to rebound back above $20 on Friday but extended its decline today. This is a significant breakdown and further emphasises the risk of contagion into the precious metals.

Gold is a big liquid global market. That means it is available to institutional investors when prices are rising but is susceptible to outsized volatility when they are in trouble and looking to plug holes in their P&L. Gold also tends to bounce back quickly from deep short-term oversold conditions when contagion selling has run its course.

Back to top