Global Equity Strategy Who sells where in 2016

Thanks to a subscriber for this heavyweight 118-page report from HSBC covering the international exposure of major companies on a global basis. Here is a section:

European equity markets are by far the most global, more than their economies, and are most exposed to Emerging Markets (EM)

US equity market is the most closed of the Developed Markets (DM), a key ingredient to the US’s relative ‘safer-haven’ status

Japanese overseas revenues have grown sharply in recent years, but are now threatened by yen strength

EM stock markets are the most closed, accounting for the bottom seven countries in our ranking

Economies are not stock markets. DM and EM have similar exports/GDP levels, but DM stock markets are twice as globalChinese corporates going abroad, but only generate 10% overseas today. Brazil corporates only 20% overseas after commodity slump

Italy and India have ‘globalized’ the most in recent years

IT is the most global US sector; Healthcare the most global European sector. Utilities and telecom are respectively the most local

Overall overseas revenue contribution has stalled (at 44%) the last three years, as globalization has come under pressure

Looking at indices based on revenue rather than domicile transforms the investment universe: EM much larger, whilst US a lot smaller

Here is a link to the full report.

With the growth of the global consumer base we began to pay attention to large international businesses that dominate their respective sectors from about 2011. I developed the list of Autonomies by looking at data similar to that compiled in this report; using it to identify companies that have global businesses. In perusing the report veteran subscribers will no doubt be familiar with many of the names.

The continued growth of India’s export market, driven by its leading position as a pharmaceuticals manufacturer and destination of the offshoring of customer support is one of the country’s primary strengths. Developing a manufacturing base which could serve both the international and domestic markets would truly unleash the economy’s growth potential. The Nifty Index continues to extend its rebound and is now approaching a potential area of resistance near 9000. However a break in the medium-term progression of higher reaction lows would be required to confirm more than temporary supply dominance in that area.

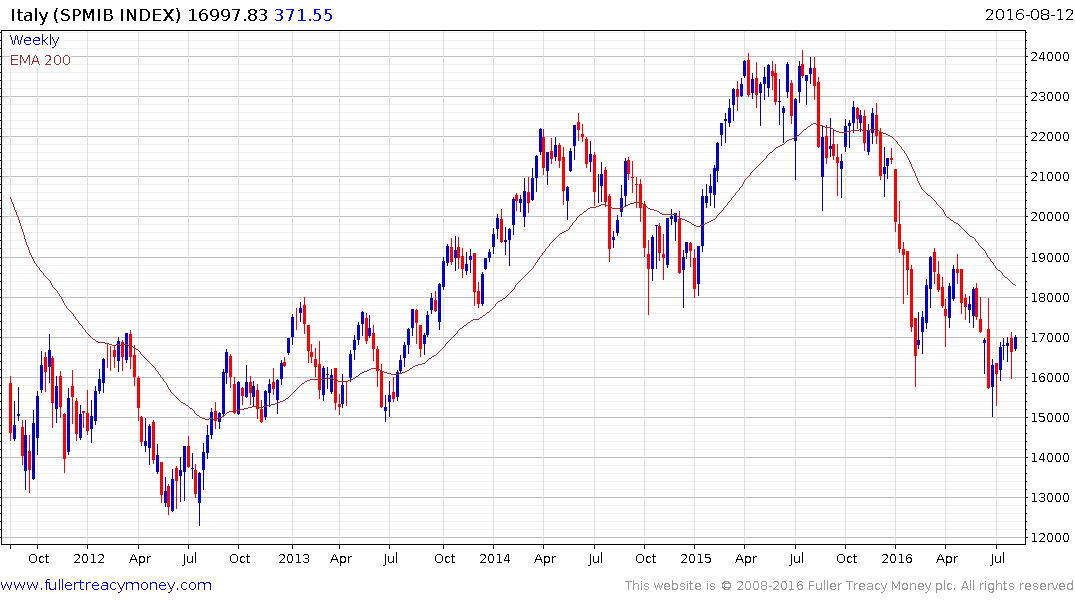

News flow regarding Italy remains downbeat with the economy stagnating and Renzi’s government likely to fall if its referendum on lessening the power of the senate is defeated. Nevertheless, as an investor we look at companies not governments and Italy is replete with internationally oriented businesses with the big exception of its banking sector.