Global connectedness: A world you should start imagining

Thanks to a subscriber for this article by Bernard Kellerman focusing on a speech by Adrian Blundell-Wignall of the OECD while in Sydney. Here is a section:

The situation cannot continue though, as the current trade equilibrium will soon be exceeded — or thrown completely by a change in the USD exchange rate. Blundell-Wignall noted that the US economy accounts for 20 per cent of the world economy on a GDP basis, while the BRICS economies and other emerging economies now make up 50 per cent of world GDP.

Blundell-Wignall said that this group of countries are run in a very different way to how OECD countries run their economies. In particular this part of the world economy manages its exchange rate in relation to the US dollar.

"The emerging markets are closed capital markets, relying on domestic savings for their investment capital, and, in effect, managing to the US dollar.

"What this means is that the US, which accounts for just 20 per cent of world GDP, cannot manage its exchange rate in the way it wants to in relation to its biggest trading partners.

The net effect is damage to the US trading sector, with jobs being effectively exported overseas. This export-led policy — on both sides of the transaction — has meant that while inflation and other costs may have been kept in check, US workers have not had a real wage rise in 30 or 40 years. During this same period, those wealthy enough to own shares have been doing very well, creating an expanding divergence in wealth.

Blundell-Wignall asserted that this "export led" growth model by emerging economies cannot continue, so the question that needs to be asked is: how will this change?

"Imagine in the future that the OECD is only 10 per cent of the world economy and the emerging markets are 90 per cent of the world economy," he said.

"Is 90 per cent of the world economy going to be able to have export-led growth to 10 per cent of the world economy? Of course not."

Will it be by a co-operative solution where emerging countries gradually liberalise and adopt the ‘OECD model’ of business?

One of the primary reasons China is attempting to animate its consumer base and bolster its services sector is because the powerful export led/infrastructure development model is powerful but is not enough to propel continued outsized GDP growth. Many middle income countries face similar challenges and mustering the will to push through the reforms necessary to achieve development goals is not easy.

Considering the fact that emerging economies’ share of global GDP growth has accelerated over the last decade it is reasonable to ruminate on the questions in the above article. The implications for these economies as their share of global capital markets increase is that they will need to continue to see the trajectory of governance improve in order to successfully transition to higher income.

Heightening geopolitical risk may be a symptom of the fact that some countries are having difficulty or are incapable, under their current administrations, of adjusting to the development challenge. Easing tensions across much of Africa suggest the opposite is true in that region. The last decade was notable for a declining Dollar and outperformance of emerging markets. We have argued for the last few years that the same level of homogeneity cannot be relied on any longer. The prospects for individual countries will need to be addressed on their individual merits.

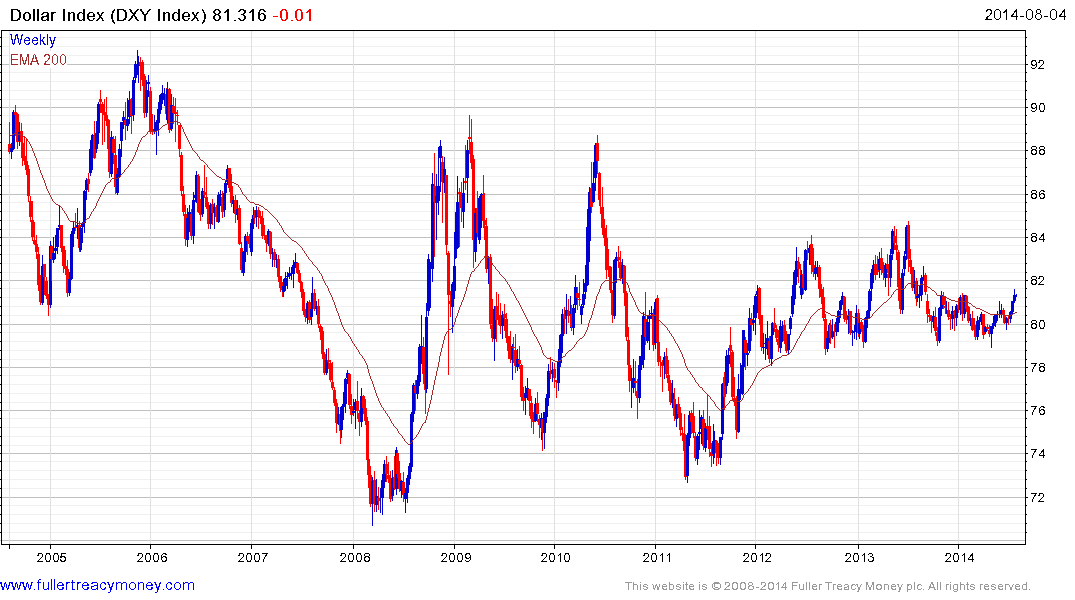

Meanwhile the Dollar’s rally against the Euro and Yen continues to offer support to the Dollar Index

which is rallying from the lower side of a two-year range within the broad medium-term base.

Back to top