Glencore profit tops estimates

This article by Jesse Riseborough for Bloomberg appeared in Mineweb and may be of interest to subscribers. Here is a section:

To combat falling prices and waning demand, investors have demanded the world’s biggest mining companies slash spending on new mines and return more cash to shareholders.

Producers will cut spending on projects and exploration by $20 billion this year, according to estimates from Macquarie Group Ltd., as they rein in growth plans amid waning prices. Last month, Glencore trimmed its spending for 2015 to a range of $6.5 billion to $6.8 billion from an earlier target of $7.9 billion.

Net debt dropped 15 percent to $30.5 billion, Glencore said. The company booked $847 million of impairment charges on platinum, iron ore and oil assets for the year.

Glencore completed the $29 billion acquisition of Xstrata Plc in 2013 to add coal, copper, zinc and nickel mines to its trading empire.

Its approach to Rio Tinto about a possible merger was rebuffed by its larger rival in October. That effectively barred it from bidding for six months under U.K. takeover rules. Rio last month reported a 9 percent decline in underlying profit for 2014 and announced a plan to buy back $2 billion of shares.

Miners have spent a great deal of money developing new supply which is increasingly reaching market. Unfortunately the demand growth forecasts this investment was made under are not panning out.

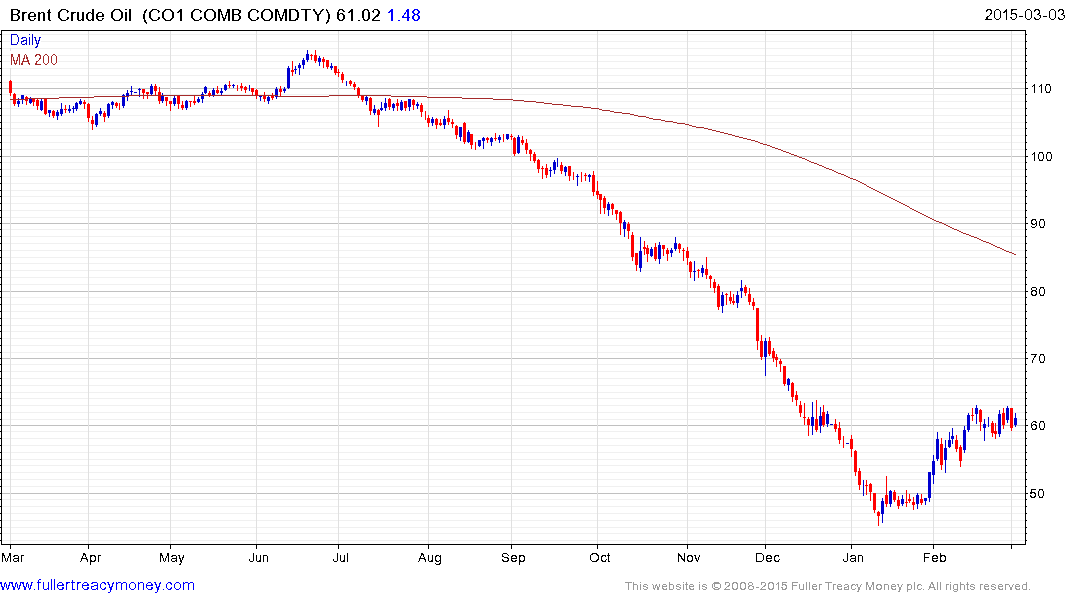

Iron-ore prices remain in what is still a consistent downtrend. Copper has partially unwound an oversold condition but still needs to demonstrate that the February low can hold on a pullback. Meanwhile the majority of industrial metals are pressuring their respective lows.

The low price of oil is also allowing marginal production to come in at a lower price point so that metals prices remain under pressure. Against this background, miners have little choice but to cancel expansion and take any measures possible to maximise cash flow.

Industrial metal miners were among the leading decliners on the FTSE-100 today. Glencore continues to encounter resistance in the region of the 200-day MA. Anglo American has a similar pattern.