Email of the day on trend consistency

Eoin and David are doing a spectacular job of calling equity trends and should be congratulated on this (I am sure they are being well rewarded on their personal portfolios!).

However on 2 issues I think they have been less accurate.

1. Eoin's answer to Alexander Scaggs/Peter Fisher is inadequate (a) because Ben Bernanke/Janet Yellen/Bill Dudley are all sensitive democrats. They have no interest in boosting equities and making Wall Street wealthier per se. They see it merely as a necessary transmission mechanism to the wider public. As such even though they - and many of us feel that they have helped boost the real economy - they are not celebrating. It took too long, has hardly boosted median wage consumers' jobs and pay since 2000 (though it might have been much worse) and more importantly it was probably mostly the result of the competitive devaluation effect of more proactive monetary easing - hence much of this may be unwound over the next 3-5 years as other economies adopt the same medicine. Moreover as most other economies (Japan, Europe, China) have rapidly ageing demographics and workforces, and much more challenging structural rigidities (high minimum wages, onerous employment law, higher public debt, pay as you go pensions etc), they look less likely to benefit from QE - other than through competitive devaluation - which just imports reflation from (steels growth from)/exports deflation to, others eg US.

2. Why can't David and Eoin read their long bond and gold charts like they read all others. US10y yield has powerful falling lows and highs that will take a massive change in momentum to change. At this late stage in the cycle I see only one item that can do this - default more particularly sovereign default. Even then it is most likely to benefit US10y because US is probably furthest of all major countries from default. Japan and France are way more likely as are a myriad of small countries (Venezuela, Greece, Portugal, Ukraine etc). Result - flight to quality? Incidentally I think short term chart trend still points towards a healthy ongoing correction (from 1.6% low to 2% today to maybe 2.25-2.5%?) before bull trend reasserts. Problem is that this renewed uptrend - when and if it comes - is more likely to be associated with an end of cycle flight to quality.

3. Likewise Gold. Sure it is a good safe hedge - but the chart is ugly as - falling lows and falling highs. Tightening in US will not be good for gold - but chart suggests meaner forces at work?

Thank you for this considered email. I don’t believe we are very far apart in our views but you have the added perspective of having studied under Janet Yellen. The world is awash in liquidity and there is little prospect of the condition changing. The ECB is primed to print a €1 trillion Euro, the Japanese are still engaged in QE, China is unwilling to allow further Yuan appreciation, a number of other Asian countries are responding to low commodity prices by also cutting interest rates and commodity reliant nations are lowering interest rates and printing currency. The Fed is unlikely to be aggressive in raising the Fed funds rate against this background. Regardless of the high-minded aims of the originators of QE, the result is the same i.e. increase the supply of money and asset prices rise.

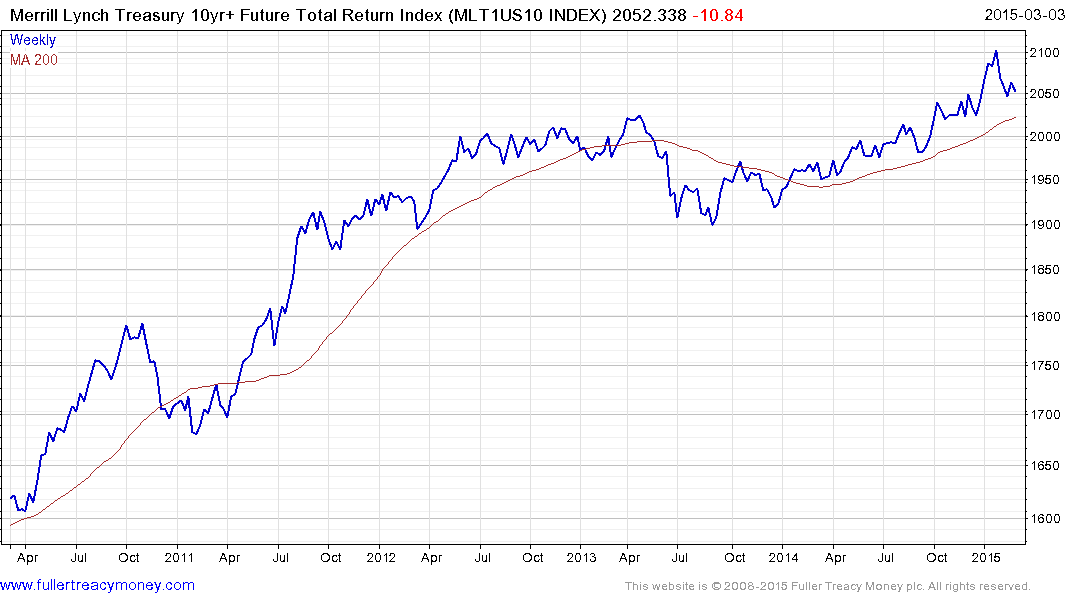

One of the reasons I tend to focus more on the total return chart for Treasuries than the yield is because momentum contributes much more to total return when interest rates as so low. I agree a process of mean reversion is underway and that the 2.25 – 2.5% area is where one would expect to see support being found.

That is why the 3% area is where one could be begin to talk about the potential for medium-term trend change. However as I pointed out yesterday that is almost a 50% move in yield from present levels and a big ask. The reason the total return chart is useful is because we are likely to get some warning of a loss of momentum and inconsistency earlier than by simply looking at yields.

I agree that the risk of sovereign default, probably among lower-rated commodity producers, is an increasing risk. However the greater risk to bond portfolios is growth. Broad based growth, which admittedly has been absent for much of the last decade would not require the extraordinarily low interest rates we are currently presented with. There are a lot of exciting themes in the energy, technology and healthcare sectors that can boost growth and the impact of lower commodity prices will wash through the fundamental statistics in the next few quarters. Rather than be complacent, I believe monitoring the trend in bonds, although still reasonably consistent, is more important than ever.

.png)

For example the 3.75% 2043 Treasury price is no longer trending consistently higher. In fact if the benefit of the doubt is to continue to be given to the upside it needs to find support in the current area, so it really is worth watching.

With regard to gold, I believe we have been clear in stating that the period of time when gold could be relied on to deliver a positive return year after year is over. ETF Holdings have been trending consistently lower since 2013 and while the momentum of withdrawals has waned we have yet to see conclusive evidence of a return to demand dominance.

Gold prices have held mostly above $1200 since July 2013 and there is still a mild downward bias in the progression of lower rally highs. If this is in fact base formation development the lows near $`1140 need to hold. Personally I find it an easy market to avoid in my personal trading because there is no evidence of a consistently trending environment, the immediate prospect of base formation completion or a deep oversold condition which would offer an attractive entry point.