German Inflation Sinks to Level Last Seen Before War in Ukraine

This article from Bloomberg may be of interest. Here is a section:

German bonds pared declines and the euro trimmed gains after the release, as markets increasingly come around to that higher-for-longer narrative. The yield on 10-year government debt is hovering just below 3% — the highest since 2011. The euro is flirting with its weakest level against the dollar this year, near $1.05.

Money markets are wagering on two quarter-point rate reductions by end-2024, compared with as many as three just two weeks ago.

Inflation not only remains elevated but is accelerating in some countries. Earlier Thursday, Spain reported a jump to 3.2% this month on electricity and fuel costs. Citing the advance in oil that’s brought prices near $100 a barrel, its central bank sees a further acceleration to 4.3% in 2024. In Ireland, price growth quickened to 5% from 4.9%.

The era of negative bond yields afforded both the German government and private sector speculators the opportunity to be paid to borrow. That also implies the EU is now more interest rate sensitive than the USA. Germany’s housing prices are in a steep decline as the era of better than free money ends.

Despite better inflation figures German Bund futures are breaking down in a dynamic fashion. This kind of move suggests a reacceleration of the downtrend is now more likely than the developing type-2 bottom that looking like it was developing last week. A clear upward dynamic will be required to check the decline.

Despite better inflation figures German Bund futures are breaking down in a dynamic fashion. This kind of move suggests a reacceleration of the downtrend is now more likely than the developing type-2 bottom that looking like it was developing last week. A clear upward dynamic will be required to check the decline.

I want to thank a subscriber for this interesting titbit of information:

“Based on #SWIFT international payments, we are witnessing 'de-euroization' and not '#dedollarization. The #euro's share in SWIFT global payments has dropped to 23% from 38% at the start of the year.

Are #Russia's SPFS and #China's CIPS eating up the euro?

By the way, #China's share in SWIFT payments reached an all-time high of 3.47% in August!”

There is no correlation between the price performance of the Euro and the extent to which it is used in as a settlement currency via the SWIFT network. That’s helps to emphasise this is less about currency volatility and more about confidence in how robust the region’s institutions are.

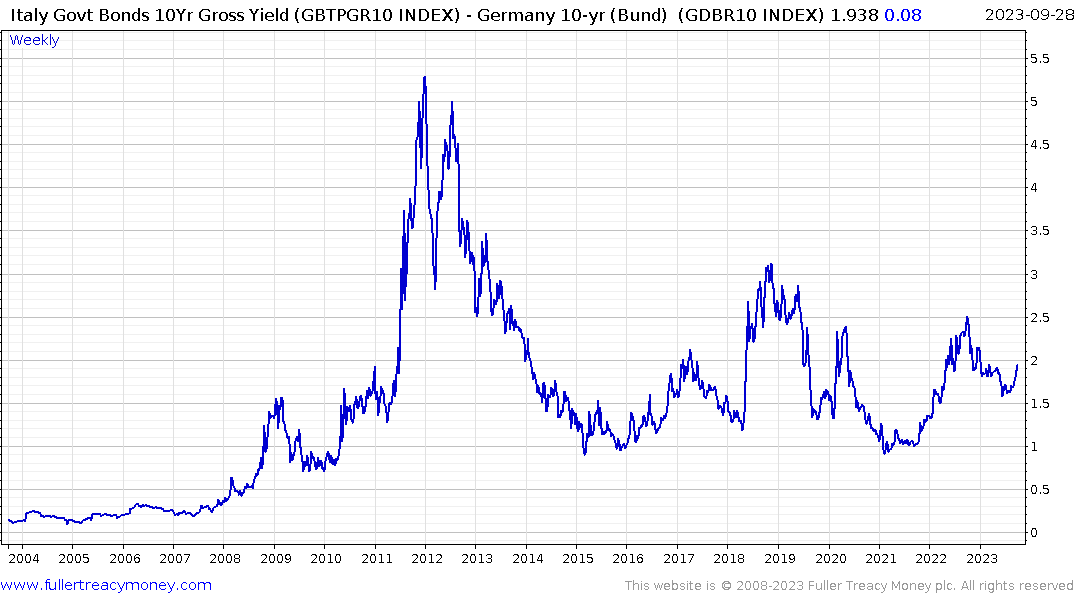

Germany yields are accelerating on the upside, but Italy’s are going up faster as the spread breaks the sequence of lower rally highs. Italy’s spread is now wider than either Greece or Spain’s relative to the Bunds.

The Euro is oversold so there is scope for a short-term upwind of that condition. However, if sovereign bonds continue to sell off in absolute terms, and peripheral spreads simultaneously continue to expand, that is setting up a difficult question for the ECB. Are they willing to seed another sovereign wealth crisis by sustaining their rhetoric about “higher for longer”? I think it is more like “higher until the first sign of trouble.”

The Euro is oversold so there is scope for a short-term upwind of that condition. However, if sovereign bonds continue to sell off in absolute terms, and peripheral spreads simultaneously continue to expand, that is setting up a difficult question for the ECB. Are they willing to seed another sovereign wealth crisis by sustaining their rhetoric about “higher for longer”? I think it is more like “higher until the first sign of trouble.”

Meanwhile, the US Dollar has not had such a high share of SWIFT payments in years. I guess all those aircraft carriers count for something.

Meanwhile, the US Dollar has not had such a high share of SWIFT payments in years. I guess all those aircraft carriers count for something.