Coinbase to let retail users outside the U.S. trade Bitcoin and Ethereum futures on its Bermuda exchange

This article from Fortune.com may be of interest to subscribers. Here is a section:

"We chose to build our business and become a public company in the U.S. believing that the U.S. should be at the forefront of efforts to update our financial system," wrote the exchange.

Coinbase's move to open up its international exchange to small investors is the latest in the company's ongoing efforts to expand its footprint beyond the U.S. where it has faced growing regulatory scrutiny.

Following the collapse of competing exchange FTX and the arrest of its now-disgraced CEO Sam Bankman-Fried, the Securities and Exchange Commission soon cracked down on a slew of high-profile crypto companies and founders, including Genesis, Gemini, Justin Sun, the crypto celebrity behind TRON, and Do Kwon, creator of the so-called stablecoin TerraUSD.

In March, Coinbase, which has long styled itself as the white knight of the crypto industry, revealed that has also become the target of impending SEC litigation after it received a so-called Wells Notice, which informs companies that they are the targets of soon-to-be litigation.

Shortly after, the U.S.-based exchange, headed by CEO Brian Armstrong, announced that it had received regulatory approval in Bermuda to operate an offshore exchange, and in May, the publicly traded company unveiled Coinbase International Exchange for the use of institutional investors.

The SEC eventually filed an outright lawsuit against Coinbase in June, but that hasn't stopped billions of dollars of crypto from flowing through both its domestic and offshore entities. Its Bermuda outpost has seen $5.5 billion in trading volume—strictly from institutional investors—as of the second quarter of 2023. (By comparison, Coinbase reported $92 billion in total trading volume in the same period.)

Whenever there is the prospect of additional new funds flowing into the crypto market, prices respond bullishly instantly. Today was another example of that with a jump in both bitcoin and Ethereum prices.

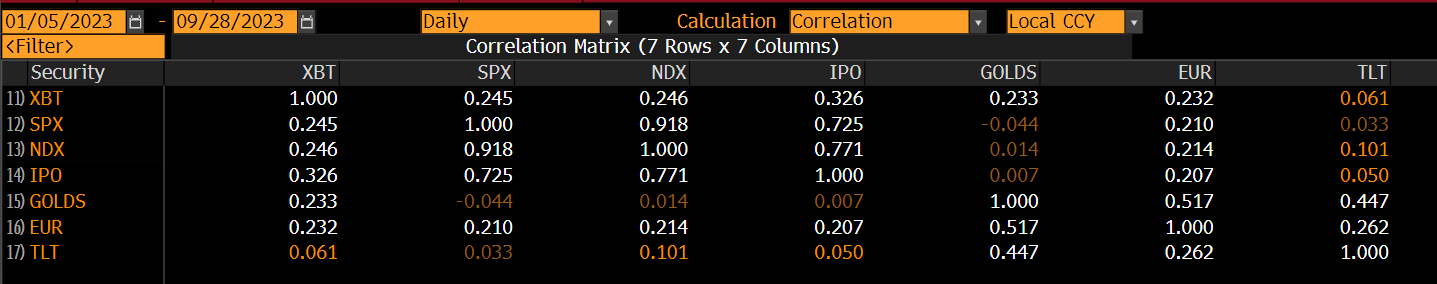

A popular topic of conversation regarding bitcoin is what it is correlated with. This graphic plotting correlations since the beginning of this year suggests bitcoin has not been especially correlated with any other assets.

There have certainly been times when it has performed in line with risk assets, but those occasions have mostly been limited to times of surging global liquidity. The primary argument to focus on at present is it is a limited supply instrument and the reward for mining new blocks is due to halve in April 2024.

In practical terms, that will double the cost of production to $30,000 per block. Immediately a significant number of miners will be unprofitable. That’s the primary explanation for why bitcoin prices tend to be volatile around halvenings.

Nevertheless, the mining process is required for validating and sustaining the network. Therefore, the price has to rise sufficiently to provide an economic return for the most efficient miners.

Coinbase continues to steady in the region of the upper side of the base formation.

Riot Platforms is one of the most efficient publicly traded bitcoin miners. The share dropped below the psychological $10 level last week but is now steadying.

Riot Platforms is one of the most efficient publicly traded bitcoin miners. The share dropped below the psychological $10 level last week but is now steadying.

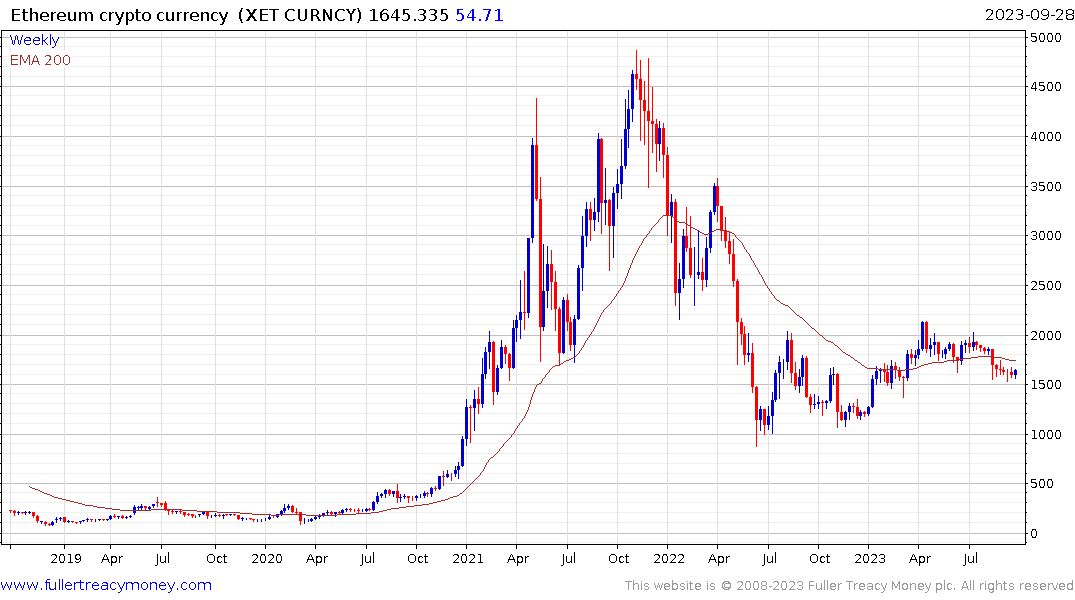

Ethereum continues to steady in the region of the 1000-day MA.