GameStop, Getty Images Surge as Meme and De-SPAC Frenzy Returns

This article from Bloomberg may be of interest to subscribers. Here is a section:

“The first thing you have to realize with these stocks is there’s no rhyme or reason,” said Keith Lerner, chief market strategist at Truist Advisory Services Inc. “They don’t trade based on the big macro trends normally. They trade on speculation and liquidity.”

A basket of so-called meme stocks tracked by Bloomberg rose 1.4%, while the De-SPAC index is lower by about 0.2%. Both gauges have plunged this year as concerns about a possible US recession diminished investor demand for shares of riskier assets.

The sudden resurgence in interest for the group comes ahead of what is likely to be a bumpy two weeks for the stock market. A Federal Reserve rate decision on Wednesday will kick off a span of seven trading sessions that will feature four major events including a key jobs report, mid-term elections and inflation data for October.

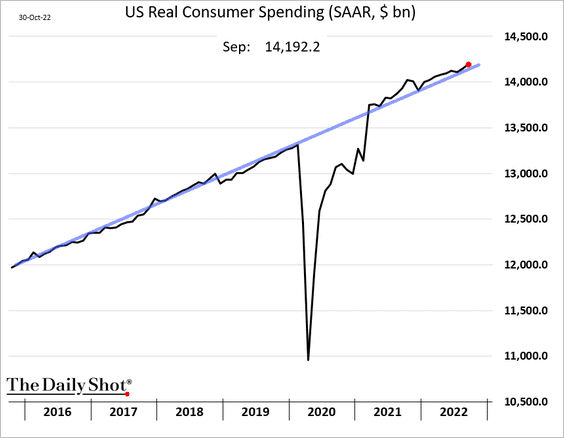

Let’s set rationale aside for the present and think instead about what kind of message this spike in speculative activity says about how much liquidity is still in the market. In nominal terms, consumer spending is way above trend. Adjusted for inflation it is back on trend.

That suggests the scope for a self-feeding inflationary cycle is intact because US consumers are still willing to pay up and have not pulled back from purchasing decisions. The bullish narrative is centred on the assumption a fed pivot is inevitable, if not now, then in Q1 2023. I remain of the view that is unlikely until inflation comes down or unemployment rises.

With quantitative tightening underway and M2 year over year data close to negative, there is clear scope for CPI figures to moderate. The 2023 conversation is likely to be much more about deflation rather than inflation as the rapid pace of tightening bites.

With quantitative tightening underway and M2 year over year data close to negative, there is clear scope for CPI figures to moderate. The 2023 conversation is likely to be much more about deflation rather than inflation as the rapid pace of tightening bites.

The only way medium to long-term inflationary pressures are brought under control is if the days of relying on the Fed to ride to the rescue of asset prices is behind us. In order of priority asset prices should come behind both price stability and unemployment. Not every SPAC or meme stock will eventually go bust but retail traders will eventually come to realise that a meaningful discount rate implies a very different market environment to the boost GFC boom.

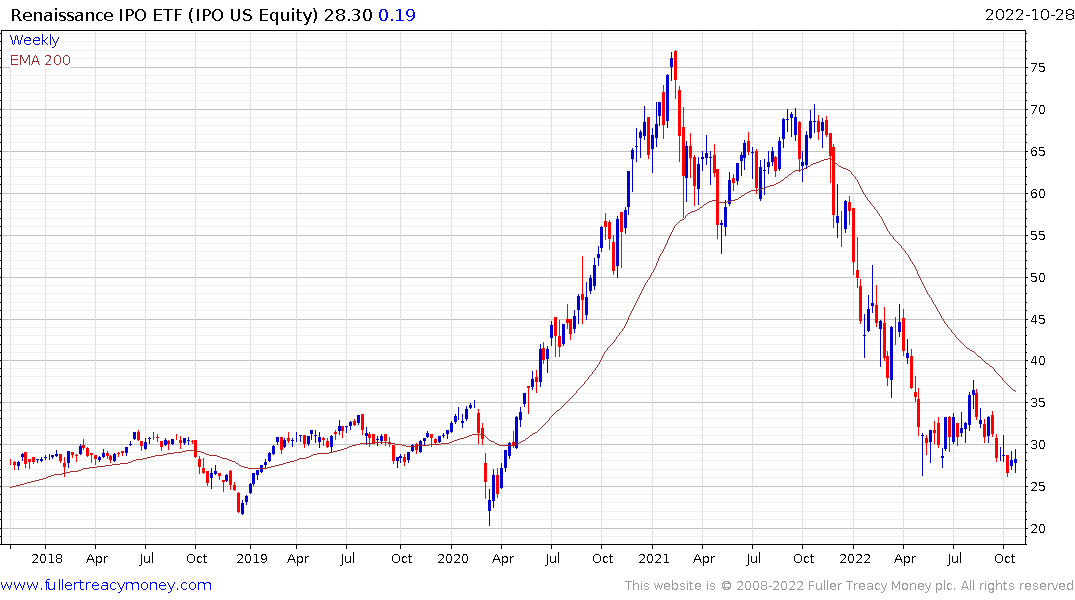

The SPAC Index continues to range in the region of its debut level.

The SPAC Index continues to range in the region of its debut level.

The Renaissance IPO ETF continues to range in the region of the May low. Companies are removed from the Index after two years so some of the biggest losers, like Roblox, will run-off in the next few months.

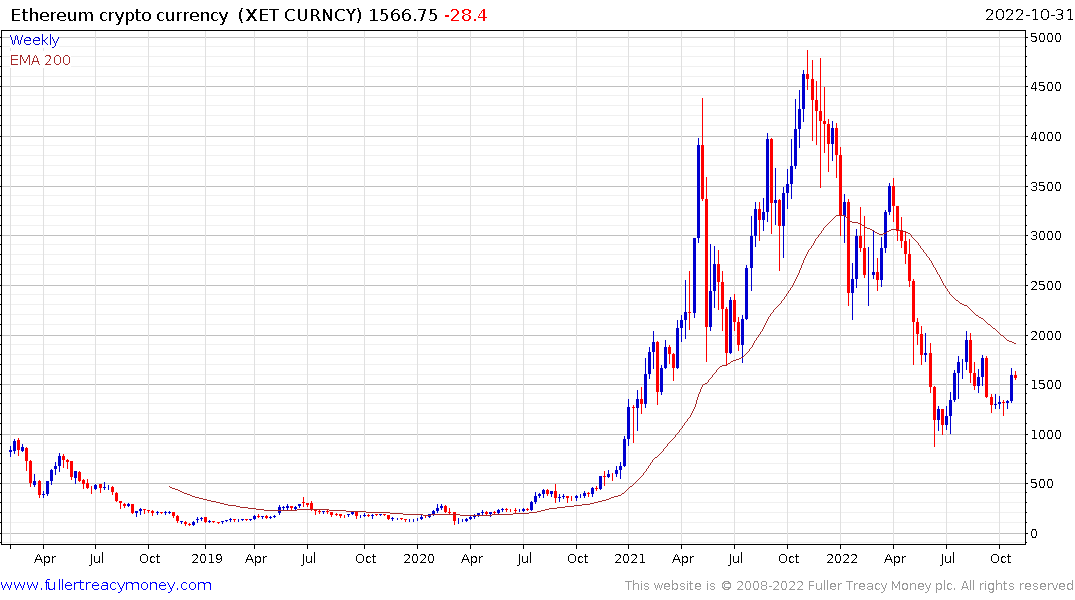

Bitcoin and Ethereum are liquidity lightning rods. Ethereum has more recently been favoured by investors because the post Merge environment of staking and crypto dividends is so similar to a deposit at a bank. Nevertheless, the truly big moves in crypto have all been associated with post halvening liquidity surges. It would be surprising to see the kind of upside crypto traders are accustomed to with a new splurge of money printing.