Foxconn recruitment spree shows automation plan setback

This article for Want China Times may be of interest to subscribers. Here is a section:

Foxconn chairman Terry Gou announced in 2011 that the company planned to manufacture 300,000 robots at a rate of 1,000 units a day and hoped to have 1 million robotic arms in 2014 for the benefit of the first batch of fully automated factories in five to ten years.

A vendor supplying equipment for automated production said that technically it is not a major problem for Foxconn to replace human workers with robots. However, using robots on the production line is only cost-effective for making homogeneous products and cuts cannot realistically be made in making mobile phones and tablet devices which have a more complicated manufacturing process, the vendor stated.

"The labor-intensive industry, such as OEM, can no longer sustain the company's growth," Gou said at a shareholder meeting on June 25. He further said that the company has been seeking a transformation of its business model in the past few years, which is expected to be crucial for Foxconn's continued growth in the next decade.

Factory automation represents an inexorable trend as companies attempt to contain costs and labour uncertainties. As the evolution of robotics proceeds, companies are becoming increasingly knowledgeable about what can and cannot be outsourced to automation. However robots have an important advantage relative to a human labour force. As pieces of technology, they are subject to Moore’s law and humanity is not. Therefore we can anticipate that as robotics continues to develop and innovation accelerates, robots will both displace humans and also develop products human hands are incapable of.

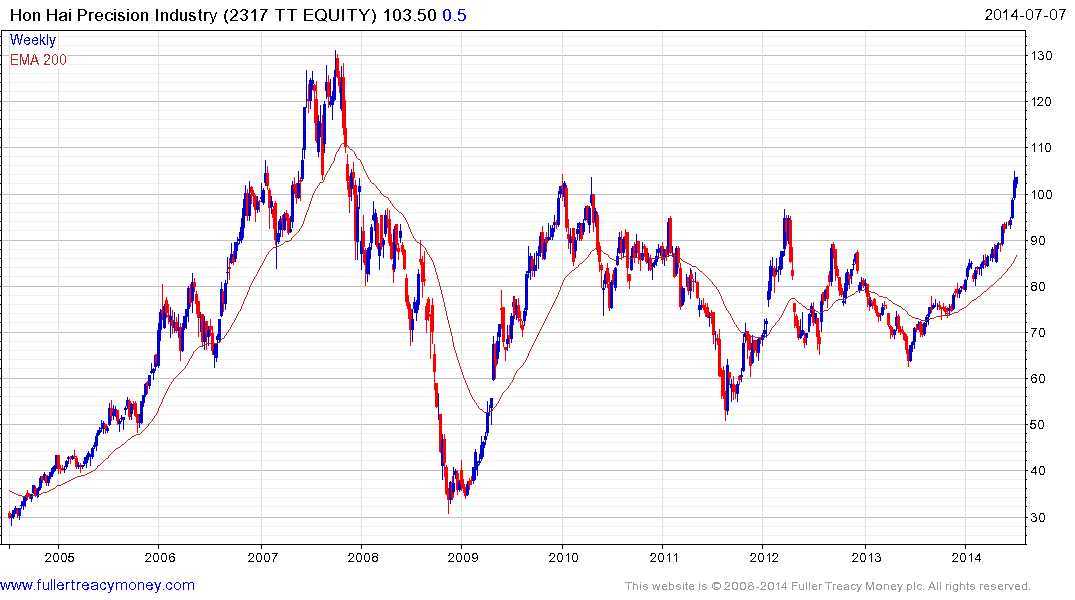

Taiwan listed Hon Hai Precision Industries has rallied impressively over the last year to test the 2010 peak nearTWD100. While some consolidation of recent powerful gains is looking increasingly likely, a sustained move below TWD90 would be required to question medium-term potential for additional upside.

Hon Hai ‘s separately listed Foxconn subsidiary found support near TWD66 from last year and has held a progression of higher reaction lows since November. A sustained move below TWD70 would be required to question medium-term scope for higher to lateral ranging.

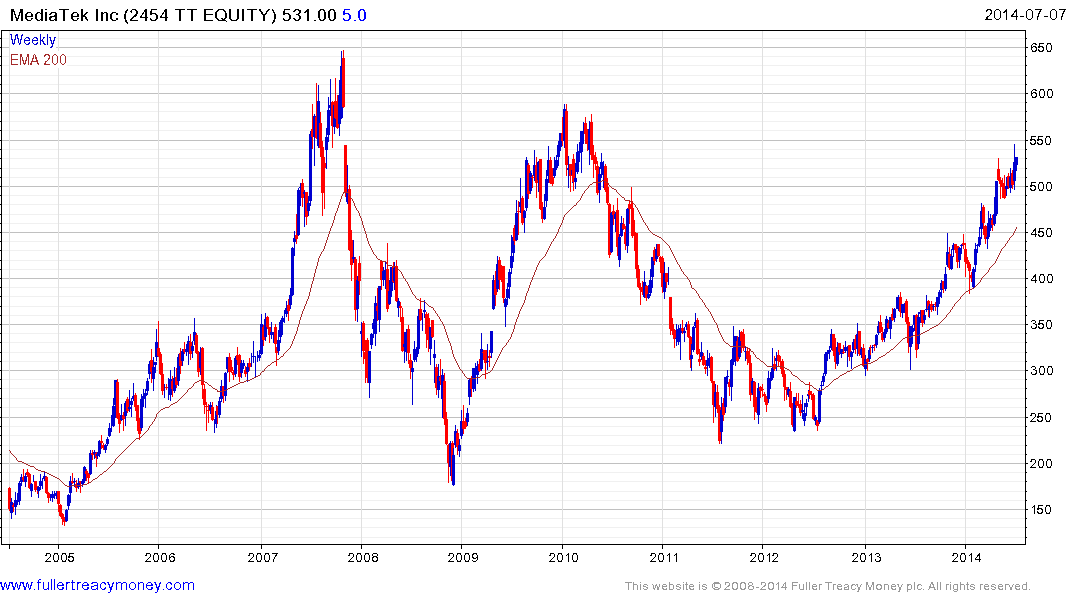

Elsewhere among Taiwan’s larger manufacturers, Mediatek found support in the region of the 200-day MA from early 2013 and continues to hold a progression of higher reaction lows. It is somewhat overbought at it tests the 2010 peak near TWD600 but a sustained move below the MA would be required to check the consistency of the overall advance.

![]()

Taiwan Semiconductor surged last week to extend its medium-term uptrend. As it becomes increasingly overextended relative to the 200-day MA potential for a reversion towards the mean is increasing.