BP Statistical Review of World Energy (June 2014)

Thanks to a subscriber for this in depth report which may be of interest. Here is a section on coal:

Coal consumption grew by 3% in 2013, well below the 10-year average of 3.9% but it is still the fastest-growing fossil fuel. Coal’s share of global primary energy consumption reached 30.1%, the highest since 1970. Consumption outside the OECD rose by a below-average 3.7%, but still accounted for 89% of global growth. China recorded the weakest absolute growth since 2008 but the country still accounted for 67% of global growth. India experienced its second largest volumetric increase on record and accounted for 21% of global growth. OECD consumption increased by 1.4%, with increases in the US and Japan offsetting declines in the EU. Global coal production grew by 0.8%, the weakest growth since 2002. Indonesia (+9.4%) and Australia (+7.3%) offset a decline in the US (-3.1%), while China (+1.2%) recorded the weakest volumetric growth in production since 2000.

Here is a link to the full report (11MB).

Coal faces stiff opposition in North America from low natural gas prices and increasingly stringent EPA regulations. However, the fact remains that coal is cheap, abundant and technologically simple to derive energy from. Coal prices are depressed and investors are fearful that the sector is in terminal decline. That has certainly been the case for a number of miners but their demise also means that the oversupply situation which has been reflected by prices should ease.

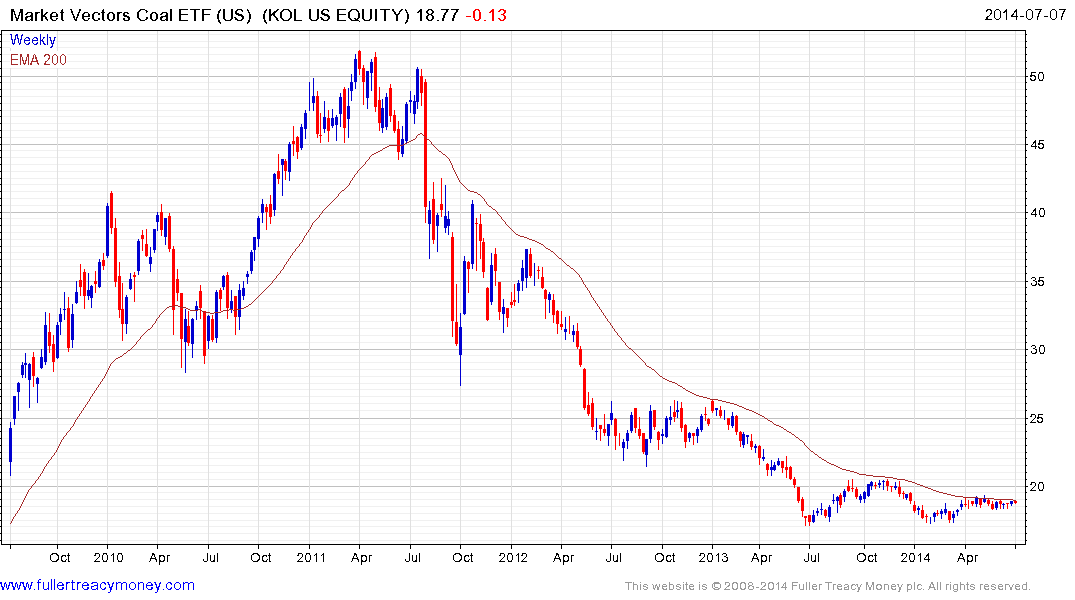

The Market Vectors Coal ETF has constituents from the mining, transportation and equipment sectors. It has been ranging above $17 for a year and a sustained move above the 200-day MA, currently near $19, would suggest a return to demand dominance beyond the short term.