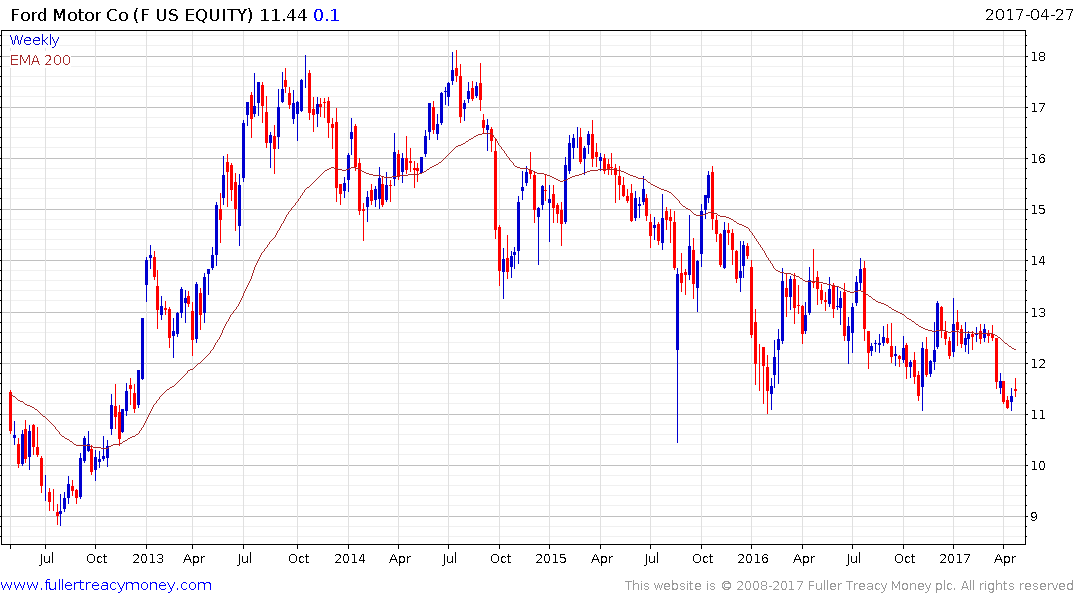

Ford Sharpening Sales Pitch as Driverless Car Wager Underwhelms

This article by Keith Naughton for Bloomberg may be of interest to subscribers. Here is a section:

Fields has struggled to generate enthusiasm for plans to pour billions into new technologies and take on upstarts like Uber Technologies Inc. and Waymo, Alphabet Inc.’s self-driving spinoff. The CEO has said earnings will rebound next year as new models including the redesigned Lincoln Navigator are expected to start paying off. Until then, earnings will continue to be pinched in a U.S. market that’s also seeing auto demand roll back following a seven-year growth spurt.

“This will be the toughest quarter,” Chief Financial Officer Bob Shanks told reporters at Ford’s headquarters in Dearborn, Michigan. “The balance of the year, in the aggregate, will be flat to better.”

Profit excluding some items was 39 cents a share during the first three months of the year, beating the 34-cent average estimate of analysts surveyed by Bloomberg as well as the company’s own projection given in March. Net income on that basis fell to $2.22 billion.

The key to any business is succeeding in giving people what they want. Recreational horseback riding is fun but horses as a mode of transport leave a lot to be desired. For many people recreational driving is fun but the slog of commuting on congested roads leaves a lot to be desired. The gap between the reality of driving and the idea of driving is just too wide. Incumbent companies have no choice than to invest in electrification and automation because the latter in particular gives everyone a chauffeur, which is something until now only the wealthiest individuals could afford.

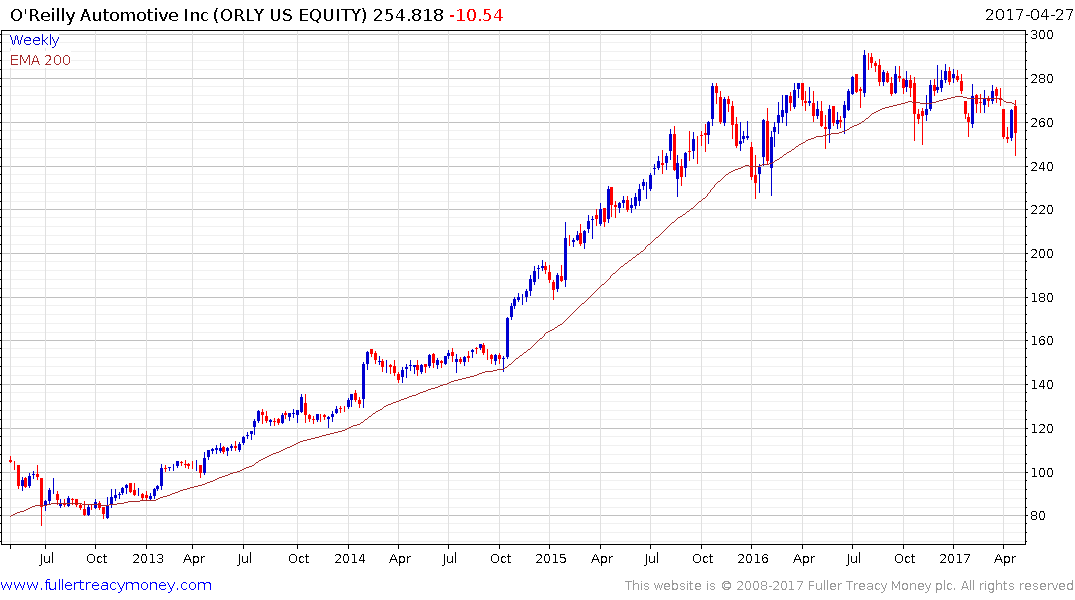

I contend that while companies like Ford, GM, Volkswagen, Daimler, BMW, Kia or Toyota have the balance sheet heft to fund transition the trend towards electrification represents a significant threat to automotive part retailers.

O’Reilly Automotive and AutoZone were subject to some quite acute volatility today and continue to exhibit developing top formation characteristics.