Fiscal impulse update: Uncle Sam goes on a spending spree

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Previously, we had highlighted the upside risks to our growth outlook pending the outcome of the latest budget debate. The recent passage of a bipartisan budget agreement provides for nearly $300 billion in additional discretionary spending in fiscal years 2018 and 2019. In turn, we have raised our 2018 real GDP growth forecast (Q4/Q4) to 2.9% (from 2.6% previously) and our 2019 forecast rises to 2.5% (from 2.1%).

Stronger growth should put further downward pressure on the unemployment rate, which we now expect will trough at 3.2% in 2019, about 1.5 percentage points below NAIRU. Lower unemployment and this morning's upside surprise for core inflation have led to a one-tenth increase in our core PCE projections, which now are 2% for year-end 2018 and 2.3% for year-end 2019. Our baseline Fed expectation is unchanged: we continue to expect four rate hikes this year and three next year. But recent developments have tilted the balance of risks to the upside.

Here is a section from the report.

Previously, we had highlighted the upside risks to our growth outlook pending the outcome of the latest budget debate. The recent passage of a bipartisan budget agreement provides for nearly $300 billion in additional discretionary spending in fiscal years 2018 and 2019. In turn, we have raised our 2018 real GDP growth forecast (Q4/Q4) to 2.9% (from 2.6% previously) and our 2019 forecast rises to 2.5% (from 2.1%).

Stronger growth should put further downward pressure on the unemployment rate, which we now expect will trough at 3.2% in 2019, about 1.5 percentage points below NAIRU. Lower unemployment and this morning's upside surprise for core inflation have led to a one-tenth increase in our core PCE projections, which now are 2% for year-end 2018 and 2.3% for year-end 2019. Our baseline Fed expectation is unchanged: we continue to expect four rate hikes this year and three next year. But recent developments have tilted the balance of risks to the upside.

Here is a link to the full report.

The Dollar is weak, wages are rising, the participation rate has bottomed and unemployment is due to fall further. That is a recipe for inflation.

The surge in supply of Treasuries due over the course of the next few months and years, while the Fed is planning to further reduce the size of its balance sheet, represents additional downside pressure on Treasury prices over the medium term.

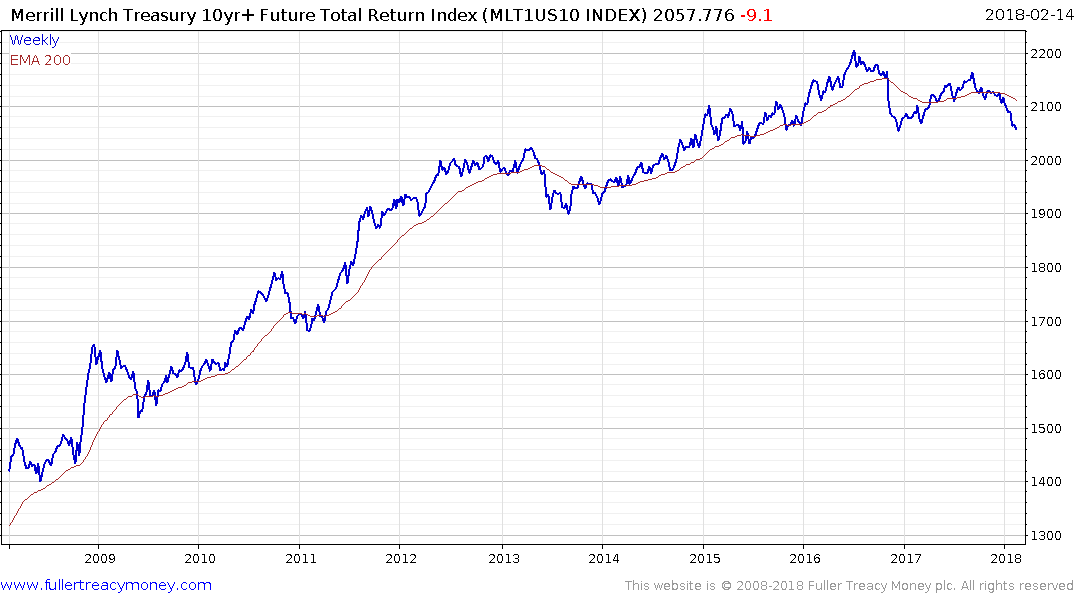

The Merrill Lynch 10+yr Total Return Index is currently testing the lower side of a developing Type-3 top which has been forming for the last three years. Considering the fact this has been one of the most impressive long-term bull markets in history, this loss of momentum, uptick in volatility and lengthier range all point to a change in investor behaviour.

The market is currently focused on the 3% rate for Treasuries as if that is a ceiling above which no one can imagine yields moving. However, there is nothing sacrosanct about 3%. The Fed appears to be fully aware it has contributed to rich valuations in asset prices and therefore has little choice but to re-arm its interest rates weapons ahead of the next recession. Considering the fact, the Federal deficit could be considerably larger by then, than now, the central bank’s ambition of normalizing interest rates while the going is good would seem to be a priority.

10-year yields are due a pause, following an accelerated move to reach the current level but a sustained move below the trend mean would be required to question medium-term supply dominance.

.png)

The Dollar Index is offering perhaps the clearest perspective on changing perceptions of the US economy’s fiscal health. It broke downwards to new reaction lows in September, encountered resistance in the region of the trend mean in October and moved to a new low to extend its downtrend in January. A sustained move back above the trend mean will be required to check medium-term potential for additional downside.

That represents a tailwind for the commodity complex with gold now pressuring the upper side of a 19-month range and copper firming from the region of its trend mean.