Fed rate hikes coming

Thanks to a subscriber for this report by Torsten Slok for Deutsche Bank which is packed with interesting charts.

Here is a link to the full report.

I commend this report to subscribers not least because it lays out in very clear terms the argument for why the USA is not about to slip into recession and the reasons behind the Fed’s decision to hike interest rates.

The chart on Page 10 highlighting the difference in importance of mortgage loans compared to high yield is particularly illuminating. The expansion of high yield spreads is a major consideration for bond investors and not least because it will have an impact on the ability of the companies concerned to refinance. However at only 2% of the total bond market it is unlikely to cause a recession.

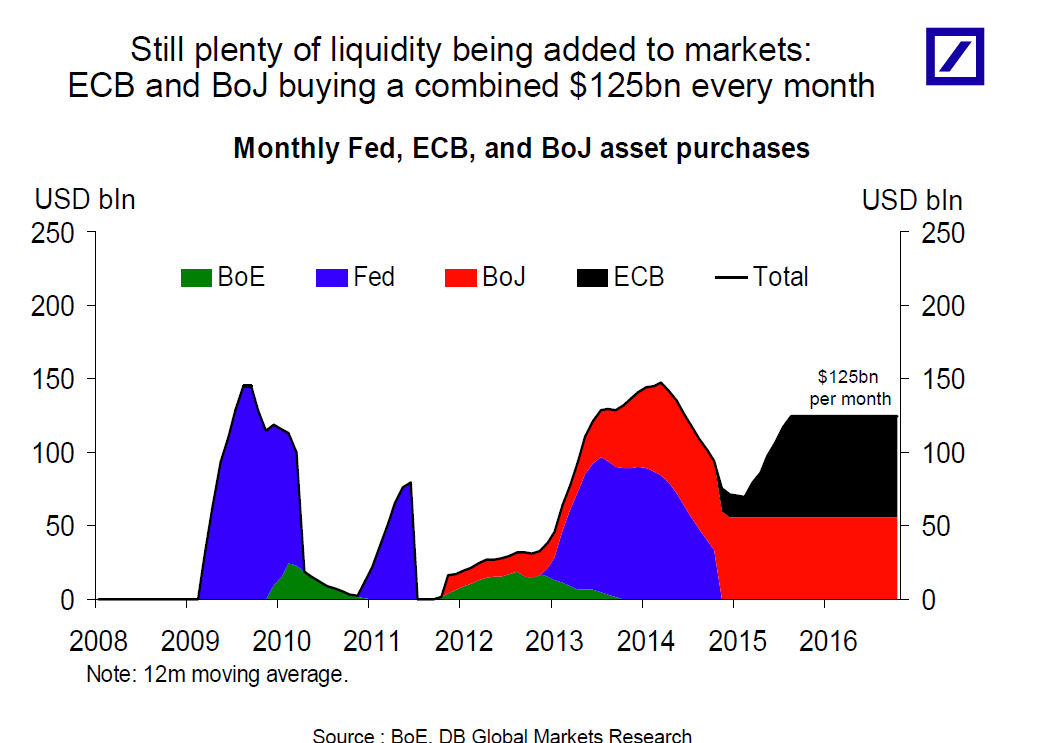

This chart of which central banks are responsible for monetary expansion does not include China which is also a major contributor to total liquidity. However it is evident from the actions of the ECB and BoJ that there is no shortage of liquidity.

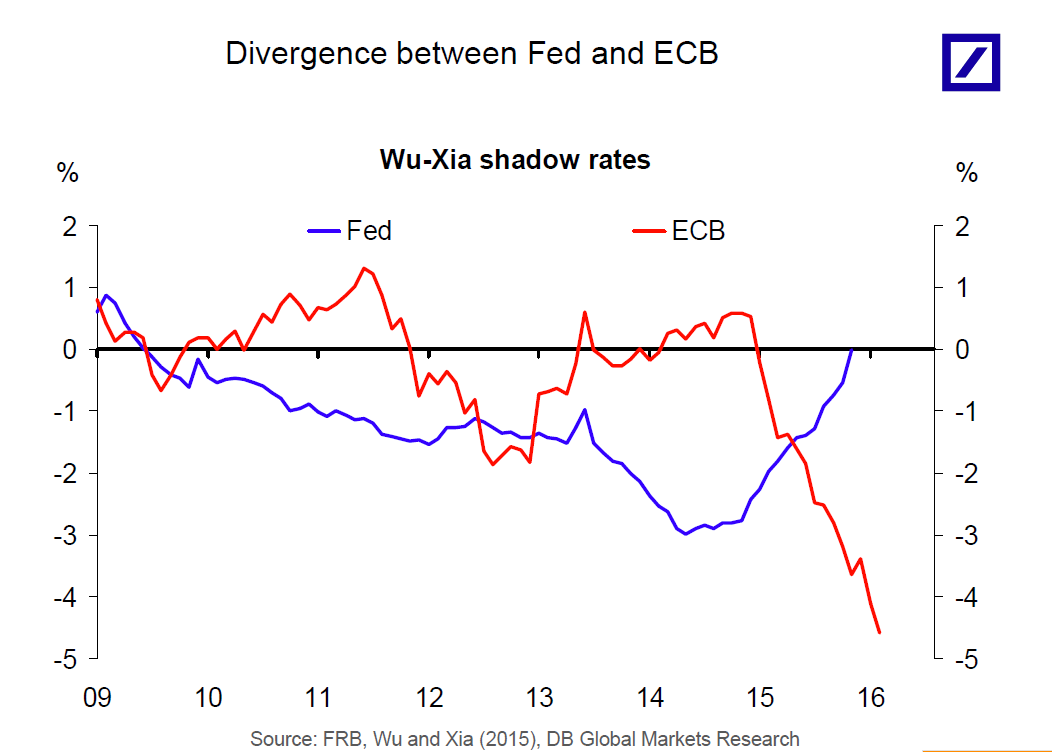

I had not previously seen this chart of the interest rates on offer to the Eurozone’s shadow banking sector. At close to negative 500 basis points the sector is flush with cash and most of that money would appear to be going into the Eurozone government bonds; riding on the coattails of the ECB. Bloomberg does not carry the ECB version of this Index but I will attempt to monitor it because when the shadow banking sector experiences tightening it is likely to have a knock-on effect on government bond yields.

I used a number of these charts in the presentation I delivered this morning for the London Investment Week webinar. Here is a link to the slides and I believe the recording will be available for at least the next week via their site.