FANG was so 2015

Remember 2015 when the F.A.N.G, stocks were all the rage and media pundits were falling over themselves to tell us how you had to own them if you were to have any chance of outperforming the major indices. 2016 was predictably a tamer year for those shares with some spending much of their time consolidating 2015’s powerful gain. However with Netflix making headlines today on successfully boosting subscribers, following an international expansion, I thought it might be worthwhile to revisit this acronym.

Facebook remains in an orderly uptrend defined by a progression of higher reaction lows and most recently bounced from the region of the trend mean at the turn of the year.

Amazon bounced from the region of the trend mean in November and improved on that performance through the end of the year. It has paused in the region of $800 but a sustained move below the trend mean would be required to question the medium-term upward bias.

Netflix experienced a deep pullback in early 2016 and spent most of last year ranging in a volatile manner. The share surged higher following the election and broke out to new highs today. A sustained move below $120 would be required to question a return to medium-term demand dominance.

Alphabet also bounced from the region of the trend mean in November and is now testing its all-time peak. A sustained move above $840 would be required to reassert medium-term demand dominance.

Elsewhere Alibaba has also bounced from the region of its trend mean over the last couple of weeks.

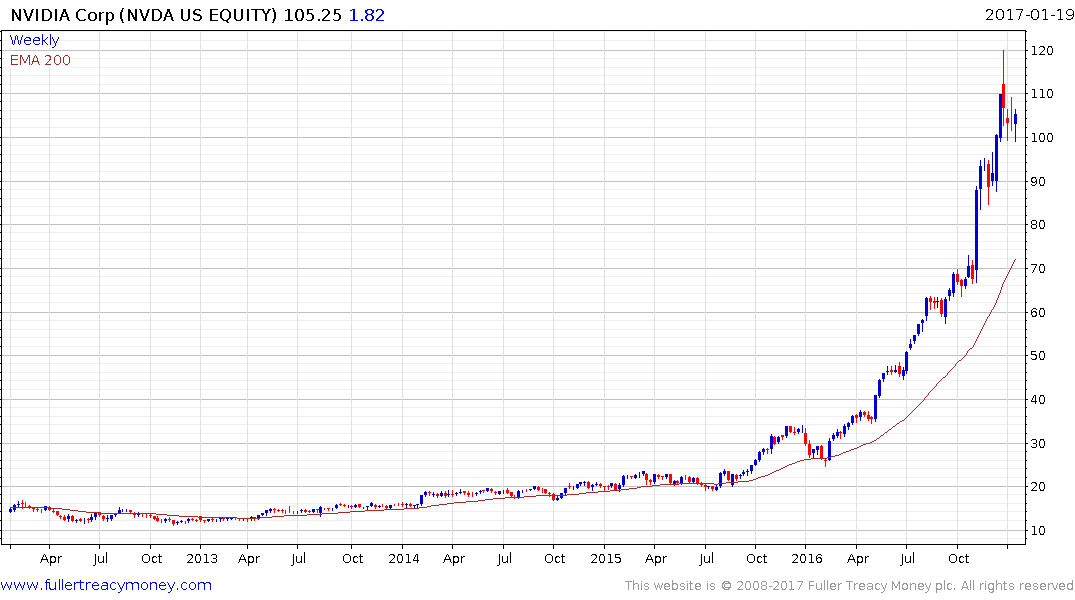

Nvidia was last year’s darling and the best performing share on the S&P500. It posted a large downside key reversal on December 28th and at least of process of mean reversion now appears to be unfolding.

Tesla Motors experienced a meteoric rise in 2013 and 2014 but has been confined to range since as the company built the largest lithium ion battery factory in the world. With that project now complete, industrial sized batteries, home power units and the much vaunted Model 3 are in the short-term pipeline. The share has rallied since early December to break an almost yearlong progression of lower rally highs and is now testing the $240 area. A sustained move above $280 would signal a return to demand dominance beyond the short term.

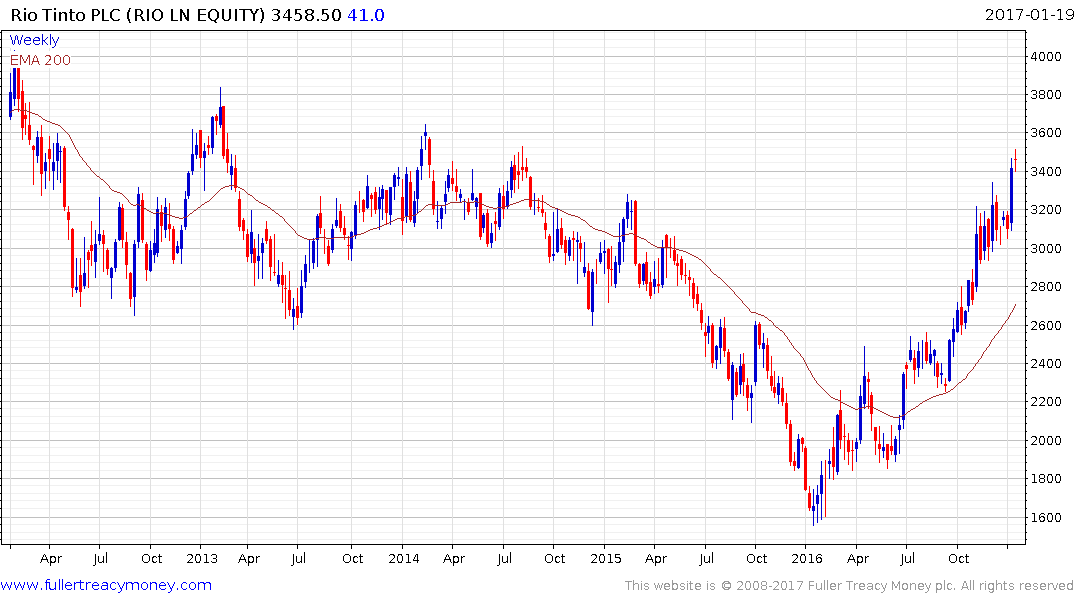

Meanwhile the B.A.R.F. stocks (BHP Billiton, Anglo American, Rio Tinto and Freeport McMoRan remain in form.