Bond Guru Who Called Last Bear Market 40 Years Ago Says Go Long

This article by Andrea Wong for Bloomberg may be of interest to subscribers. Here is a section:

Money velocity isn’t a bullet-proof economic indicator. Financial innovation, and the rise of shadow banking, have made it hard to measure exactly how much money is floating around in the financial system. And some would say that "money" itself is going through an identity crisis these days.

Hunt isn’t the only one seeing the record-low pace as an ominous sign. The fact that money velocity declined rapidly during years of near-zero interest rates may signal aggressive monetary easing actually led to deflation instead of inflation, economists at the St. Louis Fed wrote back in 2014.

"In this regard, the unconventional monetary policy has reinforced the recession by stimulating the private sector’s money demand through pursuing an excessively low interest rate policy," economists Yi Wen and Maria A. Arias wrote.

"I know I’m the minority here,” Hunt said. “I’m just trying to see the world as I think it should be seen.”

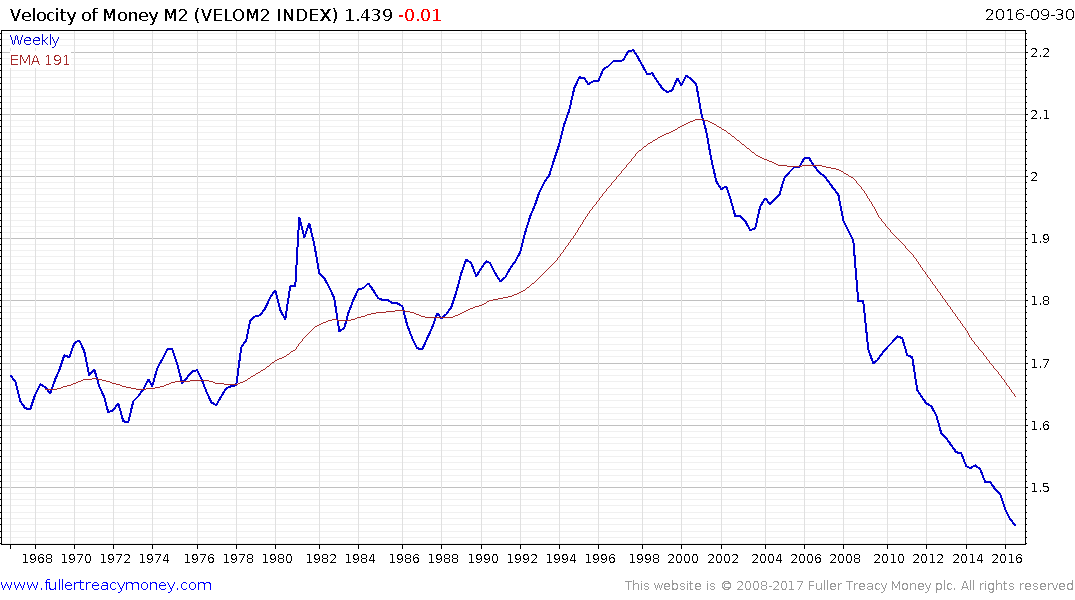

I have long argued that the disintermediation associated with the internet and technological innovation is a major contributor in the decline in the velocity of money. The downtrend in the data from 1997 offers a graphic representation of the deflationary influence of technology. It also helps to explain why the surge in the quantity of money associated with quantitative easing has not resulted in high inflation.

The problem with velocity of money data is it is reported quarterly in arrears. That means at any time it is six months out of date. The question right now is whether fiscal stimulus can succeed where monetary stimulus failed in boosting the number of transactions in the wider economy. Intuitively it should be possible. With close to full employment, fiscal stimulus puts more money in consumer’s pockets which they would then be able to spend. A revitalised banking sector with a newfound ability to profit from higher margins on lending could also help to boost transactions.

It is for this reason that what happens in the bond market is so important. Buy-the-dip traders, who have been right every time in the last 36 years, see value and have been vocally buying. However this situation is different than the taper tantrum. The Federal Reserve is raising rates, and the political climate is changing, potentially towards a much friendlier business environment. With an economy already in a mature expansion a raft of pro cyclical measures has real potential to encourage inflation.

US 30-year yields surged higher following the election and have so far held the 2.9% area during the ensuing consolidation. A sustained move below the trend mean would be required to question medium-term scope for additional expansion.