Euro-Hedged Fund Poised to Dethrone Biggest Europe Stock ETF

This article by Joseph Ciolli for Bloomberg may be of interest to subscribers. Here is a section:

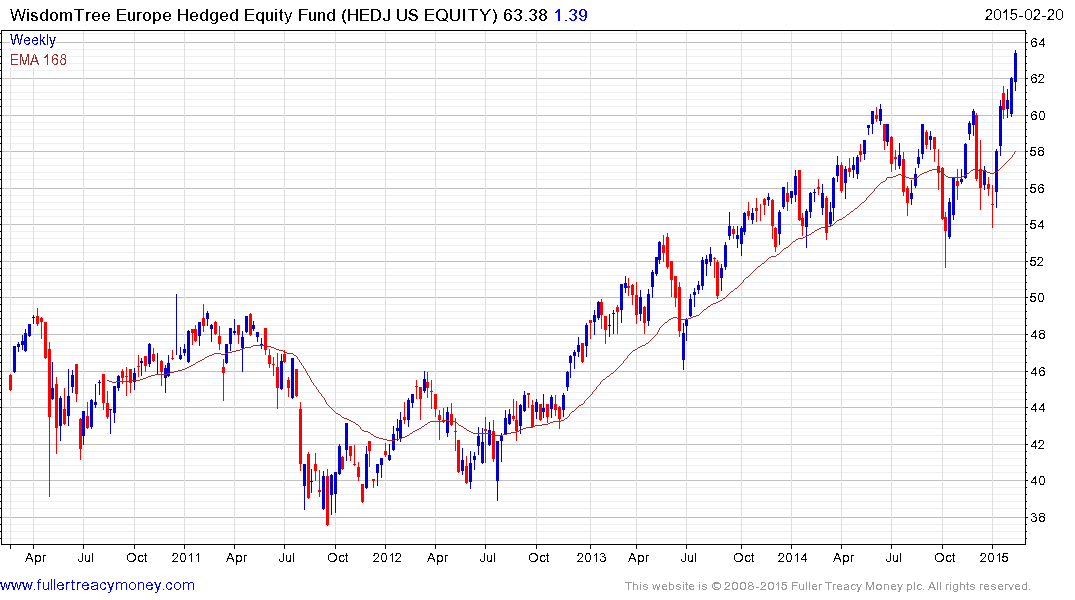

Traders put a record $2.9 billion into the WisdomTree Europe Hedged Equity Fund last month, data compiled by Bloomberg show. The ETF attracted about the same amount during the fourth quarter and has absorbed $9.4 billion of inflows over the past year. The fund aims to protect against exchange-rate fluctuations with derivatives such as forward currency contracts, currency swaps and currency futures contracts, as its prospectus explained.

“Investors are thinking of using currency-hedged ETFs as strategic core holdings,” Dodd Kittsley, head of ETF strategy at Deutsche Asset and Wealth Management, said in a Feb. 6 interview on Bloomberg Radio with Catherine Cowdery. “By eliminating currency, you’re actually creating a currency- neutral position.”

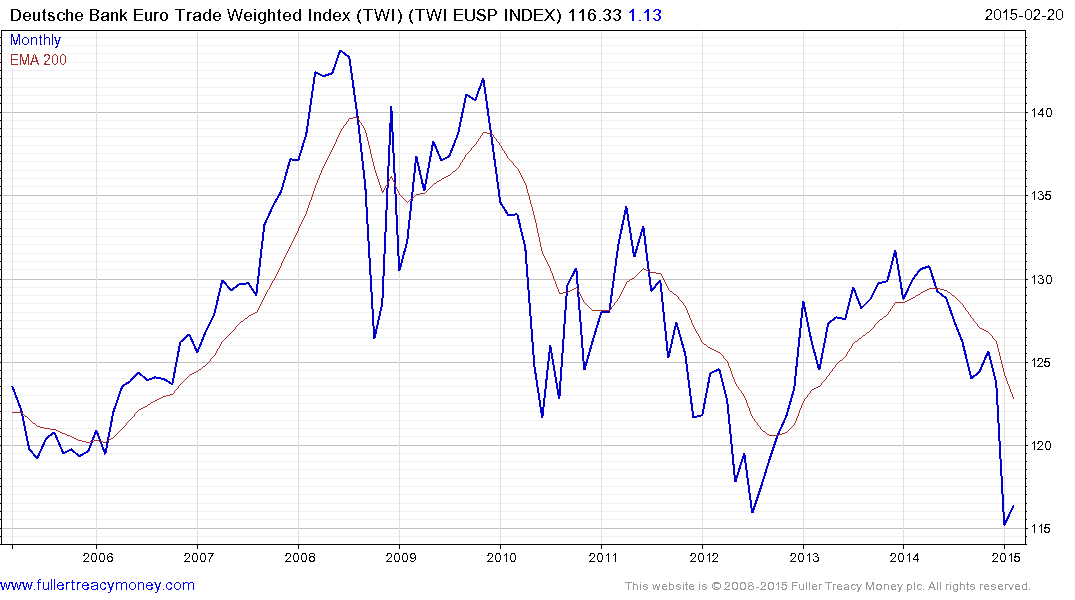

The Euro Trade Weighted Index has been trending lower, in a volatile manner, since hitting a medium-term peak in 2008 and has stabilised in the region of the 2012 lows over the last few weeks following a particularly swift decline. Some additional steadying is possible in this area but a significant bounce and a potentially lengthy period of support building would be required to question the overall downward bias.

From a market timing perspective, the requirement for a hedge is probably not as vital at the present moment as it was in July. However from an investor’s perspective the potential for additional medium-term Euro weakness,

in tandem with the low interest rate environment, makes hedging currency exposure an attractive proposition. For example the German DAX total return index is up 6.35% in US Dollar terms but 13.52% in Euro terms so far this year.

.png)

The Euro STOXX 50 Index consolidated above the 330 area for the better part of a month before extending the breakout last week. It continues to move higher and while increasingly overbought in the short term, a sustained move below the 200-day MA would be required to question medium-term upside potential.

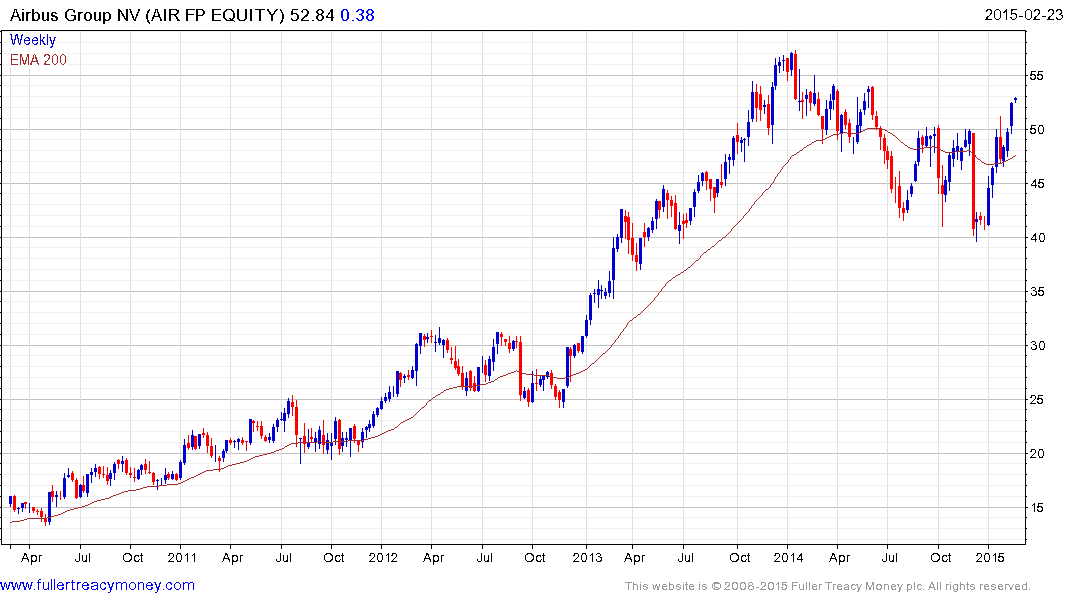

Taking a granular approach; Airbus is the best performing share on the Index this year. It posted a failed downside break in December and has rallied to break the yearlong progression of lower rally highs. A sustained move below €47 would be required to question medium-term scope for additional upside.

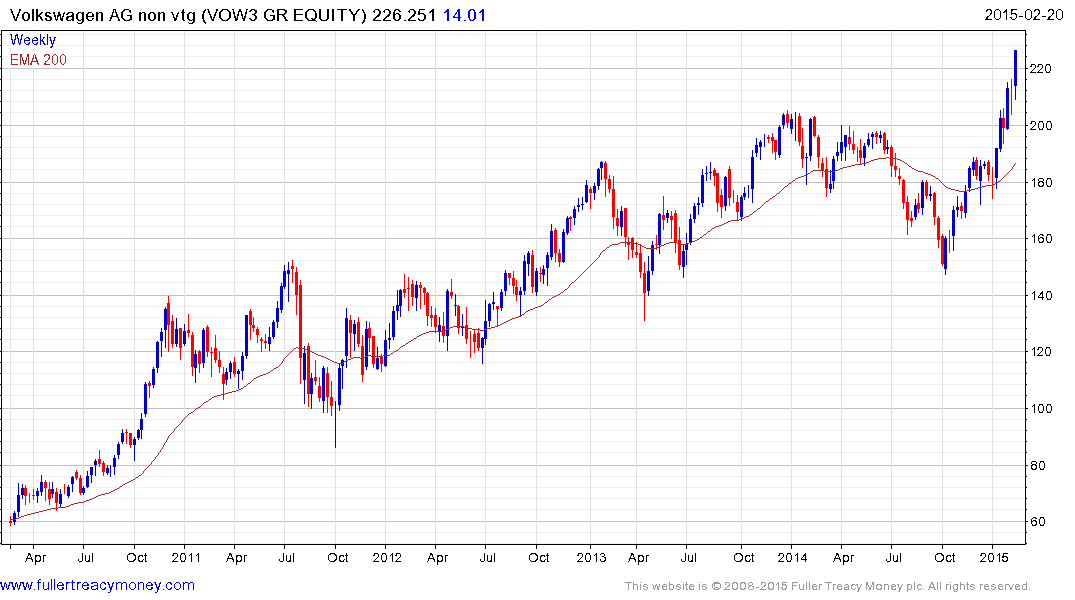

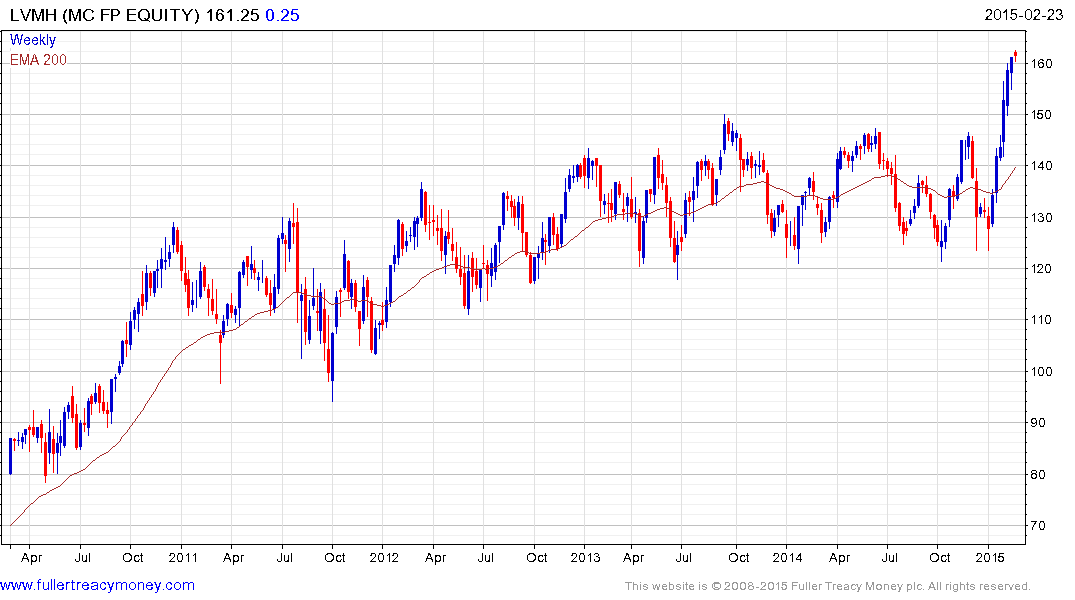

The four next best performers BMW, Volkswagen, Daimler and LVMH share a similar pattern as they extend powerful breakouts from relatively lengthy trading ranges. 20% overextensions relative to the 200-day MA are impressive but also highlight the fact that short-term overbought conditions are evident and that the risk of some consolidation of these impressive gains is increasing.