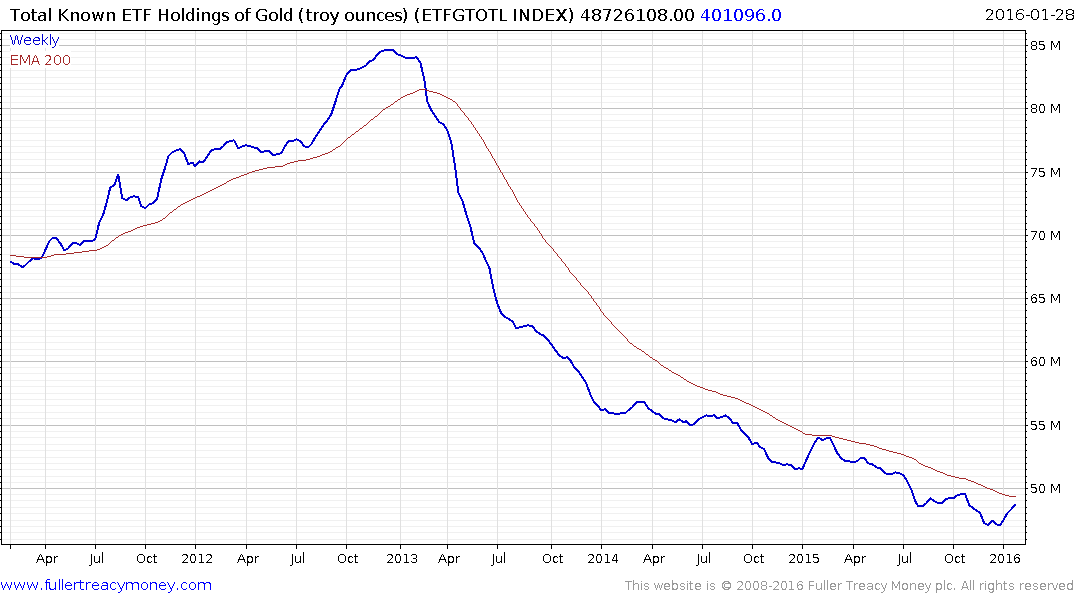

ETF Holdings of Gold

The gold market has been the subject of considerable conjecture over the last month as prices have stabilised mostly above $1050 and closed an overextension relative to the trend mean in the process. ETF holdings of gold do not represent the same influence on gold prices as they did in 2011, not least because so much selling has taken place. However, it is noteworthy that the total holdings of gold index has also been engaged in a process of mean reversion.

This is not the first reversionary rally witnessed over the course of the four-year downtrend and a sustained move above the trend mean will be required to confirm a return to demand dominance beyond the short term.

The NYSE Arca Gold Bugs Index has been relatively inert over the last six months, as it ranges mostly above the psychological 100 level in what was also a gradual process of mean reversion.

Barrick Gold has rallied over the last couple of months to break back above the 200-day MA for the first time since 2014. Provided it can sustain a move above $10, recovery potential can be given the benefit of the doubt.

Harmony Gold broke back above its 200-day MA a month ago and is now testing the $2 area. It will need to hold the region of the trend mean, currently near $1.20, during any pullback to confirm a return to demand dominance beyond the short term.

Novagold exhibits a rounding characteristic consistent with accumulation.

UK listed Randgold Resources has rallied back to test the upper side of an almost three-year range and will need to sustain a move above 5000p to confirm a return to medium-term demand dominance.

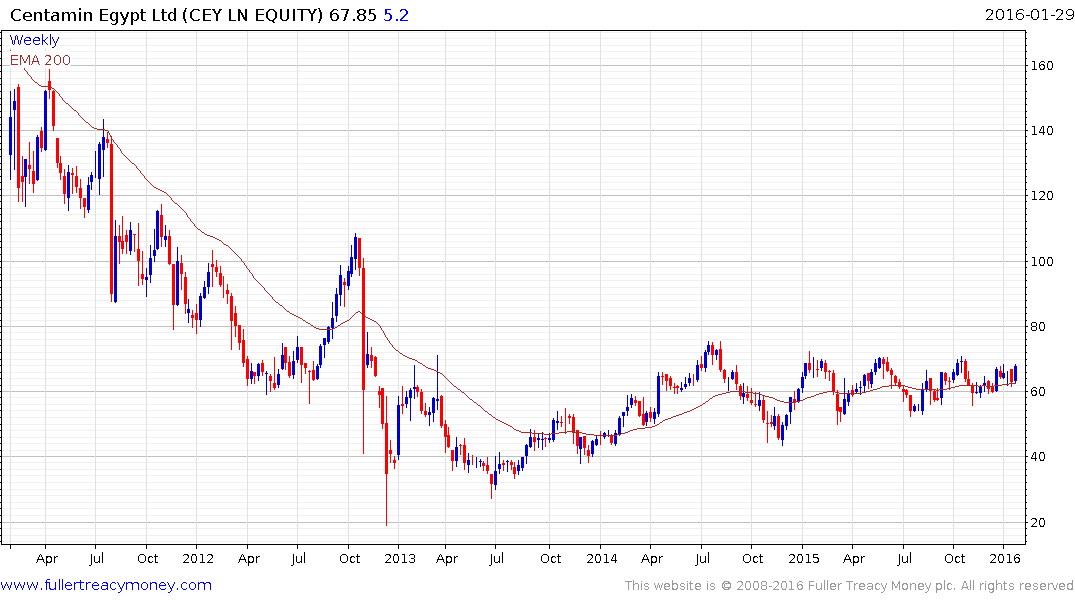

Centamin Gold has been ranging with a mild upward bias below 70p since 2014 and is looking increasingly likely to break out.

Canadian listed Detour Gold hit a recovery high today as it attempts to break away from an almost three-year base.

Claude Resources has rallied impressively from its 2013 low to test the psychological $1 level and some consolidation of recent gains is looking more likely than not.

The above shares represent some of the best performers in the gold mining sector while a considerable number of additional shares are still trending lower. It is reasonable to conclude that if the above shares can perform well in the current environment they will be well placed to perform even better if gold prices succeed in breaking the medium-term downtrend.

Back to top