Espirito Santo Creditors Doubt Containment on Missed Payment

This article by Joao Lima, Abigail Moses and Anabela Reis for Bloomberg may be of interest to subscribers. Here is a section:

Central bank assurances that Portugal’s Banco Espirito Santo SA is protected after a parent company missed short-term debt payments are failing to ease creditor concern they may also suffer losses.

The bank’s shares were suspended after tumbling more than 17 percent as its bonds dropped to record lows. Portuguese government debt led declines in securities from Europe’s most indebted nations, while banks dragged stocks in the region down more than 1 percent.

The selloff is reawakening concern that the financial system remains vulnerable to shocks as the euro region emerges from the sovereign debt crisis. While the Portuguese government said the nation’s second-biggest lender is isolated from losses in group holding companies, lack of transparency in the corporate structure is disturbing investors.

“Should the Portuguese situation continue to deteriorate, risk aversion contagion could quickly spread to other euro zone member states’ bonds and other asset classes,” Adrian Miller, director of fixed-income strategy at GMP Securities LLC in New York, wrote in a note to clients. “The situation confirms the EU’s efforts to break the link between sovereigns and the related banking system has not been successful.”

The Eurozone’s financial sector has benefitted from the ECB’s commitment to making as much liquidity as is needed available. However that has not obscured the fact that the sector’s recovery has been uneven and that repairing balance sheets is going to take time.

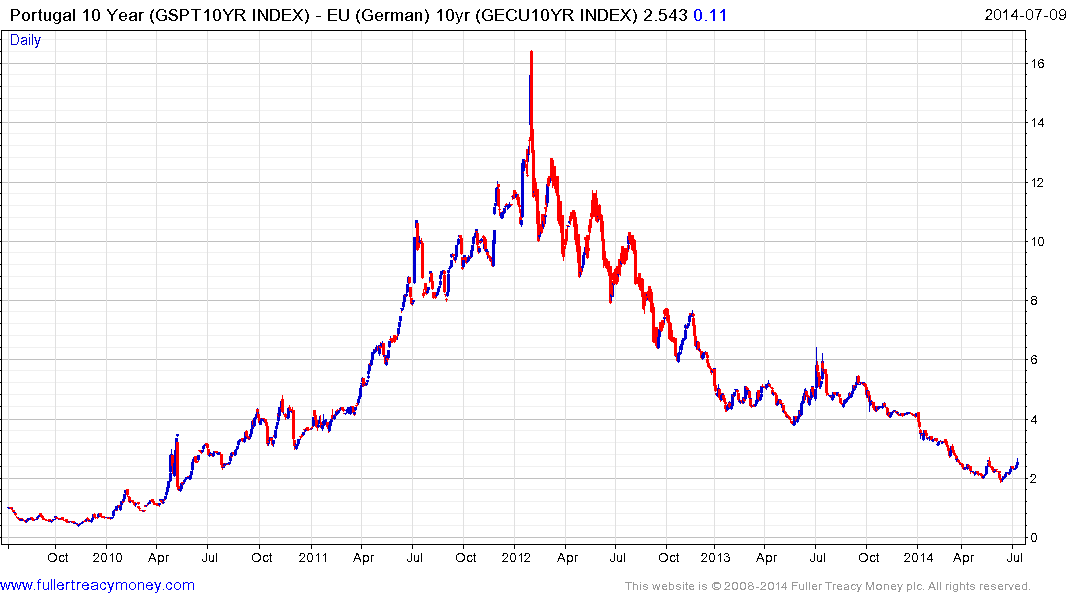

Portugal’s sovereign debt has been trading at a discount to that of Spain, Italy and Ireland and had spent the early part of the year narrowing that difference. However its spread over German Bunds encountered resistance at 200 basis points in April and it has widened to 250. Current trading suggests that 200 is a floor and that there is room for some higher to lateral ranging. However, given the ECB’s record of intervention, a deterioration similar to that posted in 2011 is unlikely.

Banco Espirito Santo has returned to test the 2012 and 2013 lows near 50¢ following this week’s steep acceleration. During the Euro’s banking crisis investors lost faith in management teams making confident pronouncements that the worst was over when fresh debilitating disclosures were released often within a few days of a confident statement. If Banco Espirito Santo is in fact insulated from the difficulties experienced by its largest shareholder it should find support in this region.

Portugal’s travails have weighed on the Euro Stoxx Banks Index but it would be a mistake to tar them all with the same brush. This pullback will probably create a favourable entry opportunity in a number of Europe’s better managed banks. For example, Banco Santander was overextended relative to the 200-day MA and now looks likely to revert to the mean.