Email of the day on the US debt ceiling

Thanks for the interesting comments about Saudi - I spent a couple of years working in Riyadh in the late eighties.

On a different subject do you see the re-occurrence of the US debt ceiling with the Senate's inability to pass (anything...) creating any problems?

Thank you for this topical question which I’m sure will be of interest to other subscribers. On another note, I suspect even veterans of living in Saudi would be surprised at the extent of progress made since MBS has taken power.

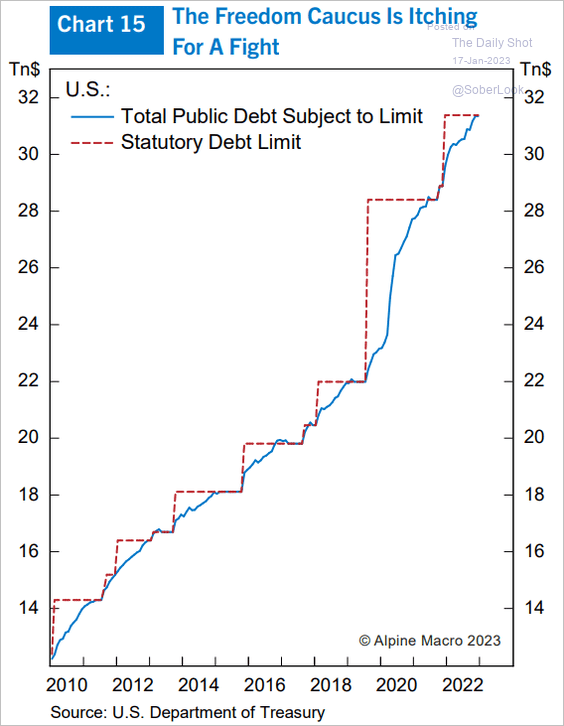

The Tea Party movement gained traction in the aftermath of the credit crisis. They eventually gained enough sway over the Republican Party to force fiscal constraints onto the 2nd Obama administration. The Freedom caucus has given us a sneak peak at the trajectory of budget negotiations in the concessions they squeezed out of Keven McCarthy.

The debt ceiling is due to be exceeded in the first half of this year so some form of agreement will need to be found. The only way a crisis will be averted is through bi-partisanship.

A lot can change in a decade. Republican election doubters/deniers were chastised by voters in the mid-terms. That suggests there is a fighting chance for compromise in a year where no one has to worry about re-election. However seeing is believing following a decade of political polarization.

10-year yields have contracted over the last few months and that has fuelled a risk on rally. The downside is the medium-term trend in yields remains consistent with reactions of 100-basis points normal in this move. A sustained move below 3.5% and the 200-day MA will be required to confirm a return to demand dominance beyond the short term.