Email of the day on rare earth metals

I have just read that in Arctic Sweden they have just discovered Europe's largest source of rare earths. It will take 10 to 15 years to bring them to market.

Thank you for this note. I saw that news too. Here is a related article discussed the discovery.

The thing to remember about rare earth minerals is they are not particularly rare. The reason China dominates the mining and processing of these metals is because they are so often found in close proximity to radioactive elements. Processing is both dirty and creates harmful byproducts so many countries were only too happy for China to take over production.

The last big bull market for rare earth metals originated because China curtailed exports, particularly to Japan. That set off a wave of investment in mining ventures. However Lynas was the only company to successfully get processing off the ground. Their facility is in Malaysia because there was no way they could build one in Australia.

The share has been ranging with a downward bias for the last year but has stabilised near A$8. A sustained move above A$9.50 would confirm a return to demand dominance beyond the short term.

MP Materials has revitalized the Mountain Pass mine in California and is building a processing facility in Fort Worth, Texas.

Even if China does not restrict exports in future, the simple fact is that it is using more and more of its own supply. The trajectory of economic development means there will be increasing demand for these metals so additional supply is required. Vertically integrated companies have a clear advantage.

MP Materials has been ranging between $23 and $60 for two years. It is currently firming from the lower boundary.

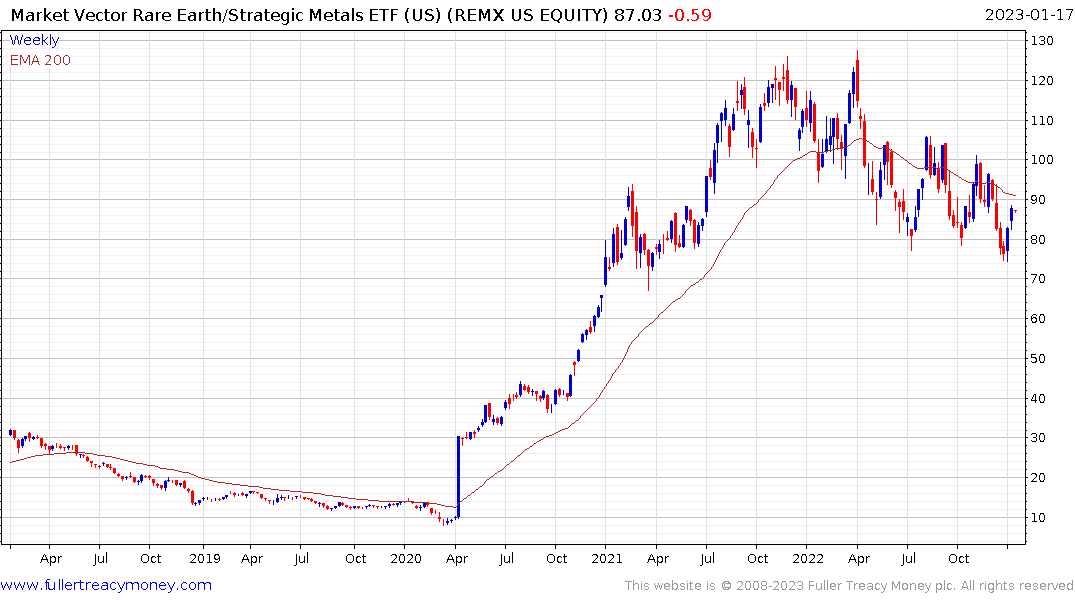

The VanEck Rare Earth/Strategic Metals ETF is firming from the upper side of the underlying base formation and the region of the 1000-day MA. A break in the yearlong sequence of lower rally highs would confirm a return to medium-term demand dominance.