Email of the day on the relationship between inflation and P/E

Hi Eoin, Over the past 3 weeks or so I heard a lot of commentators saying "valuation of the stock market is too high in this inflationary environment". do you have historic comparisons in order to say where valuations should be? Tkx for your excellent work every day, appreciate it very much! kindest regards

Thank you for your kind words and I am delighted you are enjoying the service. I have seen a good deal of conversation about this topic too. We have enjoyed decades when inflation, as measured by central banks, has reliably trended lower and been unsurprising. Now that we are in a new environment of surprising inflation, it deserves a reassessment of where value can best be found.

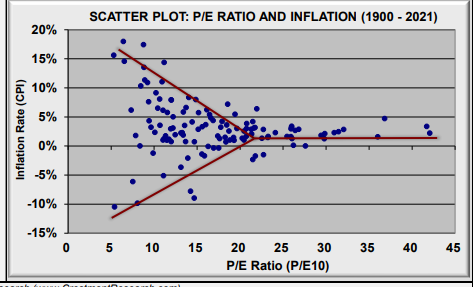

This graphic from Crestmont Research is about the clearest depiction of the argument I have seen. More often than not, P/E’s above 20 have been witnessed at times when the inflation rate is less than 5%. When inflation is greater than 5%, it is exceedingly unusual for P/Es to be above 20. There is a splatter of data points for valuations when inflation is above 5% which suggests a great deal of volatility.

At present 204 members of the S&P500 have estimate P/Es greater than 20 but that is 50% of the market cap of the Index.

90 stocks have an estimated P/E less than 10 and they represent 12.5% of the Index’s market cap.

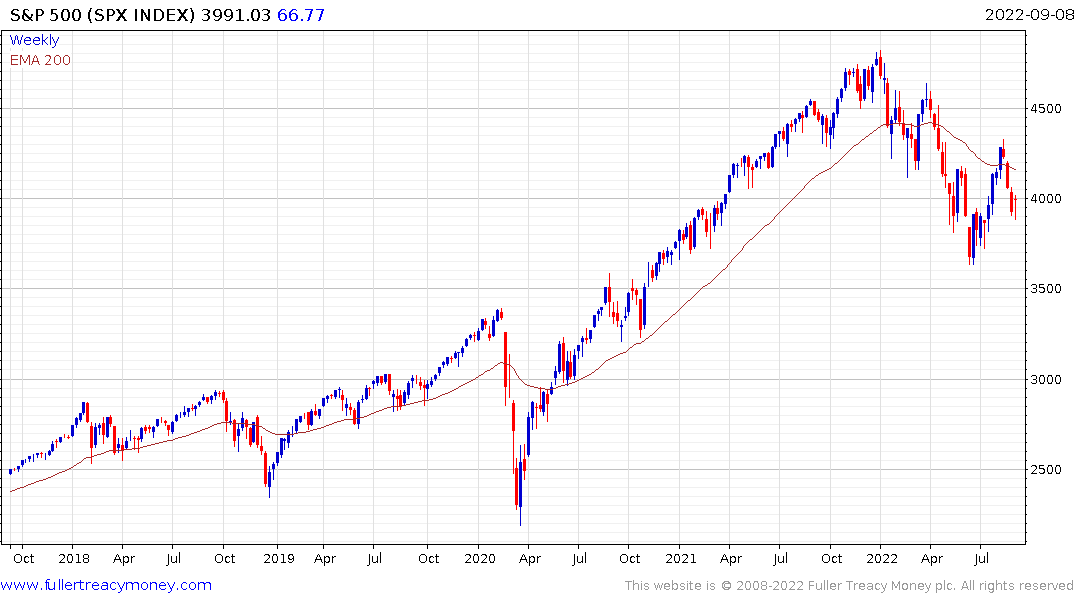

Without looking at the charts, it is reasonable to conclude the 50% of the market cap which is most expensively priced will become cheaper the longer high inflation is sustained. What I find most interesting about this market environment is central banks have moved on from thinking about inflation as transitory, but investors have yet to make that leap.

Eight companies (Apple, Amazon, Alphabet, Microsoft, Meta Platforms, Nvidia, Netflix and Tesla) represent 21% of the total market cap of the entire US market. These companies made the best use of abundant cheap liquidity and built global franchises.

The extent to which they can sustain profitability without support from cheap liquidity will dictate how well they retain market share. How well investors in their shares do, without access to cheap liquidity will dictate how well the prices do.

It occurs to me the same logic can be applied to bitcoin. It thrived more than any other asset during a time of outsized money creation and low rates. It tends to go through extremely difficult periods without those supports. That point applies entirely to the price action. It has absolutely no bearing on the merit of the underlying technology whether sound or not.

Back to top