Email of the day on the impact of the Affordable Care Act on labour force participation:

I’ve been taking a tax class at UCLA Extension because I felt so at sea with how the system is structured since we moved to the USA and I wanted to get a better handle on what the best way to structure our finances is. I finished the open book exam over the weekend and commented to my instructor, in inestimable Linda Hewitt, that if I had ever wondered, now I know why I’m not an accountant. Here is her response:

You have not lived here your entire life. But I can tell you, that our tax law continues to get crazier as we go along.

We have regular income tax, AMT (Alternative Minimum Tax), FICA (Federal Insurance Contributions Act), and State Income Tax, & Medicare Surtax + all the other taxes (property, sales, etc.)

Then on the Wealth Transfer side of things you will learn in the Estate Class we have: Gift Tax, Generation Skipping Tax, Estate Tax, and IRD ('Income In Respect Of A Decedent)

OMG!

In CA. if you are in the Top Bracket between Fed./State/FICA/Medicare surtax you really are around 68% marginally.

My husband and I used to be in AMT, until his company retired him out, with just my income we are no longer in AMT.

I have clients where the wife has either quit work or reduced hours, and because of the tax savings are better off.

You can get to the point where you punish a person for being productive!

Today with the medical subsidies many women work only part time or not at all to control their income to get the subsidy. These women were working full time prior.

I go crazy. They advertise get a medical subsidy - 4 out of 5 people will get the subsidy in CA. under Cover CA.

No one talks about the 5th person. Let's see that guy pay for his own health care + for 4 other people.

I receive no help from anyone, I am almost 66 yr. old and work about 65 hours a week. What is fair about that? I work so someone else only has to work part time, and gets a big subsidy. My cost for Medical Premiums, out of pocket max and RX for my husband under Medicare runs me almost $20,000 a year for 2 people.

If I had it to do over again, I would get a job in the public sector!

Hope you don't mind me ranting away here!

The USA has some of the most exciting advantages of any economy from the low cost of energy, to its lead position in technological innovation, to the flexibility of its labor force and the proactivity of its central bank. However, the tax structure leaves a lot to be desired.

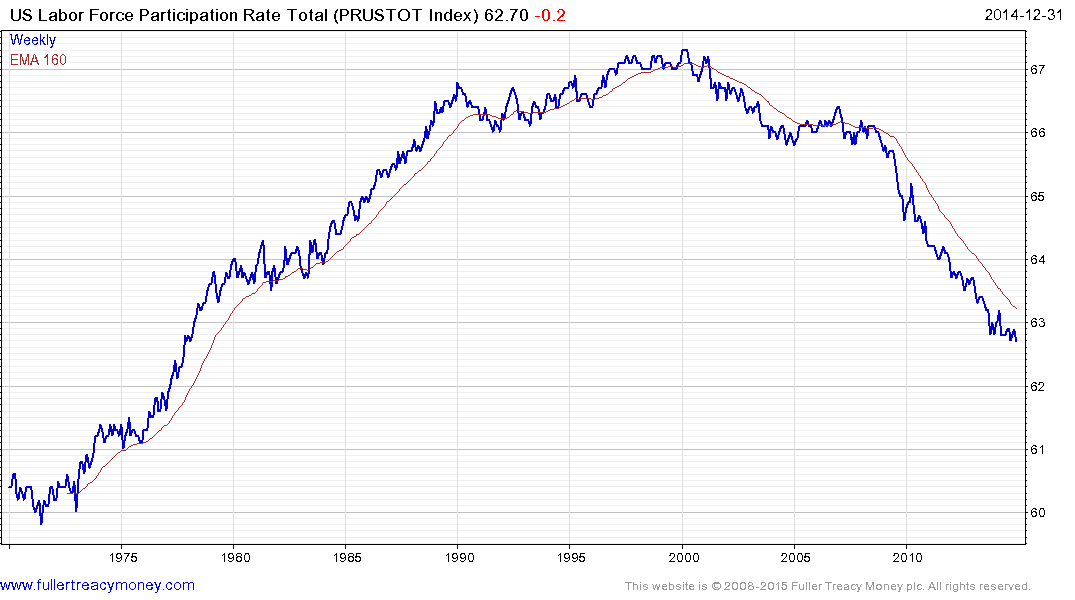

The breadth of the Affordable Care Act is incredible and perhaps more important, its full effects will not be in place for another year. The Fed has cited declining Labor Force Participation rates as a factor in why it has not raised interest rates so I thought it might instructive to view the chart.

The rate peaked in 2000 above 67% and has fallen by 3% since 2008. It has steadied over the last month but there is no evidence that the contraction has ended.

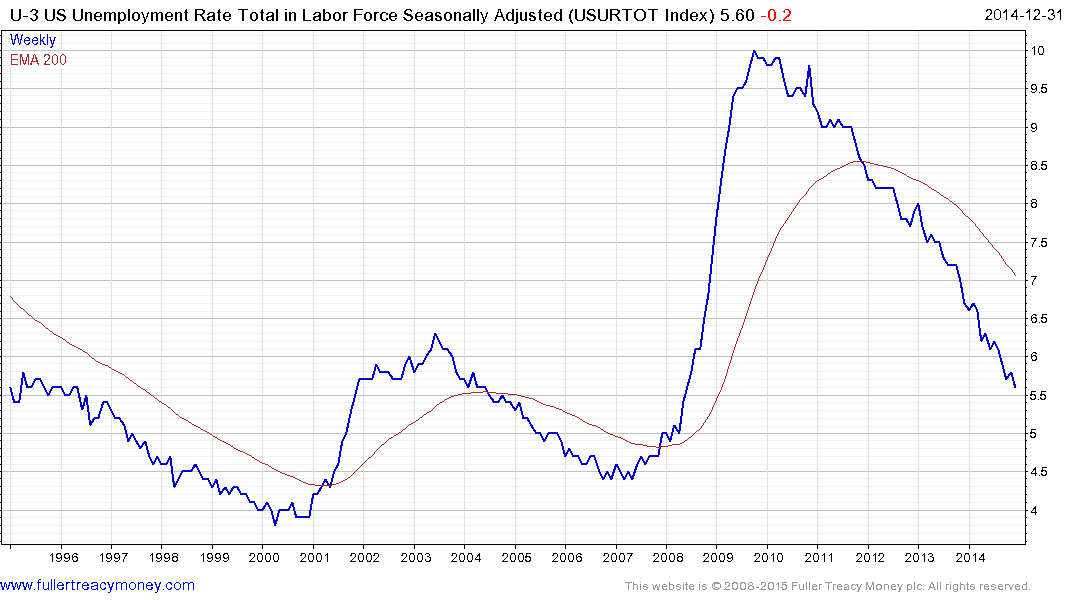

People dropping out of the workforce have flattered employment numbers. The U-3 measure of unemployment has contracted to 5.5% since 2009 but this improvement comes with a number of qualifications. As the above email suggests a number of the jobs that have been created are relatively low paying which helps people manage their cost of living burden when healthcare and taxes are considered.

The falling cost of energy represents a significant tailwind to the consumer but the disappointing Q4 sales figures at a number of retailers may be explained by the fact that consumer deleveraging is a more widespread phenomenon than simple debt restructuring.

It remains an open question as to when the Fed will raise interest rates but we can anticipate that any eventual move will be tentative and that the pace of increases will be measured.

Back to top