UK housebuilders, Dividend, dividend, dividend

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Trading as low as 0.9x 2016 NTAV we see increasing value available in the sector - recent weakness in the share prices we view as offering a good entry point in the sector. For a sector yielding >5% and ROCE >20% we see this as too cheap.

Performance may prove volatile, but we see the housing market as supportive

Macro news flow may continue to make share prices in the sector volatile; sensitivities will include: the timing and scope of interest rate rises, mortgage approvals and house price inflation leveling off, the General Election creating uncertainty and potentially lumpy trading. However we continue to see as generally supportive housing market fundamentals – mortgage lending in 2015 up marginally YoY, strong lending competition containing mortgage costs increases, stamp duty reductions for most buyers; and strong industry themes - continued land buying at strong margins, build cost inflation moderating.Upside momentum to forecasts remains

We believe upside earnings momentum is likely to be tamer in 2015 than previous but not over. While the wide range of consensus forecasts for the sector may require some narrowing in the coming months, we feel confident on the mid-range expectations for volumes and selling prices and believe there remains scope for further upgrades in the sector at the margin level from the higher intake margin from new land as well as the benefit of previous house price inflation. We feel even more substantial upside may be seen at ROCE level where hurdle rates are being exceeded more significantly from the greater use of conditional land increasing asset turn.

Here is a link to the full report.

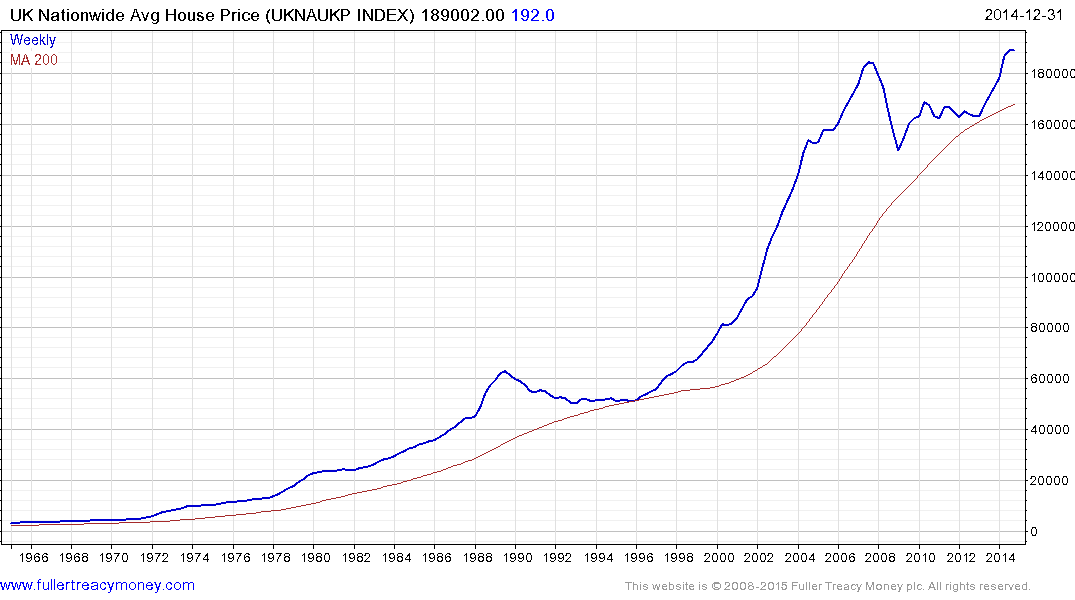

The average price for a home in the UK is back to its 2008 peak. The Bank of England’s tolerance for above target inflation and easy monetary policy has helped inflate asset prices as in other markets. The BoE was talking about raising interest rates a few months ago, but the outlook is more uncertain now that the ECB is due to embark own its on QE program. High prices will inevitably create a supply response in at least some portions of the market. In the interval between supply increases and interest rates rise, homebuilders may benefit subject to the considerations outlined above.

Taylor Wimpey (Est P/E 11.96, DY.062%) found support in the region of the upper side of the underlying trading range and potential for additional higher to lateral ranging can be given the benefit of the doubt provided it continues to hold the 120p area.

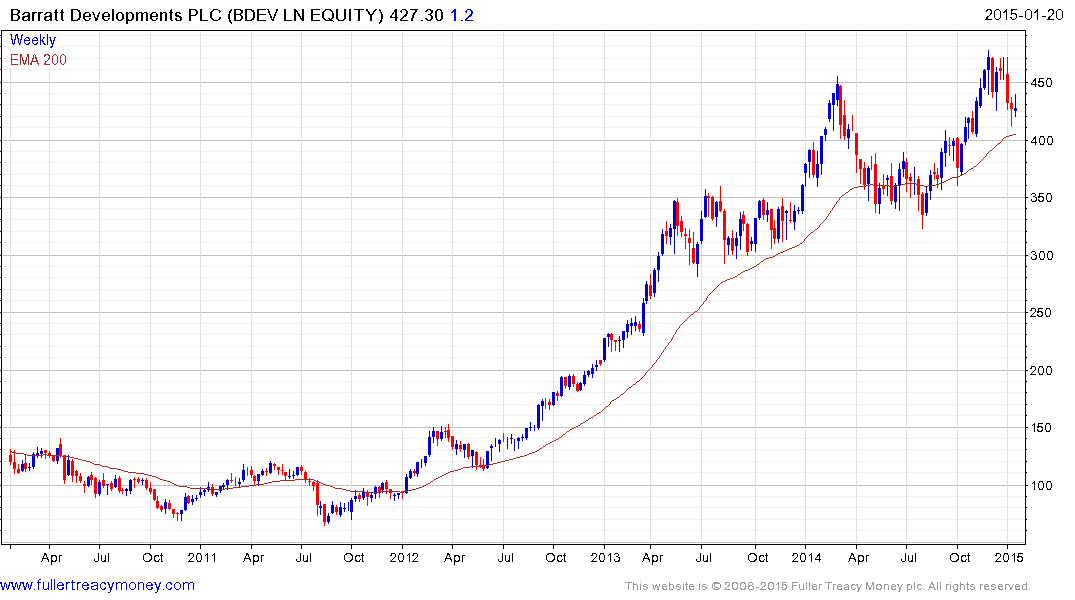

Barrett Developments (Est P/E 10.1, DY 3.64%) found support this week in the region of its 200-day MA.

Bovis Homes (Est P/E 9.93 DY 5.05%) has returned to test the lower side of a yearlong range. Potential for continued higher to lateral ranging may be given the benefit of the doubt provided the 700p area holds.