Email of the day on the upcoming Fed decision

It would appear that the Fed might have a tough decision to make on Sep 16-17 – to hike or not? Perhaps “not” due to the shaky ground of the current China stock market and the repeated pressure from the IMF & ECB not to raise the rates?

?But hypothetically, let’s assume that the Fed will really decide to hike the rates, even with a clear statement on slow increase of rates. In such a scenario, considering that China is the biggest holder of US Treasuries, would you expect China to start unloading/selling their positions immediately?, especially if they still need to further tighten their money market in order to shore/support their ailing stock market.

Also in the interest of other subscribers, your view would be appreciated.

Reading the Fed runes has the feeling of sports punditry at present and anything we think or say is not going to sway them one iota. The Fed is going to do what it is going to do. I can only think what I would do if I had bet my career and legacy on ensuring the US economy recovers from the biggest growth scare in a century. I’d be cautious, I’d want incontrovertible evidence and I wouldn’t want to take a risk. These are sober people and the last thing they want is to risk deflation.

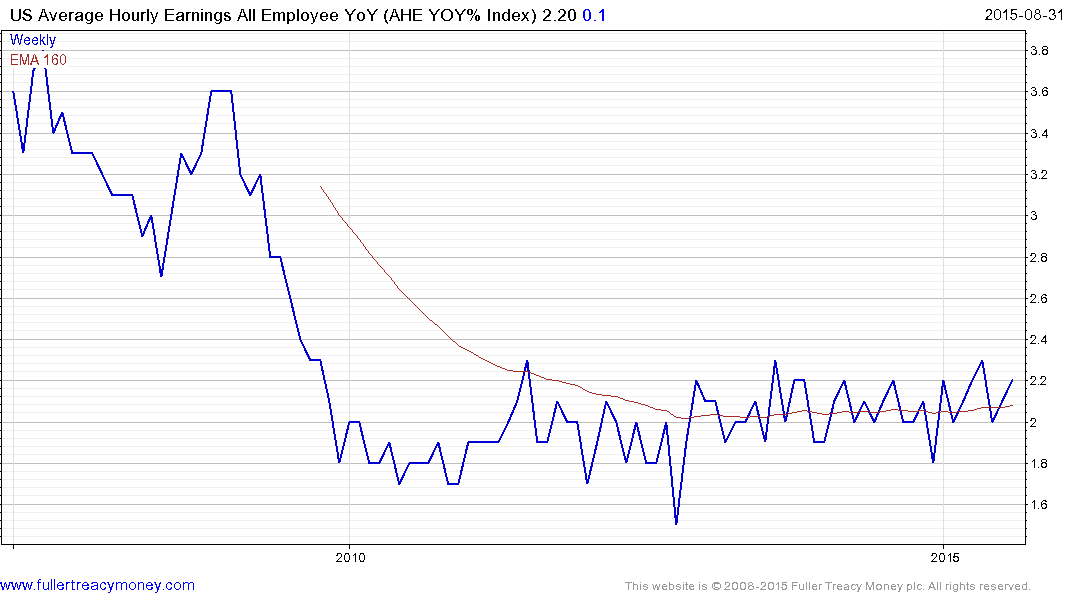

Average Hourly Earnings are still rangebound and will not be updated with a new data point until October 2nd. Against that background there is no burning need to raise rates at this time, not least because the Dollar’s rally and stock market decline has done much of the job of an initial rate hike anyway. Nevertheless, the Fed is a lot closer to raising rates now than it was a year ago.

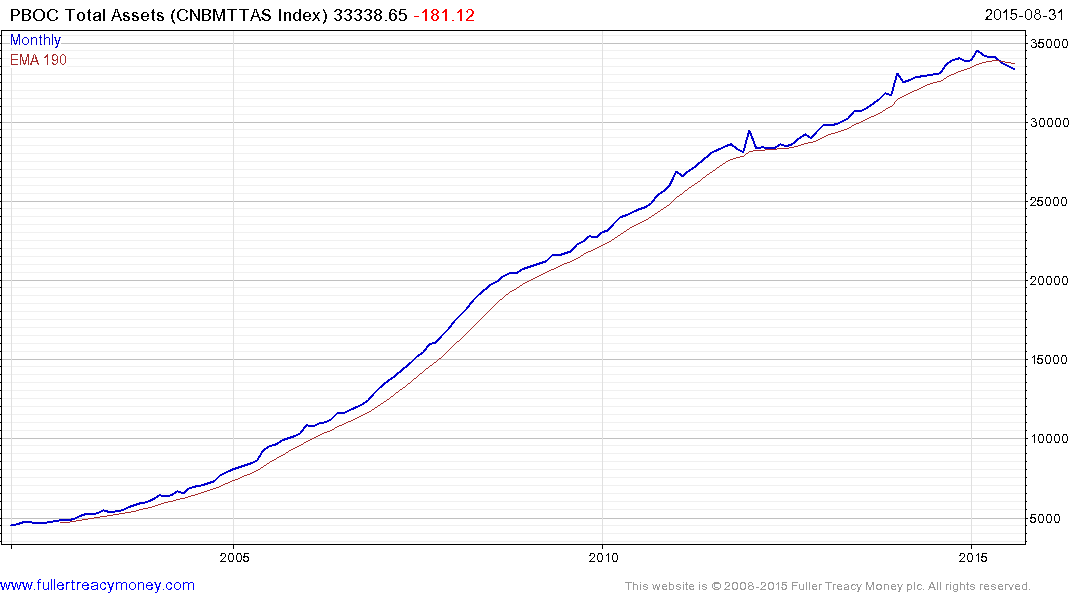

I posted this chart of the PBoC’s balance sheet last week. It is looking toppy which suggests the pace of reserve accumulation, that set world records over the last few years, is over. The Chinese have moved from retarding the advance of the currency to delaying its decline and reserves are declining as a result. It would be bad for business to sell Treasuries aggressively but they have been buying less for some time now.

US 10-year yields have held a progression of higher major reaction lows since 2012 and pushed back above the 200-day MA today. A sustained move below the late August low of 1.9% would be required to question medium-term scope for continued higher to lateral ranging.

Back to top