China Rice Market to Open Up to U.S. Imports With Trade Accord

This article by Megan Durisin for Bloomberg may be of interest to subscribers. Here is a section:

China, the world’s largest rice market, is poised to open up to U.S. exports with both countries’ governments due to sign an accord later this month ratifying American imports.

The so-called phytosanitary protocol for rice is expected to be signed during Chinese President Xi Jinping’s visit to Washington, the Houston-based U.S. Rice Producers Association said Monday in a statement.

“It’s a significant event that they would buy rice from the western hemisphere,” Milo Hamilton, president of Austin, Texas- based Firstgrain, a rice-trading advisory company, said in a telephone interview. The accord “does not mean they will buy rice from the U.S. It means they can buy rice from the U.S.”

On trips to Japan by Chinese tourists the two most desirable items people seek to take home are electronic toilet seats and high tech rice cookers. While the two might be linked in some minds, there is a general tendency to want to consume higher quality rice and to have it cooked to perfection. This is seeing demand for both the commodity and the cooking equipment trend higher.

Japan listed Zojirushi (Est P/E 17.51, DY 1.05%) surged higher in March and has spent much of its time since consolidating the advance. It is now trading in the region of the trend mean and will need to continue to hold the ¥1500 area if medium-term scope for continued higher to lateral ranging is be given the benefit of the doubt.

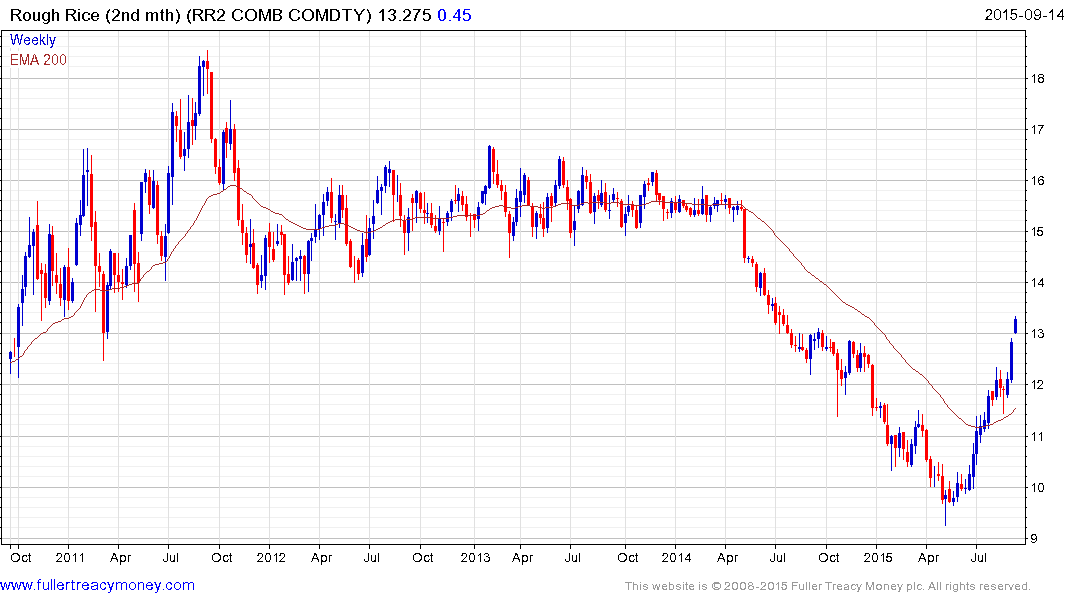

Rough Rice futures hit a medium-term low in May from the region of the 2008 nadir and rallied by July to break the more than yearlong progression of lower rally highs. Prices continue to rebound and while somewhat overbought in the short term, a clear downward dynamic would be required to check the advance.

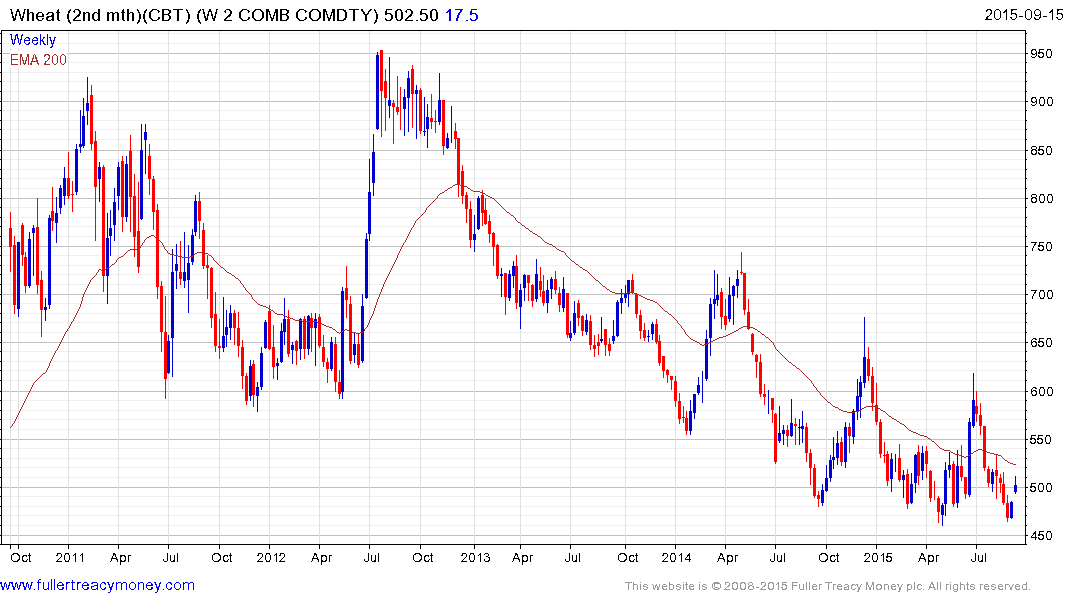

Elsewhere among agricultural commodities, wheat is rallying from its most recent retest of the 450¢ area and will need to sustain a move above the trend mean to indicate a return to demand dominance beyond short-term steadying.

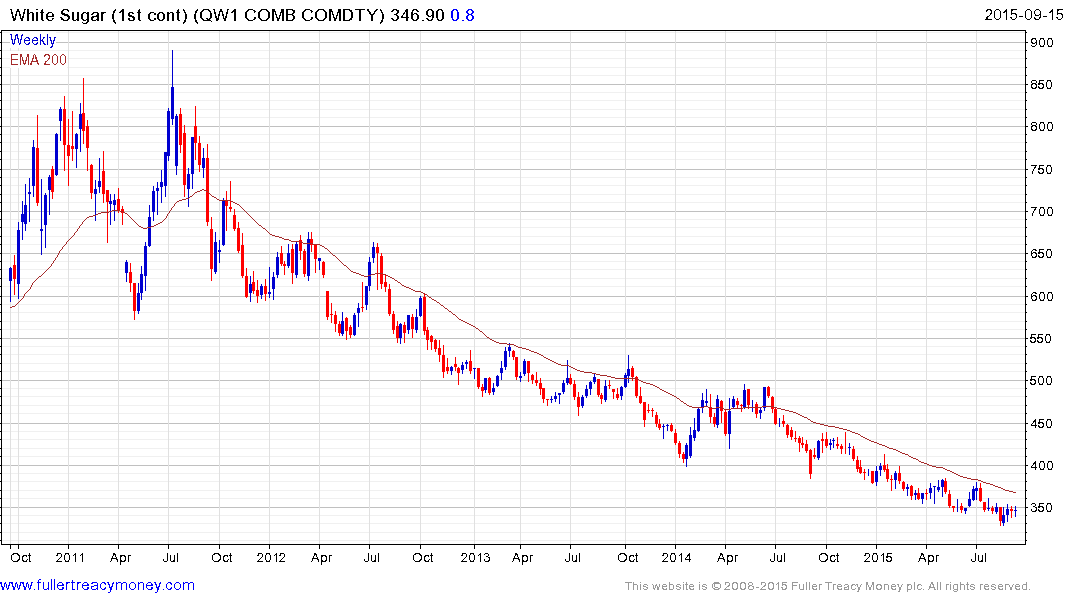

White Sugar has been trending consistently lower for nearly 5 years and a sustained move above the trend mean will likely signal a low of medium-term significance has been found.

Back to top