Email of the day on the bond market

All the attention is in Peru these days as the World Bank, the IMF etc are meeting here.

.

The problem is serious in EM countries, with the price of commodities going down and probably staying down for many years as the China economy shifts gears.

There is a credit crisis looming for EM in the private sector, since almost all companies have some exposure to the US Dollar in terms of debt. With local currencies devaluating in a fast way the math doesn´t add up so I do not know how things are going to end up. Thank you for the chart, I am very concerned about the spread.

What happened last week with the new bond issue of HP was something that caught my attention and that small event can be the sign of something worse coming.

It was a pleasure to meet this subscriber at the Chicago venue for The Chart Seminar last year. His prescient account of the slowdown in economic activity in Peru owing to the strength of the Dollar helped inform our commentary of the underperformance of commodity focused markets, particularly in Latin America, until recently.

There are a lot of moving parts in the debt markets right now with commodity weakness, the relative strength of the Dollar, China’s economic transition, weak governance and the prospect of the Fed raising rates all contributing to uncertainty. As both David and I pointed out yesterday, the sell-off in emerging market currencies is looking overdone at least in the short term so the potential for mean reversion has increased. Medium-term, there are still issues with refinancing all of that US Dollar debt which will need to be addressed and there is ample scope for spreads to widen further over the coming years.

The issue with Hewlett Packard’s bond issuance referred to above has to do with the fact that the company had to pay a significant premium last week to issue its most recent debt. It wasn’t the best week to issue debt and the company’s plans to spin-off Hewlett Packard Enterprises while holding onto the majority of its hardware operations represent an additional hurdle. All things being equal it would be reasonable to expect the yield on those bonds to tighten towards the median of other HP issues over the coming months. However, that aside, we now have evidence of bond market investors demanding a higher coupon to compensate them for interest rate risk as they anticipate Fed action.

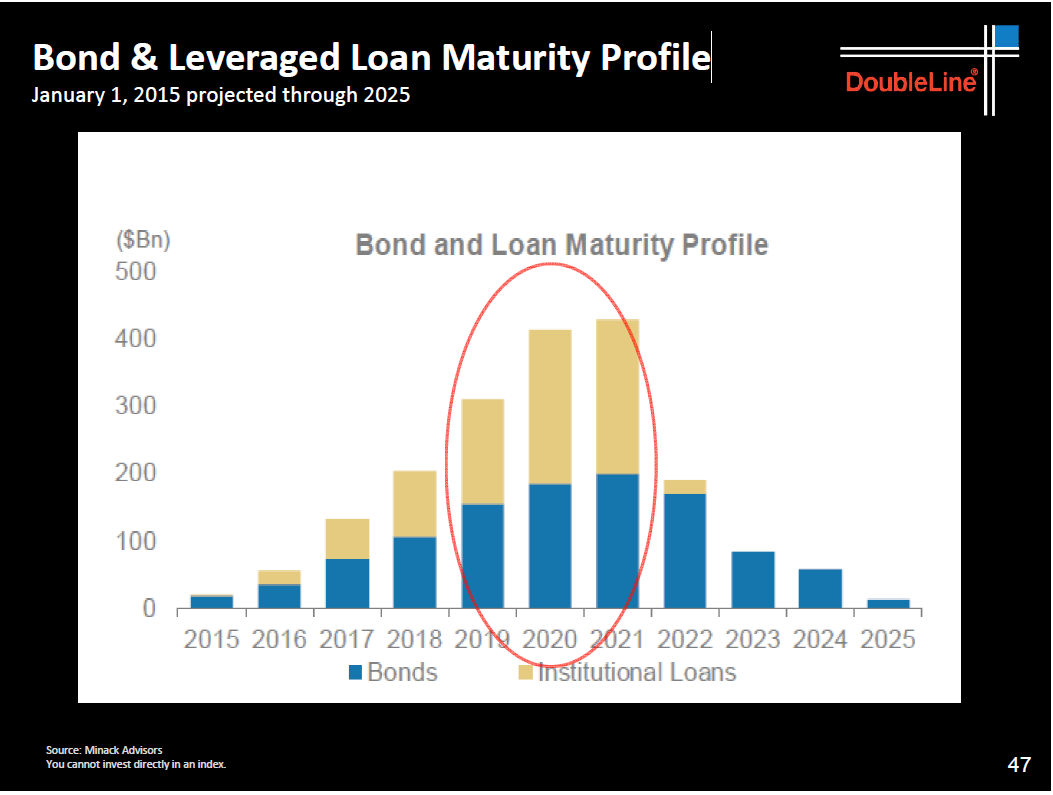

Companies have quite rightly taken advantage of ultralow rates to refinance, buy back shares and raise dividends. However they have also increased their average debt burdens in the process. This raises two separate points; coupons and refinancing. Corporate spreads have been narrow which has allowed companies, globally, to issue a great deal of debt. A major economic slowdown would probably be required to question the ability of companies to make their debt payments. Of course there will be some that are overleveraged or borrowed short term, that will go bust but that is unlikely to be a major headache for the majority. The greater challenge comes when companies that borrowed cheaply to fund financial engineering operations come to refinance with bond and leveraged loan refinancing peaking in between 2019 and 2021. Very little needs to be refinanced this year or next for US issuers suggesting this is more of a medium-term issue.

In between, companies will need to get used to the idea that debt is unlikely to be as cheap in future as it has been since 2008.

Back to top