Email of the day on the 60/40 portfolio:

For some time, the best-looking charts have been the yield charts, almost everywhere but particularly in Europe. They are a pure example of consistency.

Questions: with the trillions of dollars invested in these securities how are the losses going to be reconciled? My personal belief was that rates could not go to where they seem headed because of the losses it would imply. Is there a lower rate case? How does this logic chain play out? The "prisoners" that own these bonds, who are they and how many of them are there? Is the 60/40 cookie cutter approach to managing portfolios getting crushed? Is income the new oil?

Sorry for the multiple questions but intellectually the global losses in bonds has to be discussed in my opinion.

Thank you for these topical questions. I agree being short bonds (long yields) has been the most consistent breakout of any market anywhere this year. As a result there is no doubt bond portfolios have been under extraordinary stress. Reconciling losses in fixed income will mean pension contributions will have to rise, payouts will fall, recipients will need to work longer and/or assets prices will need to recover.

The total number of bonds with negative yields has fallen from a total nominal value of $18 trillion to $2.4 trillion today. Of course, that does not imply a commensurate loss in portfolios because a move from -0.01% to 0% would take a bond off that list. Nevertheless, the decline in the bonds sector has put a great deal of pressure on fund performance.

The Blackrock 60/40 Target Allocation Fund (BIGPX) might be viewed as representative of the performance of the most common allocation to a “balanced” portfolio. 40% of the holdings are in the iShares S&P Total US Stock Market ETF (ITOT) and the iShares ESG Aware MSCI USA ETF (ESGU). Both these funds are heavily weighted by mega-cap technology companies which tend to be interest rate sensitive.

Actively managed funds would ideally have chosen to avoid interest rate sensitive sectors and prioritise dividends as the threat of interest rate hikes and quantitative tightening emerged, but for most hindsight is 20/20.

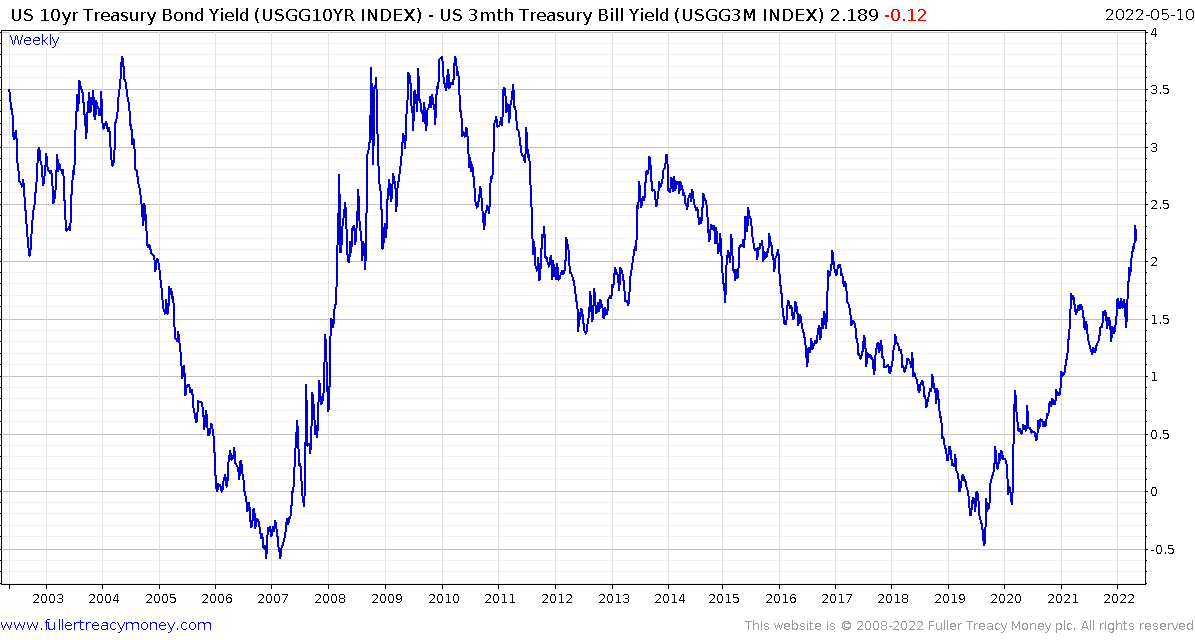

Bond fund managers, with leeway to invest across durations, have universally opted for short-term issues. That has depressed 3-month yields relative to Fed Funds rate and created the illusion of easy financial conditions in the 10-year – 3-month spread.

The brief dalliance with modern monetary theory during the pandemic resulted in a 20% increase in US government debt and an inflation issue that is proving difficult to shake. Bond yields rose in response.

However, there is a clear path to lower yields. It’s just not very pleasant. Global growth slows down and takes commodity price inflation with it. Maybe we are not in a new paradigm and Japanisation of the US economy is inevitable. Maybe a recession or housing crash in China takes the global economy with it. There is increasing fear that Russia will resort to a tactical nuclear weapon to turn the tide of the war in Ukraine.

Any one of those unpleasant outcomes would suggest lower growth and lower inflation and more money printing to combat them. The only way the outstanding debt is going to be dealt with, is through negative real rates over a prolonged period. That’s a lot easier with moderate inflation and predictable consumer demand. Ultimately, that is the Fed’s aim in deploying quantitative tightening.

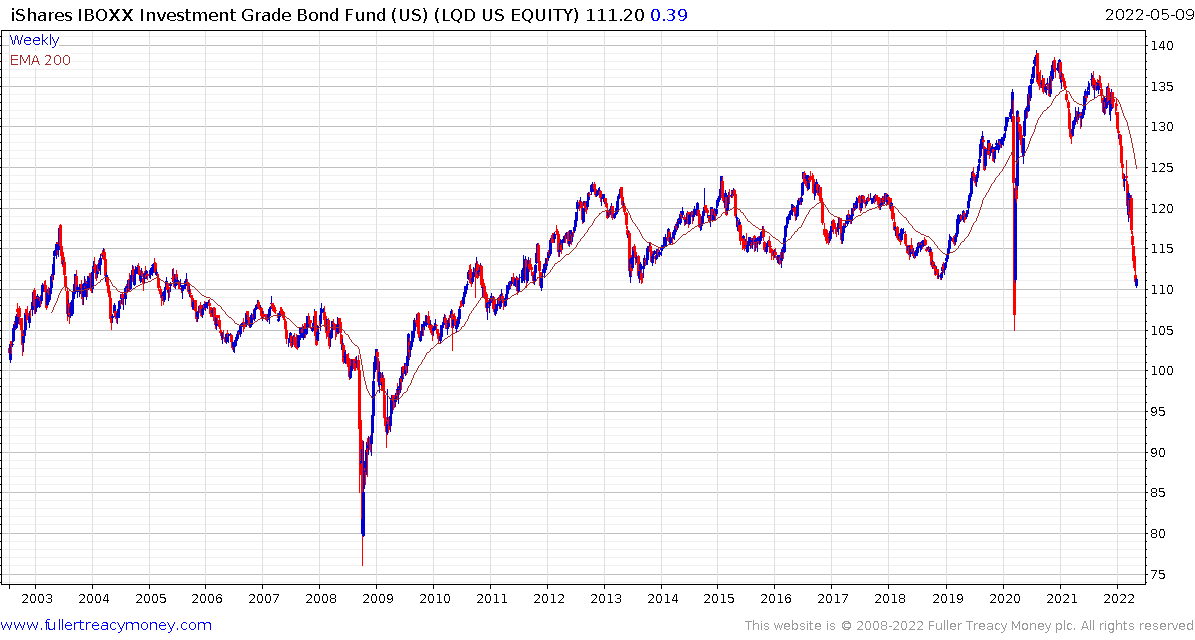

The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) is back testing its lows from over the last decade and is deeply short-term oversold. There is clear scope for at least a reversionary rally. I was too early in buying TLT two weeks ago and I quickly sold it when it broke lower. I may be tempted back in if the 10-year yield breaks its succession of higher reaction lows.

I don’t expect to see a meaningful return of risk appetite until central banks walk away from their determination to tighten policy.

Back to top