Email of the day on precious metals and buying Ukrainian stocks

Could you please share your thoughts and help on the following two issues.

1. It seems that gold and silver found some kind of support after recent decline, both on the upper side of the underlying ranges, at about $1,800 and $21 respectively. Do you think, it can be so? Should we await them ranging for significant amount of time, as they usually do? Can this be just a short-term support after which decline will continue? And what about platinum?

2. Baron Rothschild is credited with saying, “The time to buy is when there's blood in the streets, even if the blood is your own.†Also, John Templeton bought shares of more than 100 companies at the beginning of the WWII. I think, some investors may consider it worthwhile to look at the Ukrainian stock market today. But it is rather small, and information is poor.

In the chart library, it is even not clear what is the main stock index. With your resources, maybe you can look if there are any instruments available for international investors, be it Ukrainian ETFs or mutual funds. At East Capital, that specializes at East European markets, I found none. The same, at Franklin Templeton. Ukrainian leading firm Dragon Capital seems to offer just brokerage services and private equity, not asset management. I suppose, the Ukrainian market is too small to be considered for a separate fund but may be, say, an East European fund with Ukrainian stocks can be found. Also, 10-15 years ago, the Warsaw Stock Exchange, in an attempt to become the regional financial centre, courted Ukrainian companies as well so some of them can be listed there.

Thank you for these topical questions. Let me take them in reverse order. I share your instinct in looking at potential opportunities in Eastern Europe because valuations will have certainly improved as a result of the war. However, it is also worth considering that the war is not over. In buying today one is taking the bet the war will be resolved favourably and minority shareholder interests will be respected in future.

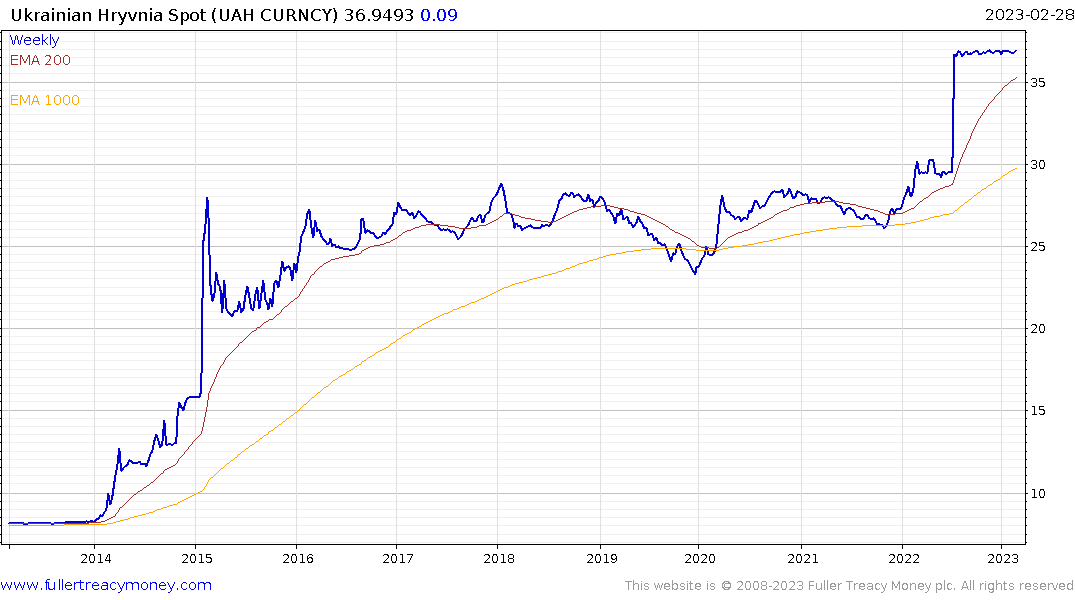

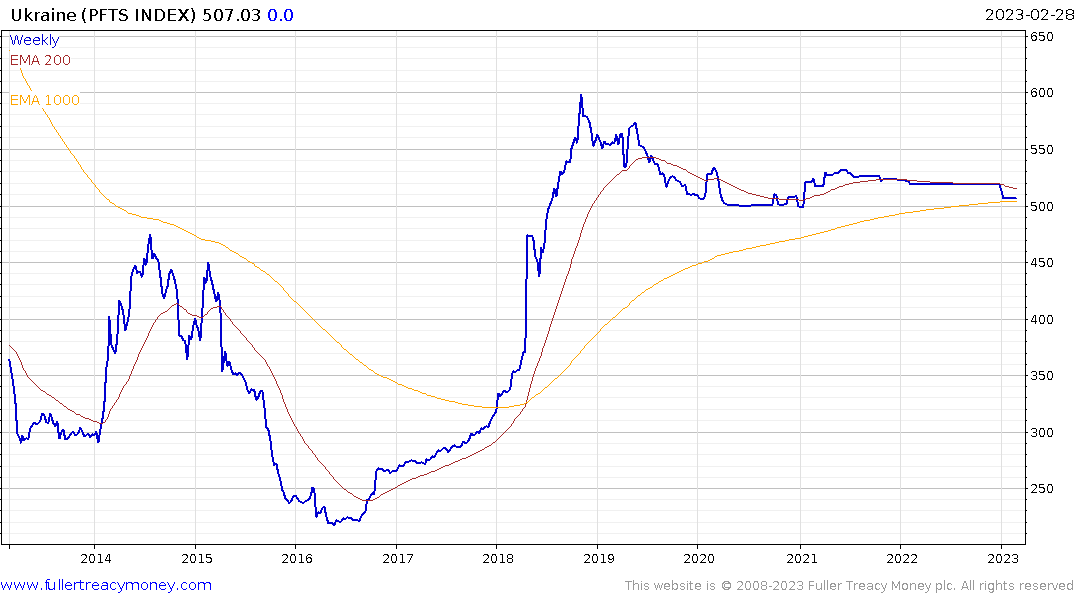

Both the Ukrainian Hryvnia and the PFTS stock market index have static price series. Meanwhile US Dollar government bonds yield 36.5% as the 7.25% 2035 tests the upper side of a nine-month range. Ukraine is unlikely to default while the flow of arms and money to support the economy is ongoing. The EU has also promised to rebuild the country following the war. I think everyone is hoping they will follow through on that commitment.

Prior to the invasion it was quite difficult to get ex-Russia exposure to Eastern Europe equities via funds. That’s because most benchmarks are market cap weighted so it is virtually impossible to avoid the heavyweights. The war changed that. The Lyxor MSCI Eastern Europe Ex Russia UCITS ETF continues to firm above its 200-day MA as it rebounds from the lower side of a 15-year range.

Astarta Holding is listed in Poland and headquartered in Kyiv. It’s a sugar and agricultural products exporter. The first is currently firming within its base and broke the sequence of lower rally highs this week.

Astarta Holding is listed in Poland and headquartered in Kyiv. It’s a sugar and agricultural products exporter. The first is currently firming within its base and broke the sequence of lower rally highs this week.

Industrial Milk has a similar corporate structure and is a grain and milk producer. The share is firming from the lower side of its range.

Industrial Milk has a similar corporate structure and is a grain and milk producer. The share is firming from the lower side of its range.

MHP SE is listed in the UK and headquartered in Kyiv. It produces both poultry and grain. The share is holding steady in the region of the post invasion low.

MHP SE is listed in the UK and headquartered in Kyiv. It produces both poultry and grain. The share is holding steady in the region of the post invasion low.

Coal Energy SA is also listed in Poland. It produces both thermal and coking coal so it should benefit whenever they get around to rebuilding the country. That might not be soon.

I suspect this will be a pivotal year for the war. NATO has to significantly increase manufacturing capacity for all manner of basic and sophisticated armaments. Russia is betting they can win by running down NATO’s inventory. Meanwhile, China is waiting on the sidelines with a full arsenal. By the end of this year the relative competitive positions of the three major global military power centres could have changed considerably.

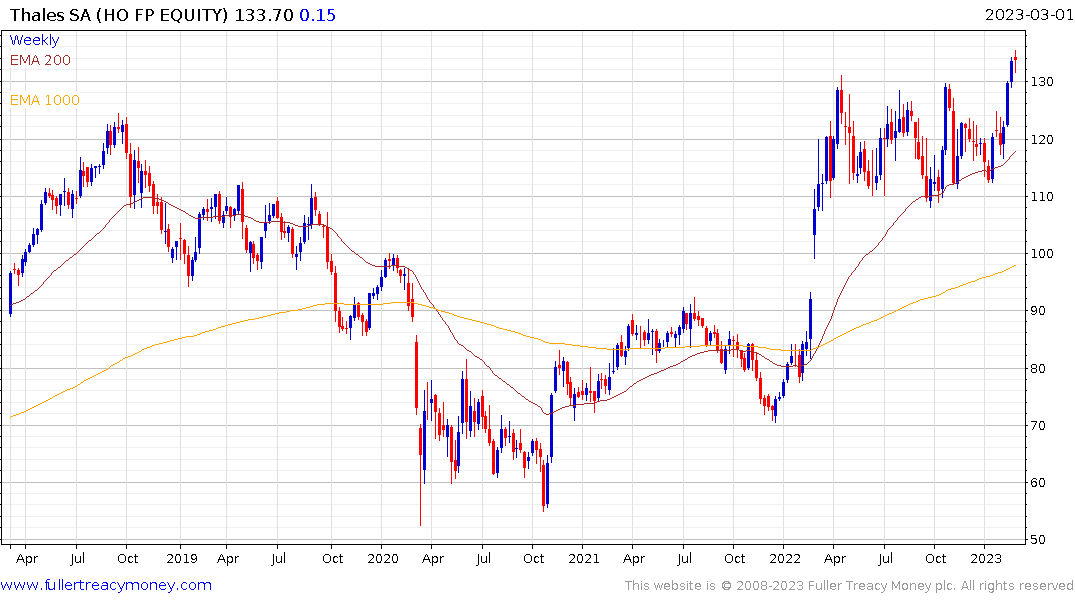

That continues to boost demand for European defense shares. Thales broke out this week, while BAE Systems, Rheinmetall, and SAAB all broke out in the last couple of weeks.

Let’s turn our attention to gold. The price has been ranging for more than two years. The failed break below the $1680 level resulted in a return journey to the upper side mean $2000.

Big bull markets in gold require both negative real interest rates and a weak Dollar. The Federal Reserve has been hiking rates aggressively for the last year and inflationary pressures have moderated. That suggests the negative real rate has contracted significantly. As a result gold is more sensitive to the Dollar’s movement.

The Dollar Index is at least pausing in the region of the 200-day MA and gold is testing support in the region of its 200-day MA. That is not a coincidence. Investors are betting the terminal rate for rate hikes is a lot closer than it was a year ago and that the Dollar will decline in a big way when rates peak.

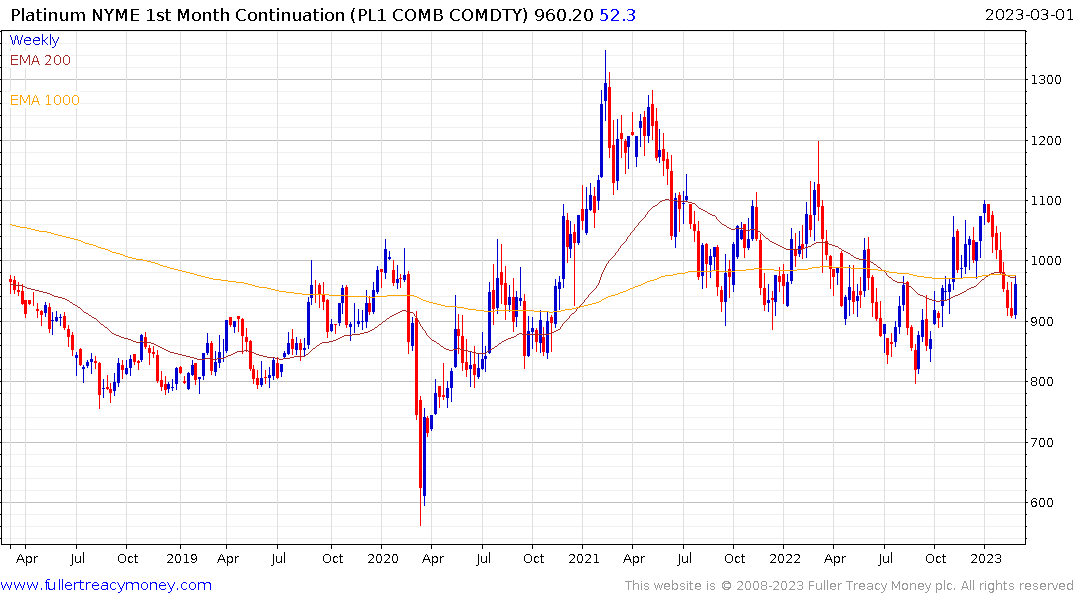

Platinum has been bereft of a clear bullish catalyst since the demise of diesel engines. The potential for hydrogen fuel cells to drive demand in future is the direction a bullish narrative is most likely to drive towards. Meanwhile, the power crisis in South Africa has yet to limit supply in anything like the manner it in 2008. The price is currently firming but a sustained move above $1000 will be required to signal a return to demand dominance beyond short-term steadying.

Platinum has been bereft of a clear bullish catalyst since the demise of diesel engines. The potential for hydrogen fuel cells to drive demand in future is the direction a bullish narrative is most likely to drive towards. Meanwhile, the power crisis in South Africa has yet to limit supply in anything like the manner it in 2008. The price is currently firming but a sustained move above $1000 will be required to signal a return to demand dominance beyond short-term steadying.