Chinese Markets Roar Back on Upbeat Data Ahead of Congress

This article from Bloomberg may be of interest to subscribers. Here is a section:

China’s manufacturing activity recorded its highest monthly improvement in more than a decade in February, while services also showed stronger-than-expected performance. With home sales rising for the first time in 20 months, the string of positive data helped allay concerns over the nation’s recovery from the damage induced by its Covid Zero policy.

The timing of positive news flow ahead of the Party Congress is very convenient and has boosted sentiment about the strength of China’s reopening. The Hang Seng Index in Hong Kong rebounded emphatically from the region of the 200-day MA to confirm near-term support and, potentially, a high reaction low.

The credit impulse tends to be a forward looking indicator for Chinese economic activity which highlights how dependent growth is on liquidity. It was last updated at the end of January and continues to recede. At the same time many more Chinese consumers have the wherewithal to afford a property downpayment. That suggests with some confidence government support for the property market will be forthcoming, demand could increase. That would be a very positive development for the economy but the credit impulse will also need to support an upswing.

The Hang Seng Property Index is now firming from the psychological 25,000 level.

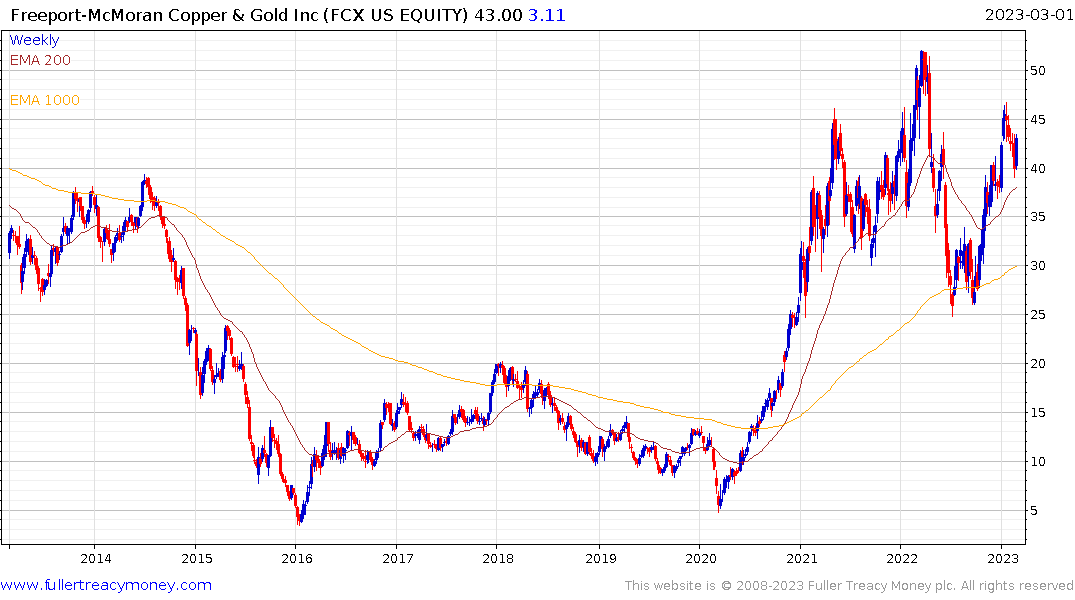

This news also supported the global materials sector today with both copper and steel firming.

Freeport-McMoRan bounced this week from the region of the 200-day Ma.

ArcelorMittal is firming at the upper side of a decade-long base formation.

ArcelorMittal is firming at the upper side of a decade-long base formation.