Email of the day on oil prices and their effect on commodity prices more generally

David has often referred to the out-performance of commodities in the latter stages of a bull market. You have reinforced that message with regular reference to the consistency of the crude oil chart (see below).To this observer, that chart is looking very tired. Doesn’t the chart, and the threat of the return of supply dominance, suggest that future oil price rises will be limited, even as other commodities are strong?

Thank you for this question which raises a number of relevant points. We have both highlighted how the outperformance of the resources sector following a large decline is generally a confirmation that the medium-term bull market is entering its latter stages which can last for a couple of years. We can expect the resources sector to be among the last to peak and as such is unlikely to be a lead indicator but rather could act as a relative and absolute performer even as leading sectors roll over.

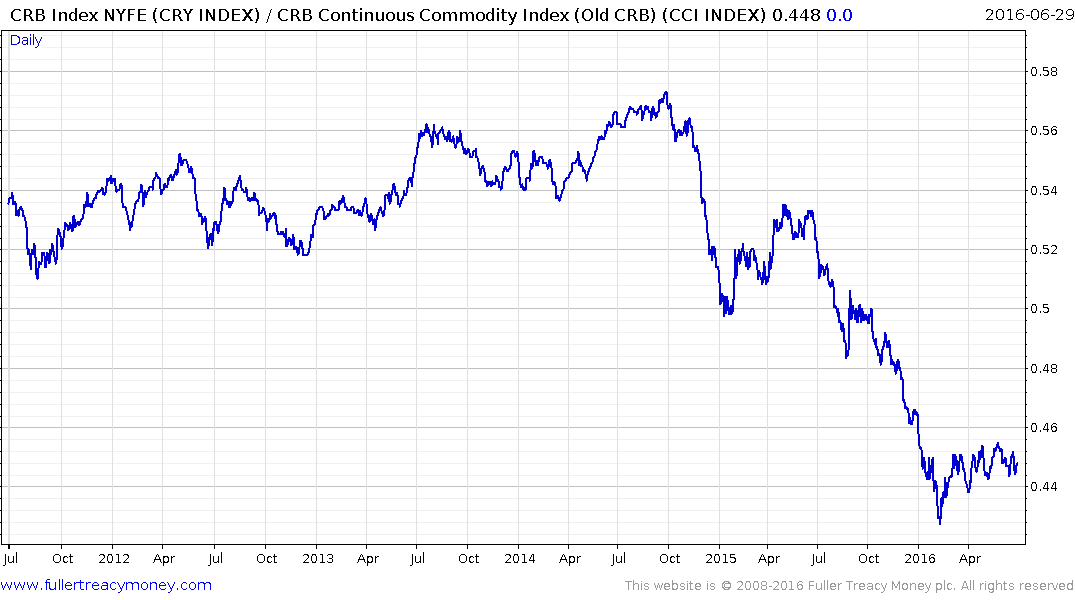

The role of the oil price rebound is supporting that view is an important one. The difference in the relative weighting of the CRB and the Continuous Commodity Index (CCI or Old CRB) gives us some idea of oil’s role in the pricing of the whole sector. The CRB is liquidity weighted so has a very large energy component while the CCI is unweighted.

The ratio between the two helps to illustrate the impact oil’s rally has had on pricing. The CRB underperformed between late 2014 and early this year and has outperformed moderately this year. The collapse in oil prices allowed marginal producers of other commodities to reduce costs and sustain their operations. The rally will have had the opposite effect since oil prices have almost doubled this year and bankruptcies have increased. This has acted as a tailwind for the stronger constituents of the mining sector in particular.

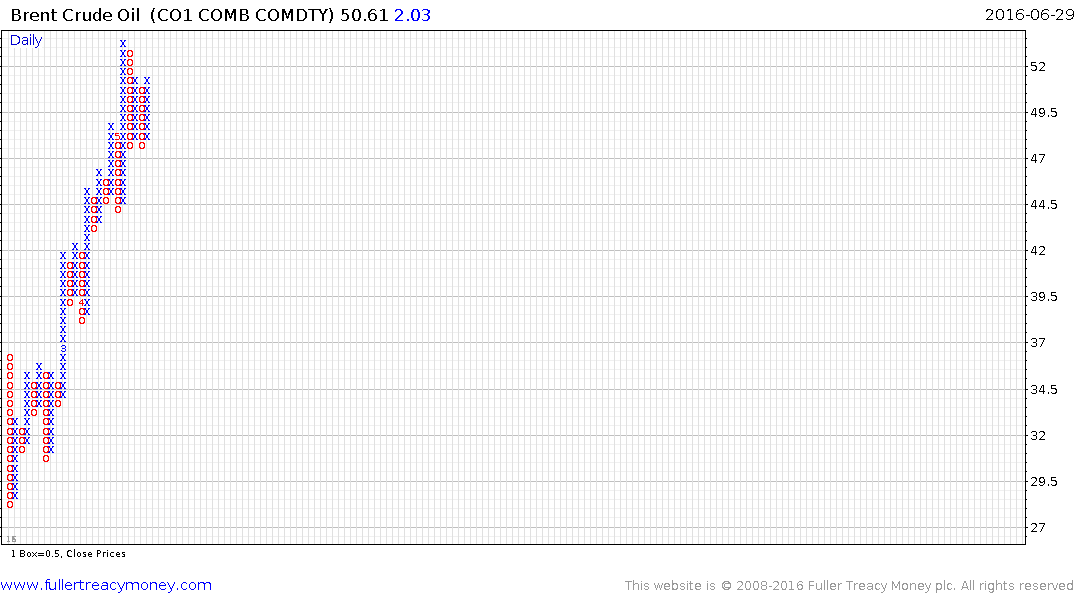

A number of soft commodities are rallying based on their own individual merits relating more to the after effects of El Nino than the oil price rally. I agree oil’s, so far consistent rally, is beginning to look a little tired, but as you will see from this 6-month 50¢ box p&f chart a progression of higher reaction lows is still evident amid what is still a staircase step sequence uptrend. Until the lows near $47 are taken out there will be no evidence that a medium-term peak has been reached.