Brexit wins: British stocks will prove winners, too

Thanks to a subscriber for this article by Donald Coxe for Pensions & Investments. Here is a section:

The European Central Bank and the Brussels bureaucrats are in shock. Radical parties in France, Italy, Holland, Poland and Hungary — which protest the immigrant tide, the powers of the ECB and the Brussels committees, and cheered for Brexit — now call for their own version. The euro might soon move back into the emergency ward, putting more upside pressure on the dollar.

The European Union has been China's biggest customer. No surprise that Xi Jinping, president of China, toured Europe encouraging a good outcome in the Brexit debate, meaning a ringing defeat of Brexit. This setback comes at a time when the Chinese economy is being buffeted by bad news from so many directions — external and internal. Time for distraction: China is stepping up activities in the South China Sea with the West bedeviled by Brexit.

Investors should expect more turmoil in global financial markets, and even more issuance of negative-yield bonds from the ECB and other European authorities. Chances of a global recession increase when there are, in the short term, so many economic losers from the shock of l'Affaire Anglaise, with Europe still in the recovery ward from the crash of 2008.

The Fed's chance for a rate rise vanished with the voting result.

The number of things to worry about has increased and as a result so has central bank intervention. With news today that the Bank of England expects to lower interest rates and stimulate the economy, the Pound declined but stocks continue to rebound not least because of the improving competitiveness globally oriented companies will derive from these developments.

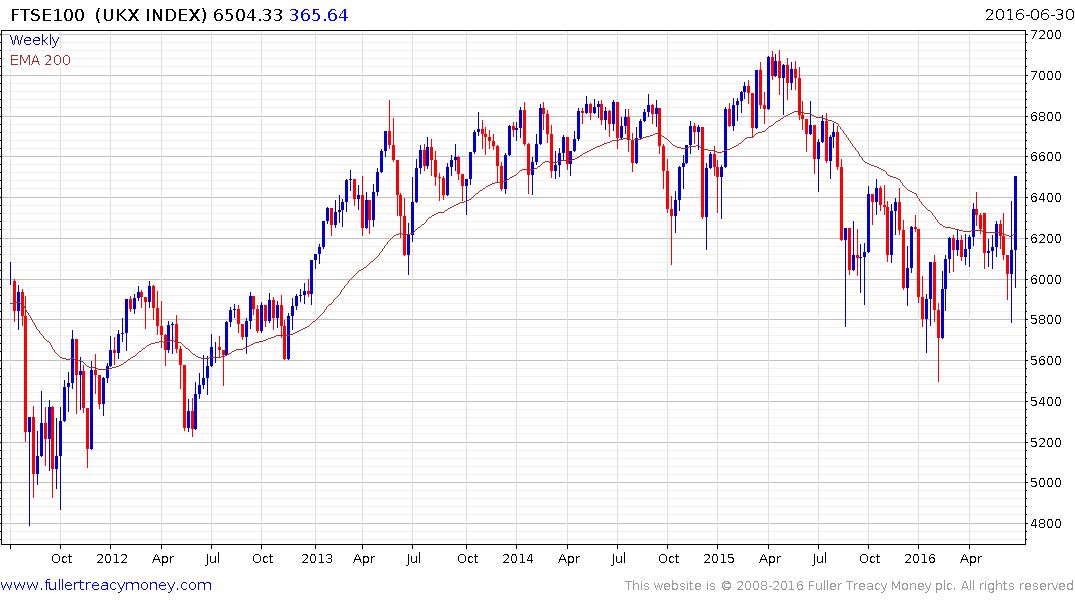

In nominal terms, the FTSE-100 Index moved to a new high for the year today and a sustained move below the trend mean, currently in the region of 6225, would be required to question potential for additional upside.

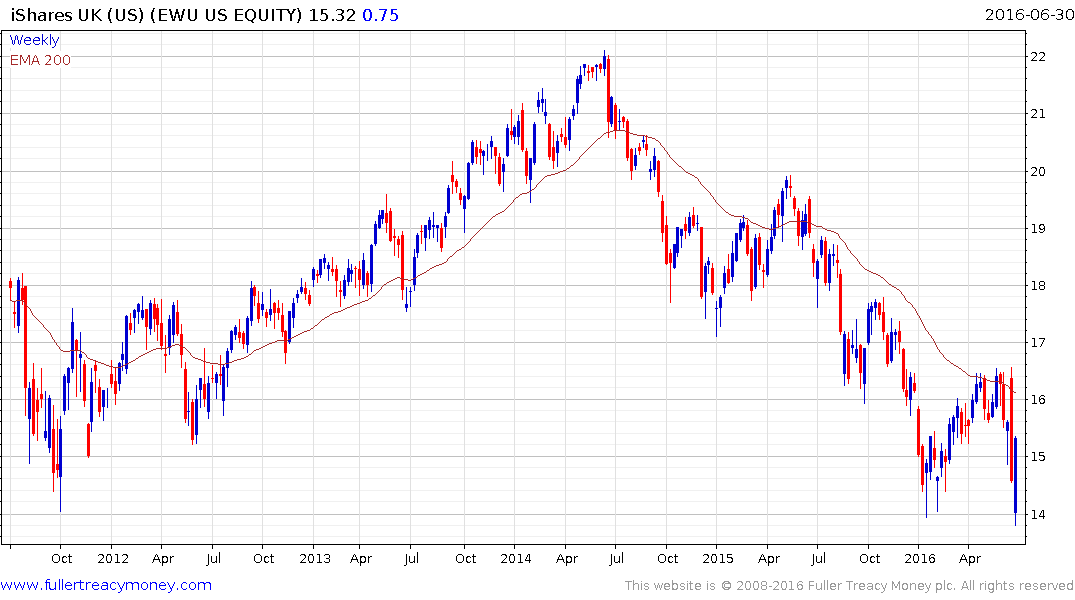

The US listed US Dollar denominated iShares MSCI UK ETF continues to rebound from the region of the January lows but will need to sustain a move above the trend mean to signal a return to demand dominance beyond short-term steadying.