Email of the day on Mexico

“The following is the text of a message from a businessman from Monterrey Mexico I met recently in Austria. His business (offshoring) is based in Mexico generating USDs.

“He is obviously pessimistic and believes there will be a new President next year.

“Thank you for your valuable service.

“Nice to have met you. Following up on our conversation around the strong Mexican peso I mentioned that I think it is 4 things that are impacting, and some might not be sustainable, mind you I am not an economist or politician, just a small businessman."

-“The artificially high official interest rates the Mexican central bank is paying, around 11 or 12 percent which is generating purely short-term financial investments from foreigners that can leave as fast as they came.

“At the same time Mexican companies cost of capital is extremely high as they mostly take loans in pesos The surprisingly high level of “remesas” which is the money that Mexican workers in the US send back home to Mexio, have grown from $20 billion us dollar annually to over $60 billion, story goes most of the BBC increase is related to the drug trade.

“Nearshoring which is direct investment by American, European (or Chinese companies trying to avoid getting caught in the middle of a trade war) and being close to US markets due to supply chain mgmt., which could be really sustainable.

Finally, the fiscal “discipline” of our government is more due to their lack of the most basic investments in schools, education, hospitals, medicine, highways, ports, infrastructure, and energy. Once new govt takes over and realizes the major hole there, they will have to start the debt race again and the peso will probably lose value.

I believe only the third point could be sustainable in the mid-term.

Thank you for this insightful account which raises several important points relating to the strength of the Peso. Since the currency has never had such a long period of outperformance relative to the US Dollar, it certainly worth taking the time to highlight what that has been the case and whether it is sustainable.

Latin American countries have been among the most aggressive in raising rates to combat inflation. Mexico has held its rate at 11.2% since March and is likely to begin cutting before long as inflationary pressures moderate. The CPI rate has fallen from 8.7% to 4.6% so the positive real rate has continued to improve. When that spread reverses, it will remove one of the tailwinds for the currency.

Reducing rates is likely to support consumer demand as the cost of capital comes back down. That will act to support the economy which should improve the outlook for the currency.

Remittances are heavily reliant on US economic health. The massive jump in the total has been fuelled by the excessive deficit spending and transfers to consumers over the last several years. As monetary conditions normalise over time, that will reduce remittance totals which is bearish for the currency.

Foreign direct investment to build factories, utilities and energy infrastructure is all productive and supports employment. Mexico’s unemployment level is still close to a record low. I expect to see volatility in the Peso rate since Mexico is heavily dependent on US demand for its exports. However, the currency has plenty of room to consolidate and to still hold the breakout.

The S&P/BMV IPC Index has broken lower and is approaching the region of the 100-day MA. The stronger performance of the iShares ETF is entirely reliant on the currency’s performance.

The S&P/BMV IPC Index has broken lower and is approaching the region of the 100-day MA. The stronger performance of the iShares ETF is entirely reliant on the currency’s performance.

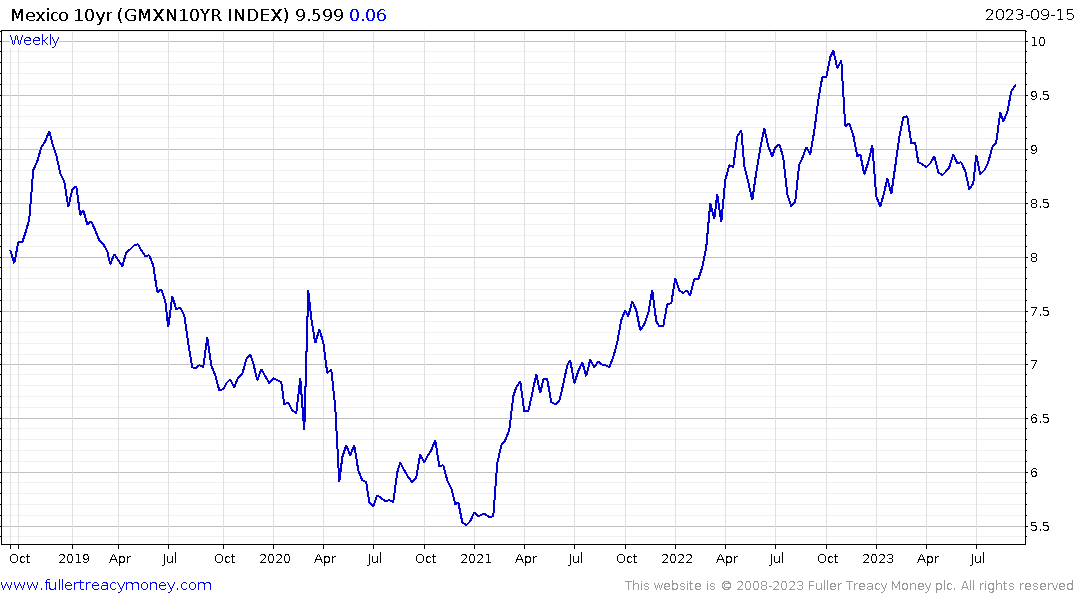

The weakness in the government bond market, with yields advancing towards the 10% level suggest investors are still cautious about government finances. The government is currently attempting to buy the impending election. That’s increasing the deficit. The long-term recovery will be heavily dependent on sound fiscal responsibility and economy management following the election.

The weakness in the government bond market, with yields advancing towards the 10% level suggest investors are still cautious about government finances. The government is currently attempting to buy the impending election. That’s increasing the deficit. The long-term recovery will be heavily dependent on sound fiscal responsibility and economy management following the election.