Private-Equity Giant Blackstone Joins Coveted S&P 500 Club

This article from the Wall Street Journal may be of interest. Here is a section:

Earlier this month, analysts at Goldman Sachs estimated that Blackstone could attain a 0.19% weighting, implying about $15 billion of demand from index-tracking funds. Some of that buying may have already taken place: Blackstone stock has risen 9% since its inclusion was announced on Sept. 5.

Blackstone is joining after S&P Dow Jones Indices in April relented on a previous ban for new index entrants with multiple share classes.

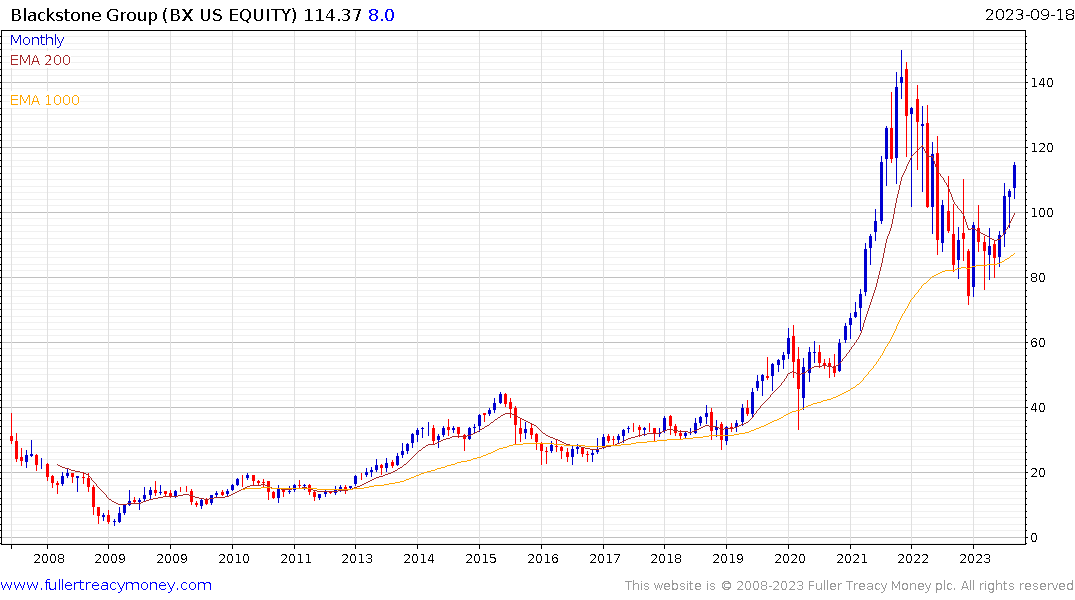

Blackstone rallied impressively over the last month in advance of its entry into the S&P500. The company’s ambitions of soon achieving the goal of $1 trillion under management and its dominant position in private credit have been the other factors that drove interest in the share.

Despite the continued tightening of global liquidity, Blackstone has succeeded in attracting institutional funds for its private capital/merchant banking solutions. That’s quite impressive and highlights the company’s ability to point to its track record as a reliable custodian.

The share is quite overbought in the short-term so some additional consolidation is likely. A break back below $100 would be required to check the uptrend.

Airbnb also joined the S&P500 today. The share has been ranging below $150 since May 2022 and a sustained move above that level will be required to confirm a return to demand dominance.