Email of the day on hedged exposure to Japan:

I always enjoy your service very much. But todays comment & audio was extraordinary it deserves to be a classic. Congratulations. I now have a question: You had been very bullish on Japan last year, especially on hedged instruments on the Japanese market. It does not seem to be going that way recently. Do you think it is the right time to lighten hedged Japanese equity positions?

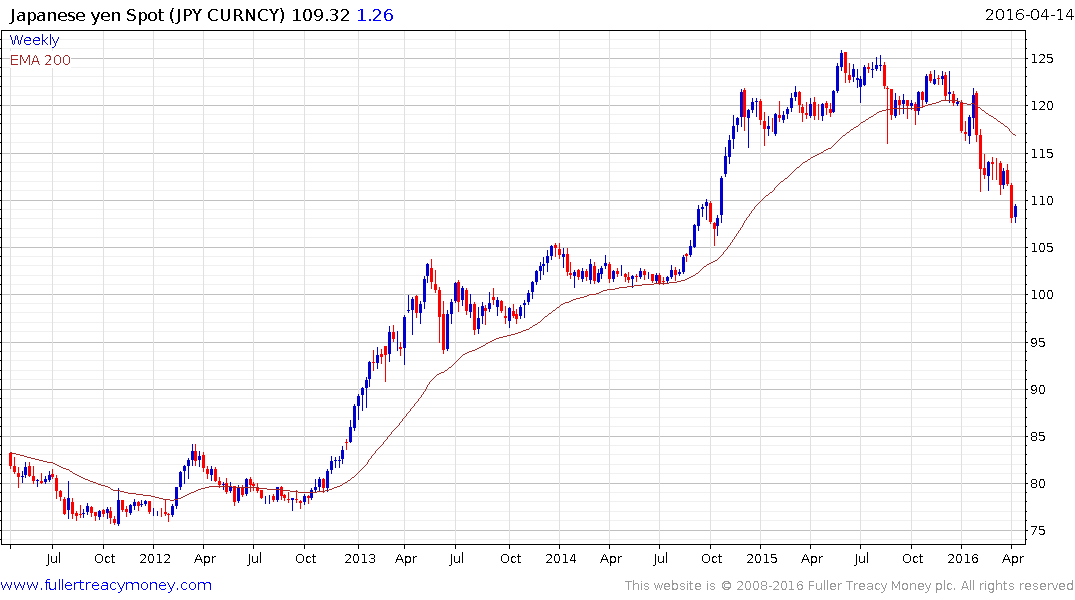

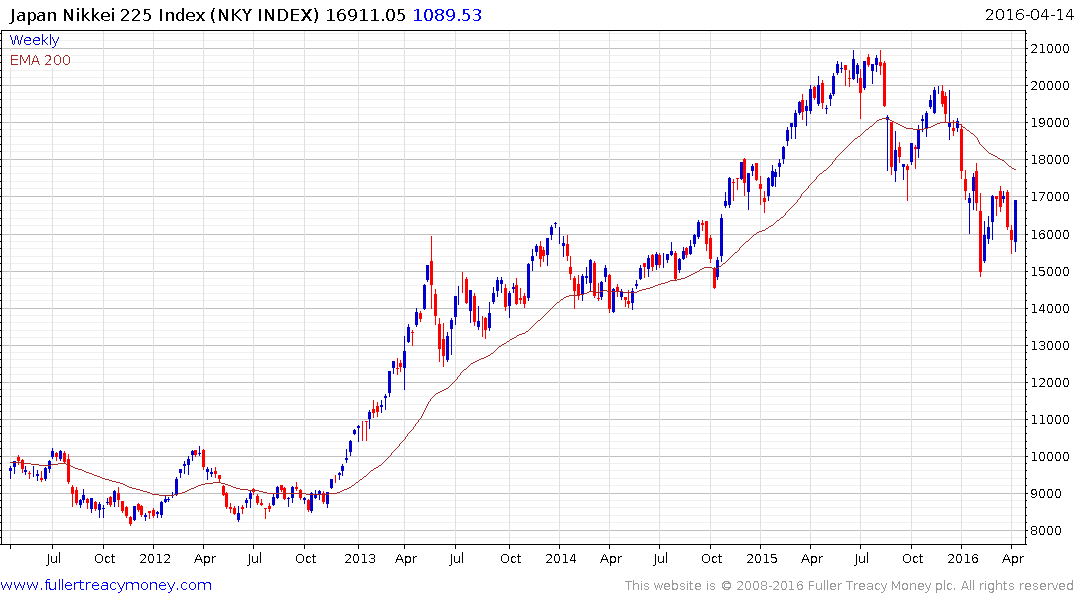

Thank you for this question which may be of interest to other subscribers. The correlation between the weakness of the yen and the relative strength of the Japanese stock market was a powerful bullish phenomenon until the middle of last year when the Yen began to find support. Since then the currency has strengthened from ¥125 to ¥109 and what had been a tailwind turned into a headwind for the stock market.

With a short-term oversold condition now evident for the Dollar against the Yen, potential for a reversionary rally is increasingly. The Japanese stock market is responding with the Nikkei-225 jumping almost 10% this week to post a higher reaction low. A sustained move below 15,500 would now be required to question current scope for a reversionary rally back up towards the trend mean.

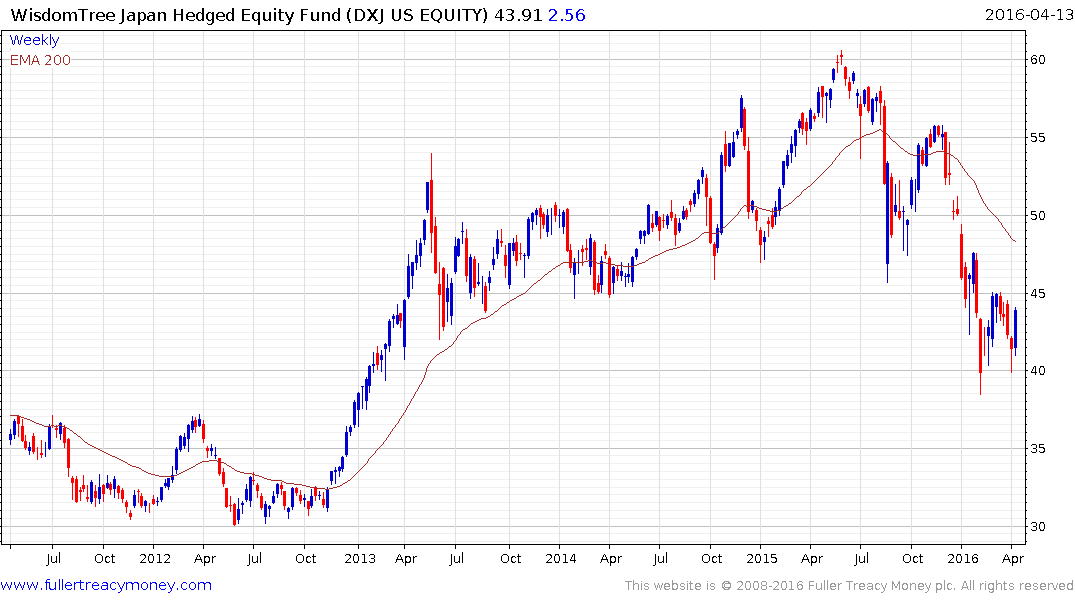

Taking the Wisdomtree Japan Hedged Equity ETF as an example. It has also now posted a higher reaction low and potential for at least a reversionary rally is looking more likely than not.