Exxon Says `$25 Billion Rule' Will Sink Deepwater Oil Drilling

This article by Joe Carroll for Bloomberg may be of interest to subscribers. Here is a section:

Environmental groups say the new rules don’t go far enough to safeguard marine life and the people who depend on it for their livelihoods. Friends of the Earth has called on the government to halt all auctions of offshore drilling leases.

“There’s no such thing as safe offshore drilling,” said Marissa Knodel, a climate campaigner for the Washington-based group. “Tougher rules aren’t going to mitigate the human and environmental costs of allowing more drilling to occur.”

Government Shortcomings

In a closed-door meeting last month, BP, the largest driller in the U.S., said the government underestimated the time and complexity needed to implement the rules, ignored the reduced production and stranded reserves that would result, and added unneeded operations that could boost risks rather than decrease them. The comments came in slides Exxon presented at the meeting and were posted on a government website.The Deepwater Horizon disaster looms large over federal attempts to tighten requirements. The blowout at the $153 million well sank a $365 million drillship, paralyzed the Gulf region for months and cost BP more than $40 billion in penalties, compensation and restoration costs.

Exxon, in the closed-door meeting with White House and Interior Department officials on March 7, outlined its assertion that the rules will cost $25 billion and argued they would increase the danger of a blowout by wresting decision-making from on-site engineers with decades of experience.

Offshore and deep water oil prospecting, particularly in the Gulf of Mexico, represents an important source of current and potential future supply that is seriously at risk from the increasingly long reach of regulation. The move to take decisions about how best to proceed with operations away from experienced people on the rig and hand it to bureaucrats onshore represents a major victory for anti-fossil fuel campaigners and will result in a much higher regulatory burden for oil companies.

The result is that the price of oil required to justify the additional expense of drilling offshore is likely to rise. Moreover since investment plans are not made on short-term whims, the trend of decreasing expenditure on developing new supply is likely to continue until oil companies have empirical evidence of prices stabilising at economic levels.

Attention right now is on the Doha meeting scheduled for Sunday between major OPEC and non-OPEC producers. The Dollar is an additional important consideration for commodity producers as it finds support following a two-month decline. However with the USA now a major new swing producer in the oil and gas markets the impact of increasingly tight regulations cannot be ignored.

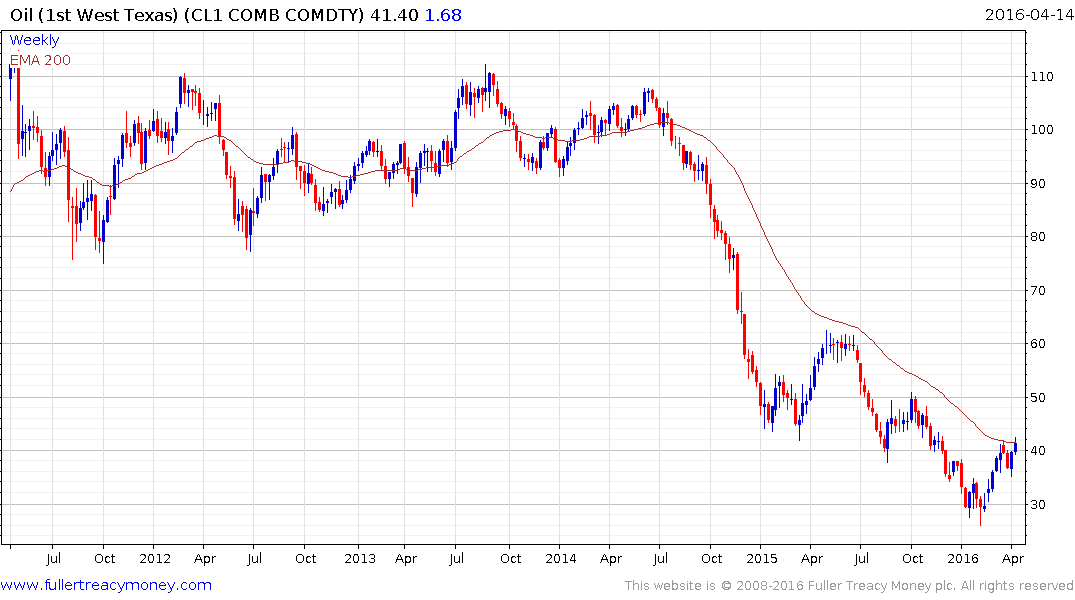

West Texas Intermediate is currently trading in the region of its trend mean and a sustained move below $35 would be required to question current scope for continued higher to lateral ranging.