Email of the day on General Electric

The 10 year weekly chart of General Electric suggests an important break out from a long term range and a move towards the old highs.

General Electric floated the idea of dispensing with its finance arm more than a year ago but confirmed the decision in April with the aim of getting back to its industrial roots. We are now seeing the fruits of that decision. GE represents a dominant player in a number of finance businesses not least aircraft leasing and had become among the world’s largest banks ahead of the financial crisis. It had fallen into a practice where it was making more money from financing the sale of its products than it was from selling them and this left the company exposed to a credit shock which saw the share fall 75% in 2008.

Selling off part of its finance arms is likely to yield a substantial dividend. However at 28% of revenue in 2014 GE Capital is still the company’s largest segment and this process will need to be managed delicately. The price pulled back sharply in August but is one of a relatively small number of shares that have moved to new recovery highs since. While somewhat overbought in the short-term, a sustained move below $25 would be required to question medium-term scope for continued upside.

There are 38 companies in the S&P 500 that have moved to at least new 5-year highs over the last week. A testament to the fact the market has been rallying for six years is that there are no companies making 3-year, 1-year, 6-month or 3-month highs. They are either breaking out to new 5-year highs or are still trading below their 3-month peaks.

Here is the list. I’ve reviewed a number of these shares over the last week, not least Amazon, Google, Nvidia, McDonalds and Starbucks. An additional point is the list is dominated by shares that could be considered to have defensive characteristics.

Rather than focus on those that are already in well-defined or mature bull markets those that are now completing lengthy ranges are perhaps more interesting.

Priceline exhibits a saucering characteristic consistent with accumulation.

Home Depot rallied back impressively from the August shakeout and moved to a new high this

week.

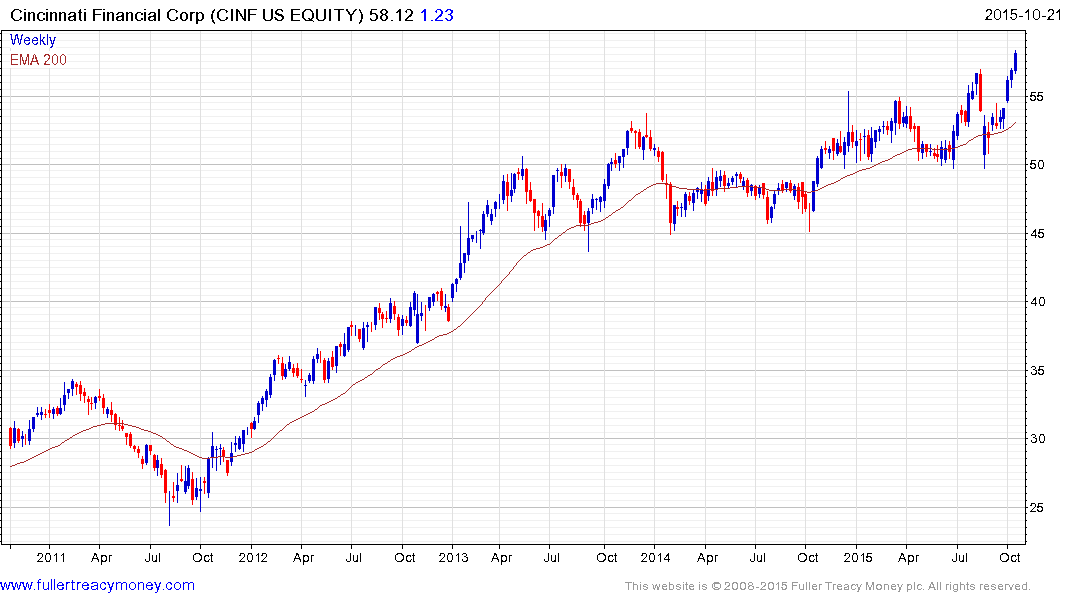

Cincinnati Financial has been ranging with a mild upward bias since 2013 but the pace of the advance is picking up.

L Brands spent much of the year engaged in a process of mean reversion and bounced emphatically in late August. A sustained move below the trend mean would now be required to question medium-term upside potential.

.png)