Brazil Impeachment Papers About to Drop as Crisis Hits New Stage

This article by David Biller for Bloomberg may be of interest to subscribers. Here is a section:

For the second time in Brazil’s 30-year-old democracy, the country finds itself lurching toward the impeachment of its president.

A group of high-profile lawyers plans to file a request Wednesday to begin the proceedings, nudging President Dilma Rousseff closer to being ousted after months of will-she or won’t-she-be-impeached speculation that has paralyzed Congress, rattled financial markets and deepened an economic slump.

If lower house President Eduardo Cunha, a Rousseff rival, accepts the request, it will trigger a months-long process and exacerbate the drama of corruption and political infighting that has highlighted Brazil’s fall from emerging-market darling.

Weakened by a bribery scandal that started at the state-run oil giant and has helped push her approval ratings to record lows, Rousseff is accused of doctoring the government’s 2014 and 2015 fiscal accounts. While the outcome of the impeachment effort is far from clear, economists and investors agree: The political stalemate needs to be resolved -- and quickly.

?Without stability in the capital, they say, Latin America’s biggest country will struggle to shore up its soaring budget deficit, win back investors and rebound from what’s projected to be the longest recession since the Great Depression.

Ahead of the 2014 election I was hopeful Dilma Rousseff would be defeated and believed that her ouster would be a positive catalyst. Unfortunately she won and the market didn’t like it. The subsequent decline in oil prices has exposed additional problems with Petrobras and examination of those issues has revealed just how much corruption there is and how inextricably linked the

President is to it. Eduardo Cunha ran against Rousseff in last year’s election so he will need to tread delicately in possibly sanctioning an impeachment lest he be seen as simply taking revenge.

The iBovespa Index has been buoyed by the weakness of the Real which has deterred foreign investors. It bounced in late August from the region of the lower side of the more than two-year range but will need to hold the 45,000 level on the current pullback to signal more than temporary steadying.

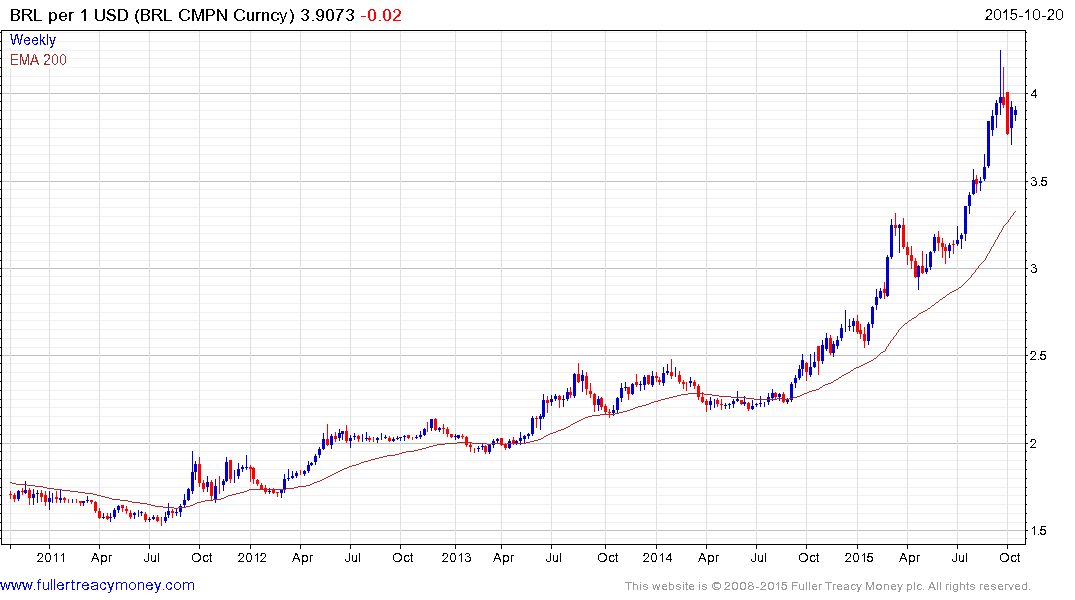

Likewise the Dollar accelerated to its late September peak against the Real. It pulled back enough to break the progression of higher reaction lows but will need to encounter resistance below the peak to signal supply coming back in at progressively lower levels.

Brazil has long been plagued with low standards of governance and failed to grasp the opportunity provided by high commodity prices to reform. Necessity may now force reform on the administrative class and the bullish case is heavily dependent on it.

Back to top