Email of the day on China's yield curve

Thank you for such an eloquent financial service! Further to your comment on China today, according to Tracy Alloway of Bloomberg, the Chinese 5-10 Yield curve inverted yesterday. Is this a bad omen or can China be different!?

Thank you for your kind words and this email which may be of interest to subscribers. The Chinese yield curve is inverted between the 5 and 10-year maturities but, generally when we talk about the yield curve spread, which is what I believe you are referring to, we look at the difference between the 2 and 10-year maturities.

The Chinese yield curve and the swap curve have about a 95-basis point spread between the long and short ends of the curve so they are not inverted in that sense. It is also worth considering that the most compelling data for an inverted yield curve acting as a lead indicator for recessions is for the USA. The data for other countries is not as compelling even if the rationale is sound.

I am keeping a close eye on the Shanghai Property Index which is a reasonable barometer for the relative health of the mainland property market. It steadied today from the region of the trend mean and the banking sector is also steady. Against a background where the government is making official proclamations about tightening these indices do not seem to corroborate that claim; while the cut to reserve requirements earlier this month suggests easier rather than tighter policy.

Chinese property developers are about the most unloved asset class in the world right now but despite proclamations to the contrary there does not yet appear to be much in the way of measures to truly limit price appreciation. The thing to watch as the full detail of what was agreed at the Communist Party Congress is revealed next week will be whether a property tax is planned for the entire country. That would signal the administration is serious about tackling speculation.

Medium-term, the focus of official attention has migrated from low cost manufacturing and infrastructure towards a consumer / technology driven economy. A great deal of progress has already been made while urbanization is less of a priority today than it was in the last couple of decades.

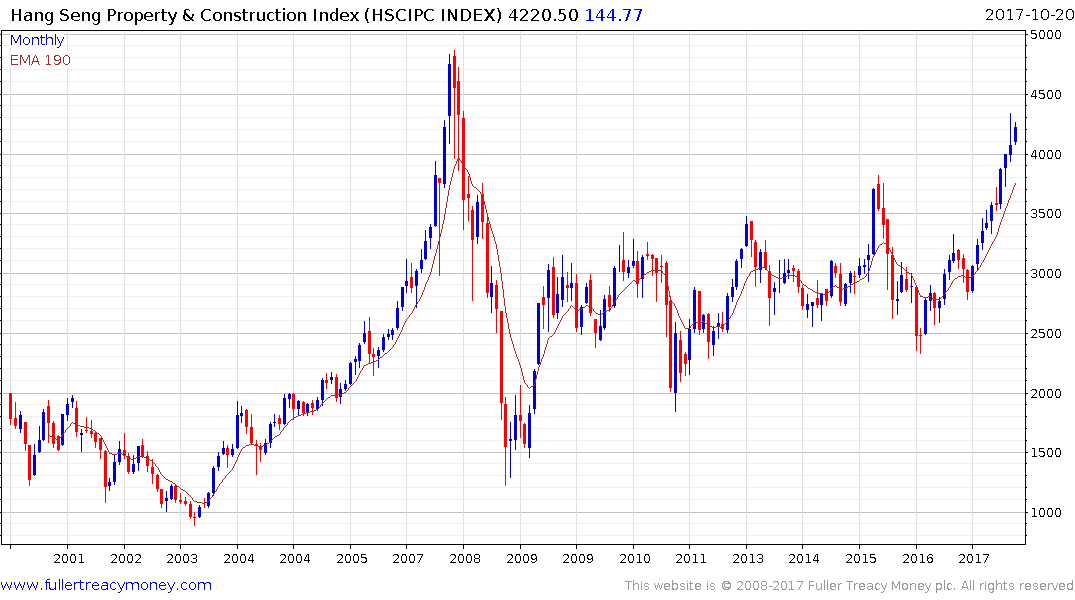

This report from Deutsche Bank highlights the fact that risk in the Chinese and Hong Kong property markets is non-trivial because prices are already high and for Hong Kong US interest rates are already rising which is a headwind for the pegged Hong Kong Dollar. However, as the following charts highlight, there is little sign just yet that investor interest has peaked.

.png)

The Hang Seng Property Index is testing its all-time peak from 2007 and while some consolidation is likely, a clear move below the trend mean would be required to question medium-term scope for additional upside.

The Hang Seng Property & Construction Index broke out to new recovery highs in September and continues to hold a progression of higher reaction lows.