ECB's Weidmann Predicts Wage Gains as He Seeks QE End-Date

This article by Jana Randow and Paul Gordon for Bloomberg may be of interest to subscribers. Here is a section:

European Central Bank policy maker Jens Weidmann reiterated his call for a definite end-date for the institution’s bond-buying program, a refrain that looks likely to gain traction among his colleagues next year.

Saying that domestic price pressures should strengthen as wage growth improves, he said they are “therefore on track toward our definition of price stability.”

While policy makers meeting last week reaffirmed their commitment to buy debt until September “or beyond,” officials including at least half the six-member Executive Board have signaled they’re willing to rein in expectations for another extension. The euro area is currently undergoing the broadest economic expansion in its history, and the ECB this month upgraded its growth forecasts for the bloc.

“A faster conclusion of net asset purchases and a clearly communicated end date would have been reasonable,” Weidmann, who also heads Germany’s Bundesbank, told reporters in Frankfurt late Monday.

Despite the upturn, the ECB remains well short of its inflation goal of just under 2 percent -- and Germany is a prime example of the conundrum. There, record-low unemployment and economic growth above its long-term potential has still failed to generate much in the way of wage growth. Weidmann said he’s confident that will soon change.

“We don’t get involved in wage bargaining and respect the independence of bargaining partners. But we expect that the increased capacity utilization and regionally appearing bottlenecks in some labor markets will lead to somewhat higher wage pressure,” he said. “That’s a projection, not a recommendation.’’

It’s considered toeing the party line for a German central banker to talk about curtailing quantitative easing and raising interest rates. However, there is no denying that the European economy is benefitting both from the ECB’s purchase program and the return to synchronized global growth. A partial counter to that argument is Europe has some of the oldest average populations in the world which represents a challenge for stoking inflationary pressures.

Here is a section from a report from Erste Bank on the government bond sector:

The ECB continues to regard an ample degree of monetary stimulus as necessary and has set a predictable monetary policy course until September 2018. We expect that it will only take steady increases in the pace of inflation for the ECB to taper off its asset purchase program by the end of the year. Currently the bond market shows little reaction to this. We believe yields on German Bunds will remain at low levels for now. Yields should begin to rise in the course of the year though, once wage growth accelerates and triggers a surge in inflation expectations. The Federal Reserve should maintain its policy of gradual rate hikes in the coming year end we expect three more rate hikes. This prospect is not fully priced in yet by the short end of the market. Strong economic data, a potential stimulus from tax cuts, a further decline in the unemployment rate and a possible acceleration in wage growth should exert a negative impact on government bond prices.

Mario Draghi has been clear the ECB will be slow to raise rates. In any case it is unlikely to see an interest rate hike before tapering quantitative easing has been fully completed which takes us out almost a full year. Nevertheless, since German Bunds have been among the primary beneficiaries of the ECB purchase program they are likely to suffer when the central bank is not the buyer of first and last resort.

German Bund yields have been ranging mostly above 30 basis points since late last year and firmed again from the region of the trend mean today. A sustained move below 0.30% would be required to question current scope for further expansion. Medium-term, a sustained move above 0.65% would confirm a return to supply dominance.

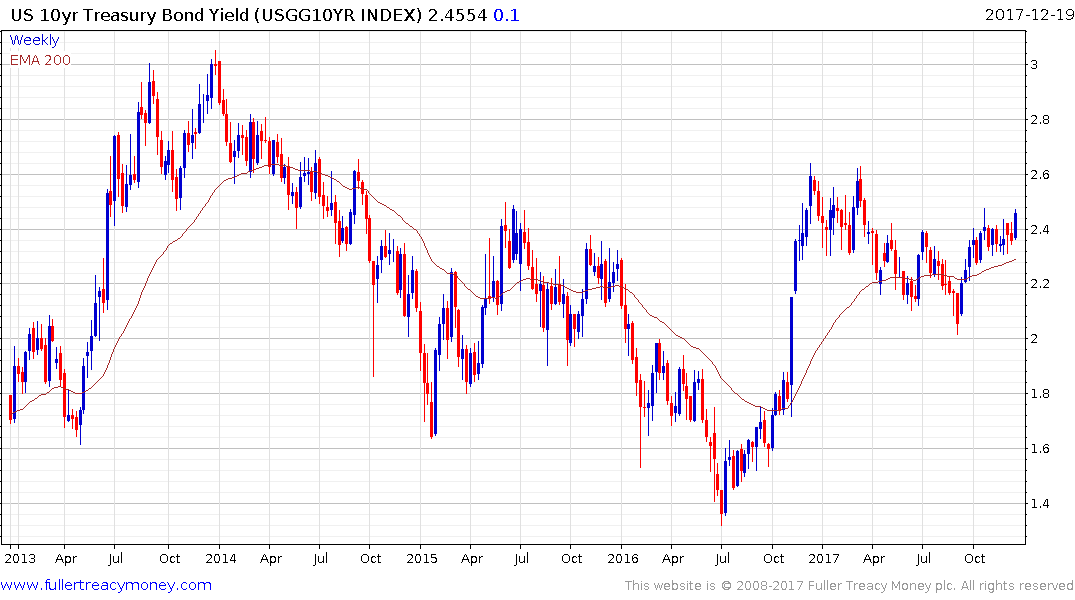

US 10-year yields are back above 2.4% and a clear downward dynamic would be required to question potential for additional upside. The USA is set to see sales of Treasury debt double in 2018 and the Federal Reserve has a lot of debt that will mature next year as well. With quantitative easing programs winding down rather than scaling up, globally, that suggests higher yields are a real possibility.

As we look ahead for 2018, it is not such an outrageous forecast that it could be the year in which the bull market in government bonds eventually tops out. That conclusion will be reinforced if yields break out on the upside over the course of the next few weeks.

The Barclays High Yield Spread Index has been largely inert this year, but a sustained move above the trend mean would represent a lead indicator, with about a six-month window, for a headwind in the equity markets.