Musings From the Oil Patch December 18th 2017

Thanks to a subscriber for this edition of Allen Brooks’ report for PPHB which may be of interest. Here is a section:

A question for the oil industry is: Will the fall in oil’s demand ease the pressure on the industry to find new oil supplies to meet projected demand growth in the world’s business as usual forecast, in addition to the amount of oil supply lost each year due to existing oil field depletion? Since the oil industry reduced its capital spending on new exploration and development during the past three years, concerns have been raised about the oil industry’s inability to find and develop new, high-cost, long-term supply sources such as oil sands and deepwater production.

How realistic are Dr. Seba’s assumptions about TaaS? In our view, they are too optimistic (or pessimistic if you work in the auto or energy industries) and too aggressive. Our conclusion is shaped by our view that this societal shift is too radical to happen as quickly as predicted, especially since the infrastructure needs are not ready and will take years to be ready. To counter our view, Dr. Seba would point to Chandler, Arizona, a suburb of Phoenix. There, Waymo, the autonomous vehicle technology subsidiary of Google’s parent, Alphabet (GGO-Nasdaq), is operating a fleet of Chrysler Pacifica minivans in a driverless mode. This follows eight years of development of the self-driving technology and dramatic improvement in sensor technology and cost. The key is that in the past two years, the vehicle’s sensors are now “seeing” three times farther (about three football fields in distance) at 10% of the cost. Moreover, the self-driving car is never tired, distracted or drunk.

Here is a link to the full report.

Autonomous vehicles represent as much of a gamechanger for the energy sector as unconventional oil and gas did a decade ago. No one knows whether it will be 2030 or 2040 when they become ubiquitous but the important point about artificial intelligence is that it only needs to learn a lesson once. It might take millions of lines of code and an equal number of pictures to teach a computer a lesson but the work only needs to be done once. By contrast, every human needs to learn to drive on an individual basis and the Pareto Principle dictates that 20% of us are not particularly good at it.

We have just been through a decade where mining and energy companies spent inordinate amounts of capital to boost supply. If the future of demand is so uncertain we can expect they will be much more reticent about spending a lot of money on new exploration and development. We are already seeing signs that investors in unconventional supply are demanding the company focus on free cashflow. That suggests dividends will probably be more reliable if they can successfully tailor supply to demand without overstretching on spending.

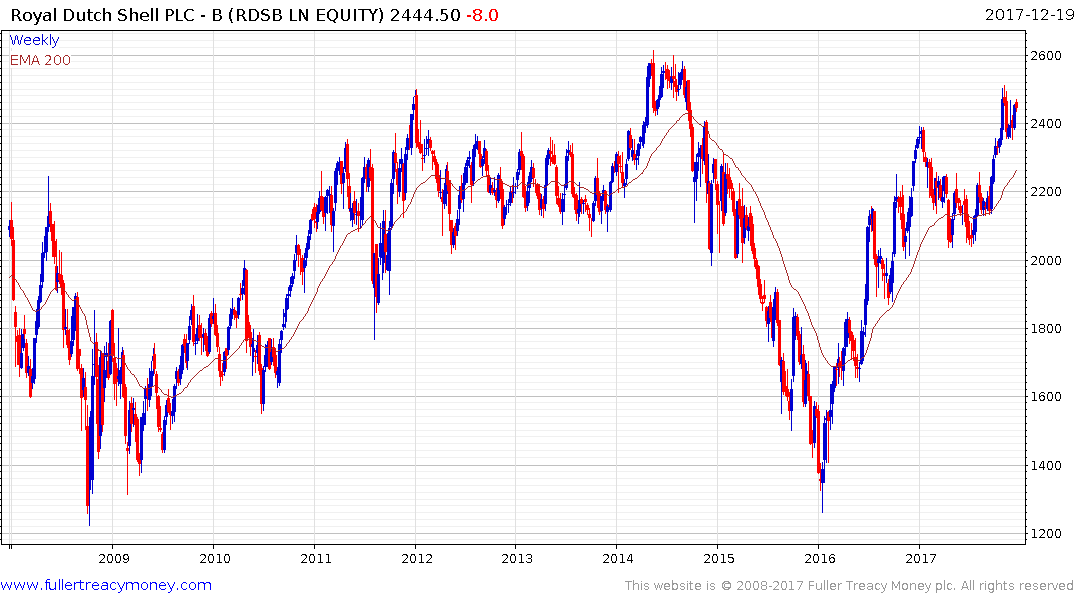

Royal Dutch Shell (Est P/E, DY) on the other hand has chosen to eschew oil for gas and is investing heavily in natural gas because that is where it sees its growth potential. The share has been ranging in a volatile manner below 2500p since 2012 and is retesting that area now. While there is room for some additional consolidation in the current area, a sustained move above 2500p would vindicate the decision to migrate to gas.