ECB: 'Broad-based asset purchases', including public QE, within 6 months

Thanks to a subscriber for report from Deutsche Bank focusing on the prospects of a Eurozone quantitative easing program. Here is a section:

What has changed? First, we have reduced our euro area GDP forecast. Our 2015 GDP forecast is now 1% versus 1.5% in June. We can no longer assume the output gap will narrow in 2015. We still expect inflation to trough in the very short term, but the growth picture combined with softer commodity prices is increasing the risk of a flatter profile to the inflation trajectory.

Second, we have become even less convinced that the combination of TLTROs and ABS/covered bond purchases allows the ECB to meet at least half of its EUR 1 trillion net balance sheet expansion. The first TLTRO was disappointing. A still deteriorating environment will give investors reason to hold onto their assets until ECB policy becomes fully credible.

?We believe a net EUR 1 trillion expansion of the balance sheet is a strong enough policy to close the gap to the inflation target by 2017. The strongest transmission channel is via a weaker euro exchange rate. To credibly target a EUR 1 trillion expansion of the balance sheet the ECB needs to move to the next step in the game plan outlined by Mario Draghi back in the spring: ‘broad-based asset purchases? (BBAP). In our view, to achieve credible scale this BBAP would encompass euro governments bonds.

When? Given our view that GDP growth will be no better than 0.2% qoq until spring 2015, we expect data and events to accumulate and push the ECB into BBAP including public QE within the next 6 months. The ECB will be led among other things by data, the staff preliminary 2017 inflation forecast on 4 December and the second initial allocation TLTRO on 11 December.

Here is a link to the full report.

In an increasingly global economy capital is mobile. The Eurozone has made ample use of the swap lines open with the Federal Reserve. As a result the USA’s quantitative easing program has been of great benefit to the European financial sector, not least as the ECB embarked on a deflationary policy of monetary contraction. As the Fed ends its QE program, the ECB is unsurprisingly coming under pressure to take responsibility for its own monetary affairs. Considering that the only mandate the ECB has is to target an inflation rate of 2%, there is an obvious need for some form of stimulus.

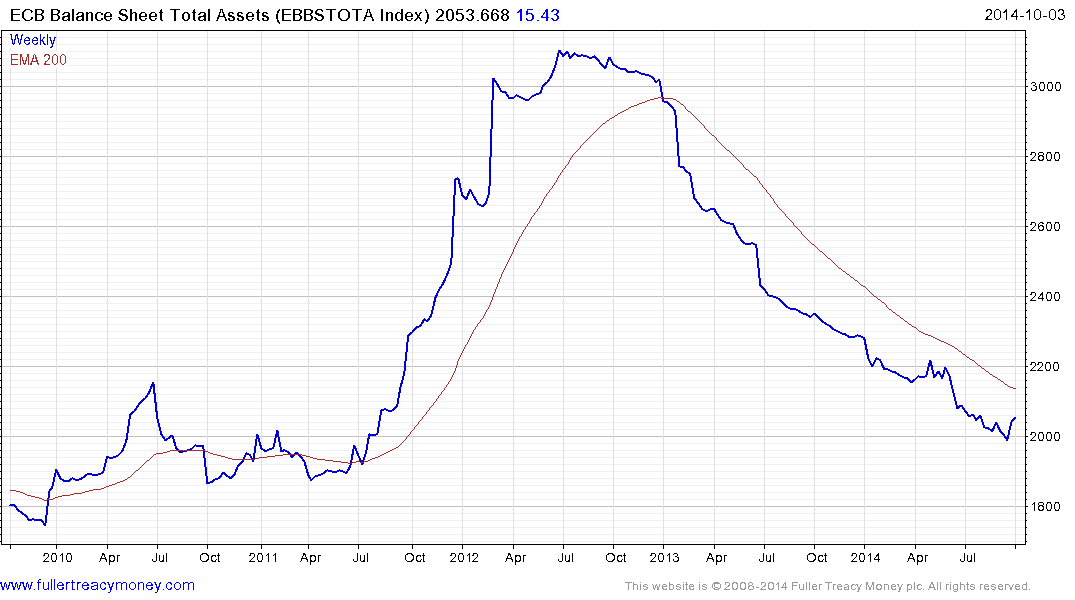

The ECB’s balance sheet found support last week in the region of €2 trillion but a sustained move above the 200-day MA will be required to confirm more than a temporary expansion.

The Euro Stoxx Index pulled back sharply this week to test the 300 area. Such has been the speed of the decline and the fact that the Index has now posted a lower high, the best case scenario is for a period of support building. How successfully shares now find support is likely to be influenced in the short term by the largess or otherwise of the ECB.

From the perspective of a foreign investor the relative weakness of the Euro over the same period has exacerbated the decline. There are a number of comparisons currently being made between the Eurozone and Japan many of which hold water. If a hedged approach to participation in Japan is a sensible strategy, then the same tack could also be taken in Europe when evidence of support building is clearly evident.

More broadly a short-term consideration is that the underperformance of the Russell in the USA shares a high degree of commonality with the German Midcaps and FTSE 250 Mid-Caps. All three have experienced uptrend deterioration with new downtrend characteristics becoming increasingly evident. Generally speaking smaller companies are more sensitive to the credit markets than large caps.

Back to top